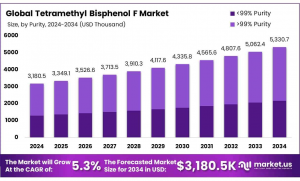

Tetramethyl Bisphenol F Market size is expected to USD 5330.7 Thousand by 2034, from USD 3,180.5 Thousand in 2024, growing at a CAGR of 5.3% from 2025 to 2034

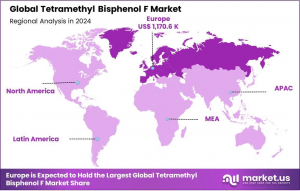

Europe emerged as the largest market for Tetramethyl Bisphenol F (TMBPF) in 2024, accounting for 36.8%”

NEW YORK, NY, UNITED STATES, January 22, 2025 /EINPresswire.com/ -- The global Tetramethyl Bisphenol F (TMBPF) market is witnessing steady growth, driven by its expanding application in high-performance polymers, epoxy resins, and specialty coatings. TMBPF, a derivative of Bisphenol F with enhanced thermal and chemical stability, is widely utilized in industrial applications requiring superior resistance to heat, oxidation, and chemical degradation. Its increasing demand in protective coatings, electrical laminates, and advanced polymer formulations has positioned it as a critical component in the specialty chemicals sector. Moreover, the growing preference for Bisphenol A (BPA)-free alternatives in food contact materials and consumer products is further bolstering the market growth.— Tajammul Pangarkar

Several factors are contributing to the rising demand for Tetramethyl Bisphenol F, primarily its extensive usage in epoxy resin formulations. The compound's ability to improve the thermal and mechanical properties of resins makes it an essential ingredient in high-performance coatings, composites, and adhesives. The electronics industry is a major driver of demand, particularly in PCB manufacturing and electronic encapsulation materials, where enhanced heat resistance and dielectric properties are critical.

Technological Advancements and Innovations is the integration of AI and computational chemistry in optimizing epoxy resin formulations. Advanced modeling techniques are being employed to fine-tune TMBPF-based resin properties for high-performance coatings and composite applications. Moreover, innovations in nano-enhanced polymers are opening new frontiers for TMBPF usage in next-generation structural materials and electronic components.

Another key development is the integration of AI and computational chemistry in optimizing epoxy resin formulations. Advanced modeling techniques are being employed to fine-tune TMBPF-based resin properties for high-performance coatings and composite applications. Moreover, innovations in nano-enhanced polymers are opening new frontiers for TMBPF usage in next-generation structural materials and electronic components.

Key Takeaways

• The Global Tetramethyl Bisphenol F market was valued at US$ 3,180.5 Thousand in 2024.

• The Global Tetramethyl Bisphenol F market is projected to reach US$ 5,461.5 Thousand by 2034.

• Purity Dominance: >99% purity held the 59.4% share of the market in 2024 owing to its superior quality and compliance with stringent regulatory standards.

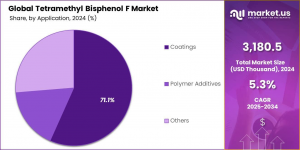

• Application Dominance: Coatings led the market with 71.1% share in 2024, driven by widespread use in food packaging and industrial applications.

• Dominant Region: Europe captured the largest market share of 36.8% in 2024 and is projected to grow at a CAGR of 6.1%.

Tetramethyl Bisphenol F Statistics

Purity Analysis

The market is segmented into >99% purity and <99% purity. The high-purity segment dominated with 59.4% market share in 2024, attributed to its exceptional chemical stability and suitability for stringent applications in food safety, medical devices, and advanced coatings. High-purity TMBPF is particularly favoured in the food packaging industry, ensuring minimal impurity migration and compliance with global safety standards like those set by the FDA and EFSA.

Application Analysis

Coatings emerged as the largest application, holding 71.1% of the market share in 2024. The demand is primarily fuelled by the need for BPA-free solutions in food and beverage packaging. Additionally, the automotive, construction, and electronics industries are driving demand for TMBPF-based epoxy resins and adhesives due to their durability and resistance to thermal and chemical degradation.

Key Market Segments

By Purity

• >99% Purity

• <99% Purity

By Application

• Coatings

• Polymer Additives

• Others

Emerging Trends

1. Increasing Demand for BPA-Free Alternatives: The rising concerns over the health and environmental impacts of Bisphenol A (BPA) have significantly boosted the adoption of Tetramethyl Bisphenol F (TMBPF). BPA, widely used in epoxy resins and polycarbonate plastics, has been linked to endocrine-disrupting effects, leading to stricter global regulations.

For instance:

o EU and US Restrictions: The European Union (under REACH) and the U.S. Food and Drug Administration (FDA) have tightened regulations on BPA use, especially in food-contact materials.

o Consumer Awareness: The rise of health-conscious and eco-aware consumers has driven demand for safer, BPA-free solutions.

2. Expanding Applications in Advanced Materials: TMBPF’s unique properties, including high thermal stability, excellent chemical resistance, and mechanical strength, are driving its adoption across advanced material applications.

Key industries include:

o Electronics: TMBPF is increasingly used in manufacturing high-temperature-resistant insulating materials and circuit boards. Its properties ensure durability and reliability, particularly in extreme operating conditions.

o Automotive and Aerospace: Lightweight components made from TMBPF-based polymers enhance fuel efficiency and reduce emissions. Flame-retardant applications in interior components and electrical systems also highlight its critical role in safety-compliant materials.

o Construction: TMBPF contributes to fire-resistant coatings and adhesives, meeting stringent safety standards for infrastructure projects.

Moreover, as innovation in advanced materials continues, new applications for TMBPF are emerging, including heat-resistant adhesives and performance-enhanced polymer additives for high-end manufacturing.

3. Sustainability and Eco-Friendly Innovations: Sustainability has become a core focus for industries worldwide, and TMBPF is no exception. Companies are prioritizing eco-friendly practices, recognizing the compound’s potential to contribute to a circular economy.

o Green Chemistry Solutions: Manufacturers are investing in greener production methods to minimize environmental impact. For example, processes are being optimized to reduce energy use and waste generation during TMBPF synthesis.

o Recyclability: TMBPF’s compatibility with sustainable production processes ensures that materials incorporating it can be effectively recycled, aligning with global sustainability goals.

o Eco-Conscious Consumer Trends: Modern consumers are increasingly choosing products with clean-label and environmentally safe certifications.

TMBPF-based materials are being marketed as sustainable alternatives in packaging, electronics, and automotive applications.

In addition, companies are adopting strategies like carbon offset initiatives and renewable energy integration in their manufacturing processes to enhance sustainability. This shift is driven by both regulatory pressures and a growing preference for environmentally responsible products among consumers and businesses alike. These trends collectively position TMBPF not only as a safer alternative to BPA but also as a cornerstone of innovation and sustainability across multiple industries.

Major Factors Driving the Growth of the Tetramethyl Bisphenol F Market

Regulatory Scrutiny on BPA

Global concerns about the health risks associated with Bisphenol A (BPA) have prompted regulatory bodies to impose stringent restrictions, creating a favorable environment for alternatives like Tetramethyl Bisphenol F (TMBPF). BPA has been widely criticized for its endocrine-disrupting properties, which are linked to hormonal imbalances, reproductive issues, and potential cancer risks. Authorities such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have implemented policies to limit BPA use, especially in food contact applications such as can linings and beverage containers. TMBPF, which exhibits similar functional properties but with significantly lower estrogenic activity, has emerged as an ideal substitute. This regulatory shift has driven industries to adopt TMBPF in coatings, packaging, and advanced polymer applications, ensuring compliance with safety standards while meeting performance requirements. Additionally, the adoption of global standards like the European Union’s REACH regulation has further propelled the demand for TMBPF in various industrial sectors.

Industrial Growth and Technological Advancements

The rapid growth of industries such as automotive, aerospace, and electronics is a major driver for the TMBPF market. These sectors increasingly demand materials that offer high thermal stability, chemical resistance, and mechanical strength to enhance performance and safety. TMBPF-based materials are used in manufacturing lightweight automotive components, heat-resistant circuit boards, and flame-retardant polymers, all of which contribute to better fuel efficiency, reduced emissions, and improved product durability. In the construction industry, TMBPF is integral to high-performance coatings and adhesives, meeting stringent safety regulations for infrastructure projects. Furthermore, advancements in manufacturing technologies have allowed for the development of enhanced TMBPF formulations, enabling industries to achieve higher efficiency and reliability. The ongoing innovation in applications such as antimicrobial coatings and high-temperature adhesives continues to open new avenues for the compound, making it indispensable across industrial domains.

Consumer Awareness and Preferences

Modern consumers are increasingly prioritizing health and safety, which has greatly influenced the shift towards BPA-free materials. With rising awareness of the potential health risks posed by BPA, consumers are demanding non-toxic alternatives in products ranging from food and beverage packaging to personal care items. TMBPF-based materials offer a safe and reliable solution, as they meet stringent regulatory standards and provide long-lasting protection against contamination. The clean-label movement, which emphasizes transparency and safety in product ingredients, has further boosted the demand for TMBPF in applications like coatings and linings for food containers. Additionally, eco-conscious consumers are driving manufacturers to adopt sustainable practices, including the use of recyclable TMBPF-based materials. This shift in consumer behaviour has led to increased investment by companies in developing innovative TMBPF-based products that align with market trends while addressing safety and environmental concerns. These evolving preferences are solidifying the role of TMBPF as a key material in various consumer-driven industries.

Regulations on Tetramethyl Bisphenol F Market

European Commission:

• Directive 2011/8/EU

o The European Commission Directive 2011/8/EU amended Directive 2002/72/EC to restrict the use of Bisphenol A (BPA) in plastic infant feeding bottles. This regulation reflects the European Union's commitment to protecting vulnerable populations, particularly infants, from potential health risks associated with BPA exposure. The directive prohibits the manufacturing, import, and sale of infant feeding bottles made with BPA-containing materials, ensuring safer alternatives like Tetramethyl Bisphenol F (TMBPF) gain prominence.

• Food Safety Regulations on BPA and Other Bisphenols in Food Contact Materials

o A broader regulatory initiative aims to impose a comprehensive ban on the use of BPA in food contact materials (FCMs), including plastic containers and coated packaging, by the end of 2024. This move follows the European Food Safety Authority’s (EFSA) scientific opinion highlighting concerns over BPA’s adverse effects on human health. The regulation seeks to eliminate BPA from all FCMs to mitigate risks, such as endocrine disruption and other long-term health concerns. These restrictions underscore the growing need for safer substitutes like TMBPF, which offer comparable functionality with significantly reduced health risks.

• United States Food and Drug Administration (FDA): Regulation on Indirect Food Additives - Polymers

o The U.S. Food and Drug Administration (FDA) amended its regulations concerning Indirect Food Additives: Polymers to address the use of polycarbonate (PC) resins in infant feeding bottles and spill-proof cups, such as baby bottles and sippy cups. The FDA determined that these applications of PC resins, which can contain Bisphenol A (BPA), are no longer in use and have been officially abandoned by manufacturers. This amendment reflects the FDA's ongoing efforts to ensure the safety of materials used in food-contact products, particularly those intended for infants and toddlers. By eliminating regulatory provisions for BPA-containing PC resins in these products, the FDA has paved the way for safer, BPA-free alternatives, such as Tetramethyl Bisphenol F (TMBPF), to meet the demand for non-toxic and compliant materials in baby care products. This regulation underscores the growing shift toward safer chemical substitutes in food-contact applications, aligning with both consumer health priorities and industry advancements in material science.

Regional Analysis

Europe

The Tetramethyl Bisphenol F (TMBPF) market demonstrates significant regional variations, with Europe, Asia-Pacific (APAC), and North America emerging as key contributors to its growth. Europe is the largest regional market, accounting for 36.8% of the global market share in 2024. The region’s dominance is driven by stringent regulations, such as the European Commission Directive 2011/8/EU and the REACH policy, which encourage the adoption of BPA-free alternatives.

With growing concerns about BPA’s potential health risks, industries across Europe are transitioning to safer materials like TMBPF for applications in food packaging, coatings, and industrial polymers. Additionally, Europe’s focus on sustainability has spurred the adoption of TMBPF-based materials that align with eco-friendly practices. The demand for clean-label products, coupled with high consumer awareness of health and environmental issues, has positioned TMBPF as a key material in food and beverage packaging, medical devices, and advanced manufacturing applications. Innovations in coatings and polymer technologies further enhance its adoption across industries.

Asia-Pacific (APAC)

In Asia-Pacific (APAC), rapid industrialization in countries like China, India, and South Korea is fueling the demand for high-purity TMBPF. The region’s burgeoning packaging and electronics sectors are driving the need for durable, high-performance materials. TMBPF is widely used in APAC’s growing food packaging industry as a BPA-free alternative, particularly as regulatory frameworks tighten and consumer awareness increases. Electronics manufacturers in the region leverage TMBPF for heat-resistant circuit boards and other components. Additionally, the automotive industry in APAC is adopting TMBPF-based materials for lightweight, fuel-efficient vehicles. The region’s cost-competitive manufacturing environment further boosts its prominence in the global TMBPF market.

North America

In North America, the increasing adoption of BPA-free solutions in food and beverage packaging is a major growth driver. Regulatory bodies like the FDA have implemented strict guidelines, prompting manufacturers to transition to safer alternatives such as TMBPF. The region’s technological advancements in coatings and materials science have also supported the integration of TMBPF in high-performance applications. Furthermore, consumer preferences for non-toxic and sustainable products are influencing market dynamics in North America, particularly in food packaging, medical devices, and construction industries.

Key Players Analysis

Leading companies in the Tetramethyl Bisphenol F market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include

• Deepak Novochem Technologies LTD

• Jeevan Chemicals Private Limited

• Other Prominent Players

Strategic Initiatives

1. Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

2. Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

3. Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.