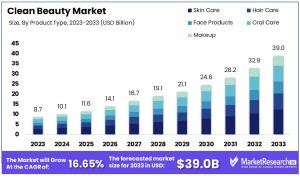

The clean beauty market, valued at USD 8.7B in 2023, is projected to reach USD 39B by 2033, growing at a CAGR of 16.65% from 2024 to 2033.

North America leads the clean beauty market with a 38.50% share, as the industry is set to grow from USD 8.7B in 2023 to USD 39B by 2033, driven by a 16.65% CAGR.”

NEW YORK, NY, UNITED STATES, January 22, 2025 /EINPresswire.com/ -- Report Overview— Tajammul Pangarkar

The Clean Beauty Market was valued at USD 8.7 billion in 2023 and is projected to reach USD 39.0 billion by 2033, growing at a CAGR of 16.65% from 2024 to 2033.

Clean beauty refers to beauty and personal care products that prioritize safety, sustainability, and transparency in their ingredients and formulations. These products are free from harmful chemicals like parabens, sulfates, phthalates, and synthetic fragrances, and are often made with natural, non-toxic, and eco-friendly ingredients. The clean beauty movement has gained significant traction as consumers become more conscious of the potential health risks associated with conventional cosmetics and seek more ethical, environmentally responsible alternatives.

The clean beauty market has emerged as a rapidly growing sector within the broader global beauty industry, driven by shifting consumer preferences and increased demand for products that promote health and well-being. This market encompasses skincare, haircare, makeup, and fragrance products that meet specific "clean" standards, and is characterized by heightened transparency, product safety, and ethical sourcing practices. The global clean beauty market is expected to witness robust growth, fueled by an expanding consumer base, particularly among millennials and Gen Z, who are more inclined to make purchasing decisions based on sustainability and ethical considerations.

Growth in this market is driven by several key factors, including rising awareness of the health and environmental impact of conventional beauty products, advancements in natural ingredient sourcing, and increasing availability of clean beauty products across multiple retail channels. Furthermore, brands that prioritize cruelty-free, vegan, and sustainable practices are tapping into a lucrative opportunity, as consumers demand greater corporate responsibility. As demand for clean, transparent, and effective beauty solutions continues to grow, opportunities for market expansion, innovation, and brand differentiation are becoming more pronounced.

Download Your Free Sample Report and Explore Key Insights Today at https://marketresearch.biz/report/clean-beauty-market/request-sample/

Key Takeaways

~~ The clean beauty market, valued at USD 8.7 billion in 2023, is expected to grow at a robust CAGR of 16.65%, reaching USD 39.0 billion by 2033, driven by rising consumer demand for non-toxic and sustainable products.

~~ Skin care dominates the clean beauty market, driven by increasing consumer demand for organic and non-toxic skincare products, reflecting the industry's emphasis on safety and transparency.

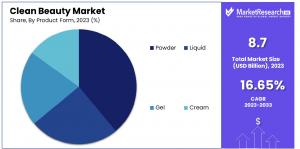

~~ Powder products lead in the clean beauty market due to their long shelf life and reduced need for preservatives, making them a safer option for consumers.

~~ Millennials are the dominant demographic in the clean beauty market, accounting for a significant share due to their strong environmental and health consciousness.

~~ Women are the primary consumers in the clean beauty market, reflecting their continued dominance in beauty product consumption and their growing preference for safe, non-toxic beauty products.

~~ North America holds the largest market share of 38.50% in the clean beauty industry, driven by consumer awareness and a strong preference for natural, eco-friendly products in the U.S. and Canada.

Driving factors

Rising Consumer Demand for Non-Toxic Ingredients

The global Clean Beauty market is being propelled by an increasing consumer preference for non-toxic and natural beauty products. As awareness surrounding the potential health risks of synthetic chemicals in personal care products grows, consumers are increasingly seeking out skincare and cosmetics that prioritize clean, safe, and sustainable ingredients. This heightened awareness is especially evident among millennials and Gen Z consumers, who are not only knowledgeable about ingredient transparency but also more vocal about their demand for ethical, cruelty-free, and environmentally conscious products. Clean Beauty offers a solution to these concerns, with formulations free from harmful ingredients such as parabens, sulfates, phthalates, and synthetic fragrances, which are commonly found in traditional beauty products.

Restraining Factors

Higher Cost of Clean Beauty Products

While the Clean Beauty market is experiencing growth, one of its significant challenges lies in the higher price points of many Clean Beauty products. The use of high-quality, sustainably sourced ingredients, organic certifications, and ethical production processes tends to drive up manufacturing costs, which in turn results in a more expensive final product. For many consumers, especially those in emerging markets or lower income brackets, the price of Clean Beauty products may be a barrier to entry. The cost disparity between Clean Beauty and conventional beauty products can deter price-sensitive consumers from making the switch, limiting the overall market penetration.

Growth Opportunity

Growth of E-commerce and Direct-to-Consumer Channels

The continued rise of e-commerce and the expansion of direct-to-consumer (DTC) sales channels present a significant opportunity for the Clean Beauty market. With more consumers turning to online platforms for their shopping needs, Clean Beauty brands have the chance to leverage e-commerce as a cost-effective and efficient method of distribution. E-commerce allows Clean Beauty brands to reach a global audience without the overhead costs associated with traditional brick-and-mortar retail. This is particularly important for emerging brands looking to expand their customer base without the significant financial investment required for physical retail spaces.

Latest Trends

Increasing Focus on Sustainability and Eco-Friendly Packaging

Sustainability has become a dominant trend within the Clean Beauty sector, with consumers increasingly prioritizing eco-conscious choices when selecting beauty products. This trend extends beyond just the ingredients used in the formulation and includes packaging, production processes, and brand sustainability initiatives. Clean Beauty brands are responding to this demand by adopting eco-friendly packaging solutions such as biodegradable, recyclable, and refillable options. Consumers are now seeking products that align with their broader values of reducing environmental impact, contributing to the rising popularity of Clean Beauty products that promise not only non-toxic ingredients but also sustainable practices throughout the entire supply chain.

Market Segmentation

By Product Type Analysis

Skin care dominates the clean beauty market, driven by increasing consumer awareness and a preference for products made with organic, non-toxic, and sustainable ingredients. The demand for clean skincare is fueled by concerns over the impact of synthetic chemicals on both skin health and the environment. Clean skincare products, such as cleansers, moisturizers, serums, and treatments, offer safe, effective alternatives to conventional options. The focus on transparency, ethical sourcing, and cruelty-free practices further enhances their appeal.

Other segments, including hair care, face products, oral care, and makeup, also play significant roles. Hair care products are gaining traction for being free from harmful chemicals like parabens and sulfates. Face products, like foundations and concealers, are evolving with clean formulations that ensure safety and performance.

By Product Foam Analysis

Powder is the dominant product form in the clean beauty market due to its long shelf life, ease of use, and minimal preservatives. It’s favored in products like setting powders, blushes, and eyeshadows, reducing bacterial growth risks and often requiring fewer synthetic additives. Liquid, gel, and cream forms also play important roles. Liquids, such as cleansers and toners, are effective for delivering active ingredients. Gels are lightweight and hydrating, ideal for skincare, while creams offer rich texture and nourishment, especially in moisturizers and makeup.

By Age Analysis

Millennials dominate the clean beauty market due to their strong focus on sustainability, health, and wellness, as well as their preference for ethically sourced and non-toxic products. Born between 1981 and 1996, they prioritize product transparency and are willing to invest in higher-quality options. While Gen Z is also influencing trends with their demand for authenticity, and Gen X and Baby Boomers are adopting clean beauty for anti-aging and health benefits, Millennials remain the key consumer group in this sector.

By Gender Analysis

Women remain the dominant segment in the clean beauty market, driven by a growing demand for safe, non-toxic, and ethically produced products. Concerns about harmful chemicals and their effects on health, especially reproductive health, fuel this shift. While men's and kids' segments are emerging, with increasing interest in grooming and gentle products, women’s continued dominance and heightened health and environmental awareness make them the key drivers of the clean beauty trend.

By Distribution Channel Analysis

Specialty stores lead the clean beauty market as the preferred distribution channel, offering expert advice, a curated selection, and a personalized shopping experience. While online channels provide convenience and competitive pricing, they lack the physical product interaction. Retail channels, such as supermarkets and drugstores, are expanding their clean beauty offerings to meet demand, but specialty stores remain dominant due to their tailored services and hands-on approach.

Get Access to the Complete Report with a Purchase Discount of Up to 30% at https://marketresearch.biz/purchase-report/?report_id=42942

Key Market Segments

By Product Type

~~ Skin Care

~~ Hair Care

~~ Face Products

~~ Oral Care

~~Makeup

By Product Form

~~ Powder

~~ Liquid

~~ Gel

~~ Cream

By Age Group

~~ Millennials

~~ Gen Z

~~ Gen X

~~ Baby Boomers

By Gender

~~ Women

~~ Men

~~ Kids

By Distribution Channel

~~ Speciality Stores

~~ Online

~~ Retail

~~ Others

Regional Analysis

North America – Clean Beauty Market with Largest Market Share of 38.50% in 2023

The Clean Beauty market is experiencing significant growth across various regions, with North America leading the global market. North America accounted for 38.50% of the Clean Beauty market in 2023, dominating the segment. The region's strong consumer demand for organic and natural beauty products, driven by increasing health consciousness and sustainability trends, contributes to its dominant position.

Europe holds a considerable share of the market due to rising demand for eco-friendly beauty products, particularly in countries like the UK, France, and Germany. Growing environmental awareness and strict regulations on product ingredients further bolster this demand.

Asia Pacific, while currently a smaller share compared to North America and Europe, is witnessing the fastest growth. Increasing disposable incomes, rising awareness of skincare, and the influence of Korean and Japanese beauty trends make it an emerging powerhouse in the Clean Beauty market.

The Middle East & Africa region is growing steadily, with a rise in awareness of natural beauty products and an expanding middle class in countries like the UAE and Saudi Arabia. Meanwhile, Latin America, with its diverse population and increasing focus on organic and natural ingredients, shows moderate growth but remains a smaller segment in comparison to North America and Europe.

Explore Custom Research Solutions Before You Buy the Report.

Players Analysis Analysis

The global clean beauty market in 2024 is poised for significant growth, with several key players shaping the landscape. Burt’s Bees, a pioneer in natural skincare, continues to drive innovation by offering sustainable, eco-friendly products. Similarly, bareMinerals remains a strong contender, emphasizing clean and non-toxic ingredients in its mineral-based cosmetics. Ere Perez Natural Cosmetics is gaining traction for its plant-based, cruelty-free range, appealing to conscious consumers. Avon has pivoted towards clean beauty, integrating environmentally responsible formulations to align with evolving consumer expectations. Juice Beauty, Inc. is recognized for its organic and antioxidant-rich skincare, solidifying its position in the clean beauty niche. Honest Beauty LLC and Kjaer Weis continue to redefine luxury clean beauty with high-performance, safe ingredients. Inika, RMS Beauty, and Vapour Beauty offer high-end, eco-conscious solutions that are resonating with ethical consumers. Brands like Mineral Fusion Natural Brands and BITE Beauty are setting benchmarks for clean, effective formulations, further reinforcing the demand for transparency and sustainability in the beauty industry. These companies are well-positioned to capitalize on the growing shift towards healthier, more ethical beauty solutions.

Key Players

~~ Burt's Bees

~~ bareMinerals

~~ Ere Perez Natural Cosmetics

~~Avon

~~ Juice Beauty, Inc.

~~ Honest Beauty LLC

~~Kjaer Weis

~~ Inika

~~ rms beauty

~~ Vapour Beauty

~~ Mineral Fusion Natural Brands

~~ BITE Beauty

Conclusion

The Clean Beauty market, valued at USD 8.7 billion in 2023, is projected to grow to USD 39.0 billion by 2033, driven by rising demand for non-toxic, sustainable, and ethically produced products. Key factors fueling growth include consumer preference for natural ingredients, transparency, and eco-friendly packaging, especially among Millennials and Gen Z. Skin care dominates the market, while powder products lead in form. Despite challenges like higher costs, opportunities lie in e-commerce expansion. Major players like Burt’s Bees, bareMinerals, and Juice Beauty are well-positioned to capitalize on this growing trend towards cleaner, safer beauty solutions.

Lawrence John

Prudour

+91 9130855334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.