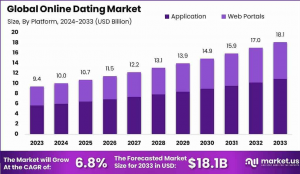

By 2033, the online dating market is expected to double, reaching USD 18.1 Billion, growing from USD 10 Billion in 2024 at a 6.8% CAGR.

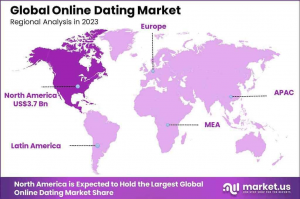

In 2023, North America held a leading position in the global market, commanding more than 40% of the market share and generating approximately USD 3.7 Billion in revenue.”

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The online dating market comprises digital platforms and applications designed to help individuals form connections and relationships through matchmaking algorithms, user profiles, and interactive features. This market includes a variety of business models, such as subscription-based, freemium, and ad-supported services, catering to diverse user needs.— Tajammul Pangarkar

The growth of the online dating market is primarily driven by increased smartphone penetration, changing social attitudes toward online relationships, and the convenience of digital matchmaking. The rising popularity of dating apps among millennials and Gen Z, who value technology-driven solutions, has significantly contributed to market expansion. Additionally, growing urbanization and busy lifestyles are encouraging individuals to explore online platforms as a practical way to meet potential partners.

AI has transformed the online dating landscape by enhancing matchmaking processes and improving user experiences. AI-powered algorithms analyze user data, preferences, and behaviour to provide highly accurate and compatible matches. Furthermore, AI tools are employed to detect and eliminate fake profiles, ensuring safer and more reliable platforms. Personalized content recommendations and conversational AI features also drive higher engagement.

Explore discounts for instant purchase now @ https://market.us/purchase-report/?report_id=100976

According to Business of Apps, over 300 million people worldwide actively use dating apps, highlighting the strong demand for digital matchmaking. Among them, around 20 million opt for premium features, showing a clear willingness to pay for added benefits. In 2023, Tinder was the most downloaded dating app, with Bumble close behind, showcasing their popularity among online daters.

Data from eBizNeeds reveals that nearly 30% of adults continue to engage with dating apps, underlining their lasting appeal. Over 40% of users believe these platforms make it easier to meet new friends or find partners, proving their effectiveness in fostering social connections. User sentiment toward dating apps is largely positive, with 60% holding favorable views. Interestingly, 68% of men feel optimistic about using dating apps, compared to 55% of women, reflecting different experiences and expectations

Key Takeaways

The Global Online Dating Market is poised for remarkable growth, projected to reach USD 18.1 billion by 2033, up from USD 9.4 billion in 2023. This reflects a steady CAGR of 6.8% over the forecast period from 2024 to 2033.

In 2023, North America emerged as the leader, contributing over 40% of the market share and generating around USD 3.7 billion in revenue. This strong performance is fueled by high digital engagement and the growing social acceptance of online dating platforms in the region.

The Application segment captured 60.7% of the market in 2023, underlining the popularity of mobile and web-based dating platforms. These platforms offer ease of use, personalized features, and a wider variety of matchmaking options, making them the go-to choice for users.

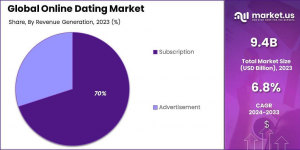

Subscription-based services held a dominant 70.9% share of the market in 2023. This trend clearly shows that users are willing to pay for premium features, such as personalized matchmaking and enhanced privacy settings, that elevate their overall experience.

Social Dating platforms topped the dating type segment with a 39.1% market share in 2023, reflecting a growing preference for casual connections and friendship-oriented interactions. This shift highlights the changing dynamics of how people approach online relationships.

According to NCBI, around 40% of single adults are looking for an online partner [8], or that around 25% of new couples met through this means

According to infrastrucure.gov.au, the top six social media services used were Facebook (74%), YouTube (69%), Instagram, (69%), LinkedIn (47%), TikTok (37.5%) and, Twitter (36.5%). The top six online dating, apps used were: Tinder (27%), Bumble (21%), Grindr (8%), Hinge (6%), eHarmony (6%), and Plenty of Fish (2%).

Tap into Market Opportunities and Stay Ahead of Competitors - Get Your Sample Report Now @ https://market.us/report/online-dating-market/free-sample/

Analyst’s Viewpoint

The online dating market presents significant investment opportunities driven by rising consumer adoption, technological innovations, and expanding demographic reach. The sector is increasingly attractive to investors due to its high-growth potential, especially in emerging markets with improving internet infrastructure and smartphone penetration. Niche platforms catering to specific communities or interests are gaining traction, offering unique value propositions and creating room for market differentiation.

Governments in certain regions are beginning to recognize the economic potential of digital platforms, providing incentives for tech-driven startups. These incentives, combined with the broader push toward digital transformation, have catalyzed innovation in the industry. However, the market faces challenges associated with data privacy and compliance with evolving regulations such as GDPR and CCPA. The regulatory environment is becoming more stringent, requiring platforms to prioritize user safety, transparency, and ethical AI practices.

Consumer awareness about data security and ethical concerns also influences market dynamics, with users increasingly favoring platforms that demonstrate robust privacy policies and secure operations. While these factors present risks for businesses unable to adapt, they also offer opportunities for platforms to build trust and loyalty.

Platform Analysis

In 2023, Applications held a dominant market position, capturing more than a 60.7% share of the online dating market. The convenience and accessibility of dating apps on smartphones have made it the preferred platform for users, especially millennials and Gen Z, who value on-the-go connectivity.

Features like swiping interfaces, AI-driven matchmaking, and integrated communication tools such as video calls and messaging enhances the user engagement and streamline the dating experience. The proliferation of affordable smartphones and improved internet connectivity has further fueled the adoption of mobile dating apps globally.

Web Portals, while accounting for a smaller market share, continue to play a significant role, particularly among users who prefer more detailed profiles and a comprehensive matchmaking process. These platforms often cater to niche audiences or those seeking serious relationships, leveraging advanced compatibility algorithms and in-depth user preferences. Web portals also benefit from offering larger screen interfaces, making them ideal for users who value thorough exploration of potential matches.

Revenue Generation Analysis

In 2023, the Subscription segment held a dominant market position, capturing more than a 70.9% share of the online dating market. Subscription-based models are widely preferred due to their ability to provide users with premium features such as advanced matchmaking algorithms, unlimited swipes, ad-free experiences, and enhanced privacy controls.

These features cater to users who prioritize value-added services and a higher probability of finding compatible matches. Leading platforms like Tinder, Bumble, and eHarmony have capitalized on this model by offering tiered subscriptions, enabling users to choose plans that align with their needs and budgets.

The Advertisement segment, while accounting for a smaller share, plays a significant role in driving revenue for freemium-based platforms. Many online dating apps leverage advertisements to monetize their large user bases, particularly free users, through targeted ads and partnerships. This model appeals to companies seeking precise demographic targeting and high engagement rates. Innovations in ad personalization, powered by AI, have further enhanced the efficacy of this revenue stream, making it a lucrative option for app developers.

Service Analysis

In 2023, the Social Dating segment held a dominant market position, capturing more than a 39.1% share of the online dating market. Social dating platforms, including Tinder and Bumble, focus on fostering casual connections, friendships, and romantic relationships, appealing to a broad audience of millennials and Gen Z users.

These platforms leverage intuitive features like swiping, location-based services, and AI-driven matchmaking to enhance user engagement and simplify the dating experience. The widespread adoption of smartphones and the popularity of quick, accessible interactions have further solidified the dominance of social dating in the market.

The Niche Dating segment is gaining traction, catering to users with specific interests, lifestyles, or demographics. Platforms targeting professionals, religious groups, or shared hobbies offer personalized experiences, making them increasingly attractive to users seeking meaningful connections within a defined community.

The report provides a full list of key companies, their strategies, and the latest developments. Download a Free Sample before buying

Regional Analysis

In 2023, North America held a dominant position in the Online Dating market, accounting for over 40% of the global share. The region's leadership is driven by the high adoption of digital platforms, a tech-savvy population, and significant disposable income levels. The presence of established players like Tinder, Bumble, and Match.com, headquartered in the region, has further fueled growth through consistent innovation and marketing strategies.

Additionally, cultural acceptance of online dating as a mainstream avenue for relationships has contributed to widespread adoption. North America continues to lead in subscription-based revenue models and the integration of advanced features such as AI-driven matchmaking and enhanced user privacy.

The Asia-Pacific (APAC) region, on the other hand, is experiencing the fastest growth in the online dating market. This growth is propelled by a large and growing population of smartphone users, increasing internet penetration, and a shift in cultural attitudes toward online dating in countries such as China, India, and Japan.

The rising popularity of freemium models and niche platforms tailored to specific communities or lifestyles further accelerates growth. As governments in the region continue to invest in digital infrastructure, APAC is poised to become a key driver of innovation and expansion in the global online dating market.

Key Player Analysis

One of the leading firm in the market if Spark Network GmbH, an American German, dating company with a portfolio of brands that are designed for bachelors seeking a serious relation. It’s online dating brands include Zoosk, SilverSingles, EliteSingles, Jdate, ChristianMingle, eDarling, JSwipe, AdventistSingles, LDSSingles, and Attractive World.

Another well-known platform is Tinder, one of the most prominent players in the global online dating market, known for revolutionizing the industry with its swipe-based interface. The app has become synonymous with casual dating and is highly popular among millennials and Gen Z users. Its innovative "swipe right" and "swipe left" functionality simplified user interactions, setting a benchmark for user-friendly dating platforms.

Emerging Trends

The online dating market is evolving rapidly, driven by changing consumer behaviors, technological innovations, and the need for more meaningful connections in a digital-first world. Several emerging trends are reshaping the landscape, focusing on personalization, security, and immersive experiences.

One of the most prominent trends is the rise of AI-driven matchmaking. Modern dating platforms are using advanced algorithms and machine learning to analyze user preferences, behaviour patterns, and even emotional cues to deliver more accurate matches. By continuously learning from user interactions, AI enhances compatibility outcomes and ensures a more seamless dating journey, helping users find meaningful relationships faster.

Additionally, Video-first dating experiences is one the latest growing trend. Features like video profiles, live streaming, and virtual speed dating have become mainstream, giving users a chance to interact face-to-face before committing to in-person meetings. This shift not only builds trust but also reduces the potential for mismatches.

Top Use Cases

The rise of niche dating apps tailored to unique demographics or interests is reshaping the industry. Examples include platforms for professionals (The League), fitness enthusiasts (Fitafy), or specific religious communities (Muzmatch for Muslims). These apps foster a sense of belonging and cater to specific needs, making them increasingly popular.

Gamified features, such as quizzes, virtual challenges, and in-app games, are being introduced to enhance engagement and make the dating experience more enjoyable. These elements encourage users to spend more time on the platform while creating unique interaction opportunities.

Language barriers are being minimized with AI-driven real-time translation tools integrated into messaging systems. This is particularly impactful for global platforms, enabling users from different cultures to communicate seamlessly.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights : https://market.us/purchase-report/?report_id=100976

Major Challenges

The online dating market, faces several challenges that impact its growth and sustainability. These challenges are majorly due to evolving consumer expectations, technological limitations, and societal dynamics, which companies must navigate to remain competitive and relevant.

One of the major challenges is data privacy and security.

Users entrust dating platforms with sensitive personal information, including preferences, locations, and even financial data. Any breach of this trust can lead to reputational damage and legal repercussions. In an era of heightened awareness around data security, platforms must invest heavily in encryption, authentication protocols, and compliance with regulations like GDPR and CCPA to ensure user safety.

Fake profiles and scams are persistent issues plaguing the online dating ecosystem. Despite advancements in AI for detecting fraudulent accounts, many platforms struggle to maintain the authenticity of their user base. Scammers exploit the anonymity of digital platforms to prey on unsuspecting users, leading to mistrust and diminished user satisfaction.

Attractive Opportunities

The online dating market is teeming with opportunities, driven by changing societal norms, technological advancements, and the growing comfort with digital connections. These opportunities offer immense potential for platforms to innovate and cater to an increasingly diverse and tech-savvy audience.

One of the most attractive opportunities lies in expanding into emerging markets. With rising smartphone penetration and improving internet infrastructure in regions like Asia-Pacific, Africa, and Latin America, the untapped potential for online dating platforms is immense. These regions offer a young, dynamic population open to digital experiences, presenting a fertile ground for growth. Localized apps that consider cultural nuances, language preferences, and specific dating norms are likely to succeed in capturing this audience.

Additionally, freemium models with premium offerings continue to generate significant revenue opportunities. Platforms can tap into micro transactions and subscription tiers, offering features like advanced search filters, profile boosts, and exclusive matchmaking to cater to users seeking enhanced experiences.

Recent Developments

- In December 2024, No Names, a dating app with a twist, is all set for launch. Designed to combat the growing fatigue of endless swiping and superficial conversations, the app offers young Indian professionals and Gen Z users an opportunity to make genuine connections in under 30 seconds.

- In November 2024, U.S. disabled dating platform Dateability has this landed on app stores in the U.K. The app, though a web version is available too, also offers a modern smartphone-based dating experience with specific customizations tailored towards the disability community.

- In September 2024, After, a new dating app based in Austin, Texas, has unveiled its first marketing campaign targeted at Gen Z singles, many of whom may have succumbed to dating app fatigue. The effort involves a set of cheeky promotions, including the "Crush Cache Clear Out Challenge," which invites users to clear their contacts list of past dates and matches with copies like "Goodbye, "Joe Hinge."

- In May 2024, Bumble, women-first dating app revealed a brand new visual identity and a new global campaign, emphasising the brand’s continual dedication to making dating better for women. The campaign is coinciding with the expansion of the dating app's signature 'Make The First Move' functionality, with the launch of Opening Moves.

Conclusion

The online dating market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and expanding global adoption. With opportunities in niche platforms, AI-driven personalization, and immersive features like video and VR, the industry continues to redefine how people connect in a digital world. However, addressing challenges such as data privacy, user trust, and market saturation will be crucial for long-term success. As platforms innovate to create secure, engaging, and personalized experiences, the online dating market is set to remain a dynamic and transformative force in the digital economy.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.