The global financial analytics market grows with advanced computing adoption, enhanced storage, and innovative analytics tools driving demand.

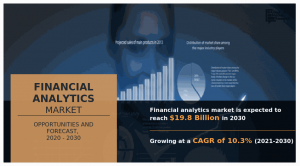

WILMINGTON, DE, UNITED STATES, January 13, 2025 /EINPresswire.com/ -- According to the report published by Allied Market Research, the global financial analytics market generated $7.6 billion in 2020, and is estimated to reach $19.8 billion by 2030, witnessing a CAGR of 10.3% from 2021 to 2030. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chain, regional landscape, and competitive scenario.Increase in pressure from stakeholders or investors for higher transparency, rise in expectations for effective partnering, changing regulatory environment, and surge in continuous economic uncertainty are some of the key factors influencing end users to adopt advanced financial analytics solutions and services.

Download Report Sample (190 Pages PDF with Insights) at: https://www.alliedmarketresearch.com/request-sample/3633

Furthermore, key analytical areas, such as profitability management, cost management, value for money analytics, business risk management, tax management, and regulatory compliance encourage enterprises to increase their expenditure on analytical solutions to gain higher efficiency and valuable insights. Moreover, enterprises operating across the verticals are inclined toward employing talented and skilled workforce to analyze huge volumes of raw data.

The ever-changing business and financial scenario has made it imperative for end-users to stay well-informed in their respective domain to effectively tackle competition. Role of financial management and analytics has transformed and expanded over the past decades. Presently, financial management analytics is more complex and certainly experience more demand.

Organizations across the globe deploy advanced financial analytical solutions to improve their process while using the information gleaned from the intelligence discovery process. At present, information is a key strategic asset that organization uses to compete. Thus, end users capitalize the information to acquire insights and build intelligence to respond more effectively to changing business environment.

Buy Now & Get Exclusive Discount on this Report: https://www.alliedmarketresearch.com/financial-analytics-market/purchase-options

Advancements in the field of artificial intelligence (AI) market and growth in cloud disruption in the modern industry boost the growth of the global financial analytics market. In addition, the availability of advanced analytical tools and prediction solutions positively impacts the growth of the market. However, huge requirements and high dependency on data, lack of experienced professionals, and difficulties in training multilayer financial analytics hamper the market growth. On the contrary, growth in application areas for deep financial analytics is expected to offer remunerative opportunities for expansion of the market during the forecast period.

Covid-19 Scenario:

1. The demand for financial analytics services and solutions increased during the Covid-19 pandemic, due to rise in need to take better financial decisions during times of economic uncertainty.

2. Moreover, the increase in the volume of data generated by different industries and the need to manage this huge amount of data also increased the demand for financial analytics.

The report offers detailed segmentation of the global financial analytics market based on component, deployment mode, organization size, industry vertical, and region.

Based on components, the solution segment contributed to the highest share in 2020, accounting for more than two-thirds of the total market share, and is estimated to maintain its dominant share by 2030. However, the services segment will manifest the highest CAGR of 12.6% from 2021 to 2030.

For Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/3633

Depending on the industry vertical, the BFSI segment holds the largest market share of financial analytics market, owing to rapid adoption of financial analytics software by various fintech and banking institutions for providing personalized service and automated voice systems to the customer. However, the retail and E-commerce segment is expected to grow at the highest rate during the financial analytics market forecast period, owing to process and record financial & production data, manage plant-level strategies, and account for material, capacity, and labor constraints.

Region-wise, the financial analytics market was dominated by North America in 2020, and is expected to retain its position during the forecast period, owing to technological advancements and new strategies applied by the major companies such as, Google, Microsoft, and Facebook to adopt AI as core strategic driver for business. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to industrialization and demand for efficient technologies in industries, such as retail, IT & telecom, banking, financial services and insurance(BFSI), and growth of manufacturing & healthcare sectors in countries, such as China, India, and Japan.

Leading players of the global financial analytics market analyzed in the research include Deloitte LLP, International Business Machine Corporation, Hitachi Vantara Corporation, Oracle, Microsoft Corporation, SAP SE, Rosslyn Data Technologies, Teradata Corporation, Symphony Teleca Services, Inc., and TIBCO Software, Inc.

If you have any special requirements, Request customization: https://www.alliedmarketresearch.com/request-for-customization/3633

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR aims to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and university students. With reports on more than 60,000 niche markets with data comprising 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients’ requirements is complemented with analyst support and customization requests.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: + 1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.