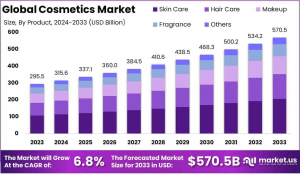

Cosmetics Market is projected to reach USD 570.5 billion by 2033, growing from USD 295.5 billion in 2023, with a CAGR of 6.8% from 2024 to 2033.

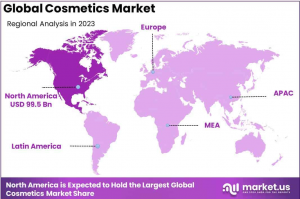

"North America leads the global Cosmetics Market with a 33.7% share, valued at USD 99.5 billion in 2023, as the market is set to reach USD 570.5 billion by 2033."

”

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- **Report Overview**— Tajammul Pangarkar

The Global Cosmetics Market is projected to reach USD 570.5 Billion by 2033, up from USD 295.5 Billion in 2023, growing at a CAGR of 6.8% from 2024 to 2033.

The cosmetics industry encompasses a wide range of products designed to enhance or alter the appearance, fragrance, and texture of the human body. These products include skincare, makeup, haircare, fragrances, and personal care items, catering to both aesthetic and functional needs. Cosmetics serve to improve physical appearance, promote hygiene, and offer personal satisfaction. The market for cosmetics has evolved significantly, driven by shifts in consumer preferences, technological innovations, and increasing awareness about personal grooming.

The global cosmetics market refers to the economic sector involved in the production, distribution, and consumption of cosmetic products. This market is influenced by various factors including demographic trends, cultural shifts, and the growing demand for sustainable, cruelty-free, and organic beauty products. As consumer behavior evolves, there has been a surge in demand for personalized products, particularly in skincare and makeup. The market is highly fragmented, with both established multinational companies and emerging brands competing across various price points and segments.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/cosmetic-market/request-sample/

Several growth drivers are fueling the cosmetics market. First, increasing disposable incomes, particularly in developing regions, are making premium and luxury cosmetics more accessible. Second, the rising trend of self-care and wellness, driven by social media influencers and digital platforms, is expanding the consumer base. Additionally, technological advancements in product formulation, packaging, and delivery systems are creating new opportunities for innovation. The demand for clean beauty, sustainability, and ethical practices has also created a shift toward plant-based, eco-friendly, and inclusive products. These trends present significant opportunities for companies to capture value and establish long-term customer loyalty.

**Key Takeaways**

~~ The global cosmetics market is expected to grow from USD 265.4 billion in 2023 to USD 449.1 billion by 2033, at a CAGR of 5.4%, fueled by rising disposable incomes, increasing self-care trends, and digital transformation.

~~ The Skin Care segment holds the largest market share at 36.2% in 2023, driven by growing demand for anti-aging and natural products.

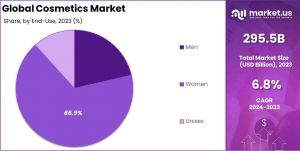

~~ The Women’s segment dominates with a 66.9% market share, supported by a wide range of products and a focus on personalized beauty solutions.

~~ Hypermarkets/Supermarkets accounted for the largest distribution channel share in 2023 at 24.2%, due to convenience and product variety.

~~North America leads the regional market with a 33.7% share in 2023, bolstered by high consumer spending and innovative product offerings.

**Market Segmentation**

By Product Analysis

In 2023, the Skin Care segment led the Cosmetics market with a 36.2% share, driven by growing demand for health-conscious beauty, anti-aging products, and skincare routines across all age groups. Hair Care followed with 25.8% market share, fueled by demand for specialized treatments like anti-hair fall and natural products. Makeup products accounted for 18.6%, boosted by social media influence and the rise of inclusive, diverse offerings. Fragrances captured 12.4% of the market, supported by consumer interest in premium and personalized scents. The "Others" category, including nail care and personal hygiene, made up 7%, with potential for growth in holistic beauty solutions.

By End-Use Analysis

In 2023, women dominated the cosmetics market, holding a 66.9% share, driven by high demand across skincare, makeup, and hair care products. Social media and rising awareness of personal grooming have fueled this growth. The men's segment captured 21.4% of the market, benefiting from increased adoption of grooming products like beard care and skincare. Changing perceptions of male grooming further support this trend.

Unisex products accounted for 11.7% of the market, reflecting growing demand for versatile, gender-neutral options in skincare and fragrances.

By Distribution Channel Analysis

In 2023, the Cosmetics market by distribution channel was dominated by Hypermarkets/Supermarkets, holding 24.2% of the market share due to their convenience, wide variety, and frequent promotions. Specialty Stores followed with 21.5%, offering expert advice and exclusive, premium products. Pharmacies captured 18.7%, benefiting from the demand for dermatologically-tested and health-focused cosmetics. Online Sales accounted for 23.1%, driven by convenience, variety, and competitive pricing. The "Others" category, including convenience stores and beauty salons, made up 12.5% of the market.

**Key Market Segments**

By Product

~~Skin Care

~~Hair Care

~~Makeup

~~Fragrance

~~Others

End-user

~~Men

~~Women

~~Unisex

Distribution Channel

~~Hypermarkets/Supermarkets

~~Specialty Stores

~~Pharmacies

~~Online Sales Channel

~~Others

**Driving factors**

Surge in Consumer Demand for Natural and Organic Products

In 2024, the global cosmetics market is witnessing a strong drive from the increasing consumer demand for natural and organic beauty products. Consumers are becoming more conscious of the ingredients in their skincare and beauty products, as they seek options that align with their wellness and sustainability values. This growing trend is not only a response to concerns over skin health but also an alignment with broader environmental considerations. Organic ingredients, free from harmful chemicals, parabens, and sulfates, are seen as safer alternatives, which has led to the emergence of clean beauty products. This consumer shift towards purity and natural formulations has intensified competition among brands, with many adapting their product lines to cater to these preferences.

**Restraining Factors**

Regulatory Challenges in Cosmetic Ingredients and Formulations

One of the significant restraints for the cosmetics market in 2024 is the growing complexity of regulatory requirements surrounding cosmetic ingredients and formulations. Governments and regulatory bodies are continuously enhancing standards to ensure consumer safety, which often results in increased scrutiny of cosmetic products. While these regulations are vital for consumer protection, they present challenges for companies, particularly smaller businesses that struggle with the cost and time associated with meeting these ever-evolving standards. Additionally, products that are introduced into international markets must navigate different sets of regulations, which adds complexity to global product distribution.

**Growth Opportunity**

Expanding Cosmetic Offerings in Emerging Markets

Emerging markets, especially in regions such as Asia-Pacific, Latin America, and Africa, present a significant opportunity for growth in the global cosmetics market in 2024. As disposable incomes rise and consumers in these regions become more brand-conscious, there is an increasing demand for beauty and personal care products. The cosmetics market in countries like India, Brazil, and South Africa is experiencing a boom, driven by urbanization, a growing middle class, and changing consumer preferences. Moreover, young, tech-savvy consumers in these markets are increasingly seeking premium and luxury beauty products, which are becoming more accessible due to e-commerce platforms.

**Latest Trends**

Rise of Personalized and Custom Beauty Solutions

In 2024, the cosmetics market is witnessing a trend towards personalized and custom beauty solutions, a shift that is transforming the way consumers approach their beauty routines. Thanks to advancements in technology, particularly AI and data analytics, brands can now offer more tailored products and experiences to meet the unique needs of individual consumers. Consumers are increasingly looking for skincare and beauty solutions that address their specific skin concerns, preferences, and even lifestyles. This growing desire for personalization has given rise to the popularity of customizable skincare regimens and bespoke makeup products, leading to a more customer-centric beauty landscape.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=60956

**Regional Analysis**

North America – Cosmetics Market with Largest Market Share of 33.7%

North America dominates the global cosmetics market, holding a 33.7% market share in 2023, valued at USD 99.5 billion. This growth is driven by the demand for premium, organic, and sustainable products, along with a strong retail infrastructure and the influence of beauty trends through digital platforms and influencers.

Europe maintains a strong market presence, fueled by high consumer spending, innovation in beauty products, and a growing preference for eco-friendly and organic items. Key markets include the UK, Germany, and France, where demand for high-quality cosmetics continues to rise.

Asia Pacific is the fastest-growing region, driven by increasing disposable income, a burgeoning middle class, and evolving beauty standards. Countries like China, Japan, and South Korea are key drivers, with rapid adoption of global beauty trends and expanding e-commerce channels.

The Middle East & Africa cosmetics market is expanding, particularly in the GCC countries, driven by rising incomes, a young demographic, and growing demand for luxury and skincare products, though market penetration is still limited compared to other regions.

Latin America's cosmetics market is growing steadily, with countries like Brazil and Mexico seeing increased demand for skincare and beauty products. Consumers are shifting toward eco-friendly and locally-sourced items, driving market expansion.

**Key Players Analysis**

In 2024, the global cosmetics market remains highly competitive, with major players such as Coty Inc., L'Oréal Group, Estee Lauder, and Unilever continuing to dominate. These companies leverage their strong brand portfolios, innovative product development, and vast distribution networks to maintain market leadership. Coty Inc., with its extensive presence in fragrance and color cosmetics, is set to expand further through strategic acquisitions.

L'Oréal Group and Estee Lauder continue to lead in skincare and premium cosmetics, capitalizing on growing consumer demand for luxury and personalized products. Avon and Revlon, while facing stiff competition, are focusing on direct-to-consumer models and sustainability initiatives to stay relevant. Unilever, with its diversified portfolio, has an advantage in the mass market segment. Other key players, like Beiersdorf, Henkel, and Procter & Gamble, are heavily investing in R&D and digital marketing to drive growth. As consumer preferences evolve toward natural and eco-friendly products, these companies will likely continue to innovate to align with new trends.

Top Key Players in the Market

~~Coty Inc.

~~L’Oréal Group

~~Estee Lauder Companies, Inc.

~~Revlon Consumer Products LLC

~~Avon Products, Inc.

~~Unilever

~~Company 7

~~Godrej Group

~~Procter & Gamble

~~Beiersdorf AG

~~Henkel AG & Co KGaA

~~Kao Corporation

~~Hoyu Co., Ltd.

**Recent Developments**

~~ 2023, L’Oréal: Acquired premium skincare brand Aesop from Natura & Co. for $2.525 billion, enhancing its luxury skincare portfolio with eco-conscious, high-quality products.

~~ September 2024, Euroitalia: Acquired Moschino’s beauty and fragrance rights from Aeffe Group for €39.6 million, aiming to expand its luxury fragrance offerings.

~~ August 2023, e.l.f. Beauty: Acquired Naturium, a high-performance skincare brand, for $355 million, diversifying its product range and expanding its customer base beyond color cosmetics.

"Check out additional related reports for further insights."

Cosmetics Shea Butter Market- https://market.us/report/cosmetics-shea-butter-market/

Luxury Cosmetics Market- https://market.us/report/luxury-cosmetics-market/

Halal Cosmetics Market- https://market.us/report/halal-cosmetics-market/

Mineral Cosmetics Market- https://market.us/report/mineral-cosmetics-market/

Cosmetics and Personal Care Packaging Equipment Market- https://market.us/report/cosmetics-and-personal-care-packaging-equipment-market/

Waterless Cosmetics Market- https://market.us/report/waterless-cosmetics-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.