Equity Access Group showcases reverse mortgages as a solution to rising costs, helping retirees unlock home equity for financial stability and peace of mind.

LADERA RANCH, CA, UNITED STATES, January 11, 2025 /EINPresswire.com/ -- In an era of increasing living expenses and economic inflation, retirees across the United States are seeking innovative and reliable solutions to maintain their quality of life. So, our team at Equity Access Group decided to find out the potential of reverse mortgages in addressing the financial challenges seniors face today.

With extensive research and in-depth understanding, EAG sheds light on how this financial tool can empower retirees to navigate modern-day retirement.

What Is a Reverse Mortgage?

A reverse mortgage is a specialized loan available to homeowners aged 62 or older, allowing them to convert a portion of their home equity into tax-free funds. Unlike traditional mortgages, reverse mortgages require no monthly repayments during the homeowner’s lifetime in the residence. Instead, repayment is not needed until the homeowner moves out, sells the property, or passes away. This makes reverse mortgages a flexible and powerful option for retirees seeking to bolster their financial security without parting with their homes.

The Reality of Retirement in the U.S.

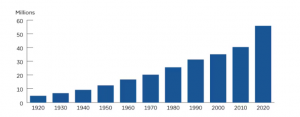

The financial landscape of retirement in the United States is increasingly complex. In 2020, about 1 in 6 people in the United States were age 65 and over. In 1920, this proportion was less than 1 in 20. According to the U.S. Census Bureau, the average retirement age is 64 for men and 62 for women.

However, retiring does not mean financial freedom for many. Data from Yahoo Finance reveals that retirees spend an average of $4,345 per month, with housing and healthcare being the two largest expenses. The average expenses were $52,141, or $4,345 per month. Out of which, the absolute essential expenses come close to $43,000 per annum as shown in the table. It was also found that the expenses of younger retirees were greater than those of older retirees.

Furthermore, it’s a possibility nowadays that most retirees may not have sufficient resources to maintain their pre-retirement standard of living. This underscores the urgency of exploring alternative financial strategies to supplement fixed incomes and manage rising expenses.

Unlocking Home Equity for Financial Stability:

According to Zillow, the average home value in the United States is currently estimated at $357,469. This figure represents most retirees’ wealth, as most Americans hold much of their net worth in their homes. A reverse mortgage allows homeowners to access this wealth without selling their property.

For example, a homeowner with a $350,000 house could unlock anywhere from $200,000 to $250,000 in funds through a reverse mortgage, depending on their age, current interest rates, and home equity. These funds can be disbursed in various forms—as a lump sum, monthly payments, a line of credit, or a combination of these options—to suit individual financial goals and needs.

How Reverse Mortgages Address Rising Costs:

Reverse mortgages are more than just financial tools; they are lifelines for retirees navigating the challenges of rising living costs. The flexibility of these loans allows seniors to:

1. Cover escalating healthcare expenses, including medical bills, long-term care, and prescriptions.

2. Fund home modifications that enhance safety and accessibility for aging in place.

3. Supplement fixed monthly incomes to meet everyday living expenses, such as groceries and utilities.

4. Build a financial buffer to handle unexpected emergencies, providing peace of mind in uncertain times.

Reverse mortgages directly address concerns about running out of money in retirement by unlocking the potential of home equity, an often underutilized resource.

“Reverse mortgages are transforming the way retirees view financial stability,” says Jason Nichols, CMO of Equity Access Group. “By leveraging their home equity, seniors can enjoy peace of mind and focus on living comfortably without the immediate pressure of monthly loan repayments. It’s a game-changer for those looking to better their retirement experience.”

The Role of Reverse Mortgages in the Current Economy:

The current economic climate, characterized by inflation and volatile markets, has amplified the importance of reliable financial solutions for retirees. Inflation, which recently hit its highest levels in decades, has eroded the purchasing power of fixed incomes, forcing many seniors to dip into savings or rely on family support.

Reverse mortgages provide an inflation-resistant solution by offering access to a non-taxable cash flow tied to the value of the home. Additionally, a reverse mortgage line of credit grows over time, ensuring that seniors have access to more funds as their needs evolve. This adaptability makes reverse mortgages uniquely suited to the modern economic landscape.

About Equity Access Group:

Equity Access Group specializes in providing financial solutions tailored to the needs of retirees. Our mission is to help seniors achieve financial stability and peace of mind through products like reverse mortgages. EAG offers personalized consultations to help you understand the benefits and determine if a reverse mortgage is the right fit for your retirement plan.

Jason Nichols

Equity Access Group

+1 888-391-4324

pr@trussfinancialgroup.com

Visit us on social media:

Facebook

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.