India's warehousing market is shifting to smart solutions, with 40% of warehouses adopting automation by 2030, driving growth and technological advancements.

India’s warehousing sector, valued at ~ USD 20 Bn in 2023, faces challenges like outdated infrastructure. However, with 40% of warehouses transitioning to smart solutions by 2030, growth is expected”

MUMBAI, MAHARASHTRA, INDIA, December 13, 2024 /EINPresswire.com/ -- Asia's warehousing market has been experiencing robust growth, driven by factors such as the e-commerce boom, supply chain diversification, urbanization, and technological advancements. Prominent markets like China, India, Japan, and Southeast Asia (including Singapore, Vietnam, and Malaysia) are leading this transformation, with demand for warehousing facilities reaching unprecedented levels.— Ruchika Rana

According to Makreo Research, the logistics market in Asia-Pacific has witnessed a sharp increase in rentals. Cities like Bengaluru and Delhi-NCR in India were among the top 10 for logistics market growth in the first half of 2023. The logistics market in India is expected to add over 30 million square feet of warehouse space in 2023, accounting for more than one-third of the region's total additions.

Manila saw the highest annual rental growth of 49.3% YoY, driven by e-commerce, while China's "China+1" strategy is accelerating the diversification of institutional-grade facilities across Southeast Asia.

India's Warehousing Market: A Key Player in Asia:

India is at the forefront of Asia’s warehousing revolution, driven by the demand for general, refrigerated, and specialized storage solutions. The Indian warehousing market is set to grow significantly, backed by a robust manufacturing sector and advancements in logistics technology. By 2030, nearly 40% of organized warehouses in India are projected to transition into smart warehouses, equipped with automation and IoT solutions.

- Economic Impact and Future Projections

The Indian Warehousing, Industrial, and Logistics (WIL) sector plays a pivotal role in achieving the country's ambition of becoming a USD 5 trillion economy. As of 2023, the industry is valued at ~ USD 20 billion, reflecting a post-pandemic surge in demand for efficient and automated facilities.

Key Drivers of India’s Warehousing Market Growth:

1. Modern Facilities and Technological Integration

Investors are increasingly focusing on Grade A warehouses with advanced technologies like automation, robotics, IoT, and RFID. These facilities enhance inventory management and optimize supply chain processes, making them attractive investment opportunities in the India logistics and warehousing market.

2. Expansion into Tier 2 and Tier 3 Cities

The India warehousing market is no longer confined to Tier 1 cities. E-commerce and third-party logistics (3PL) players are driving demand in Tier 2 and Tier 3 cities, offering higher returns and meeting growing consumer needs.

3. Strategic Location and Connectivity

Modern warehousing facilities are strategically located near highways, ports, and airports, reducing transportation costs and enhancing supply chain reliability.

4. Adoption of Advanced Warehousing Technology

Technologies like Warehouse Management Systems (WMS), cloud-based inventory solutions, and real-time tracking tools are revolutionizing warehouse operations. These innovations boost efficiency and attract investor interest.

5. Government Support and Infrastructure Development

Initiatives like “Digital India” and extensive infrastructure programs have created a conducive environment for modern warehousing, attracting domestic and international investments.

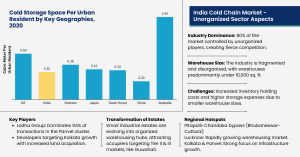

Cold Storage Market: A Growing Segment in India:

- Rising Demand for Specialized Facilities

Cold storage demand is surging in sectors like agriculture, pharmaceuticals, and food processing, requiring controlled environments to maintain product quality. The cold storage market is expected to grow at a CAGR of 3.4% by 2026.

- Innovative Developments

• Maersk’s Cold Storage Facility: A.P. Moller-Maersk’s new facility in Gujarat features 14,700 pallet positions, setting benchmarks in sustainability and operational excellence.

• Net-Zero Cold Storage Solutions: BOOTES and Cargo People’s partnership aims to reduce food waste from 40% to 5%, offering 50% greater energy efficiency.

Challenges in India’s Warehousing Sector:

1. Inefficient Layouts and Space Management

Poor warehouse layouts increase operational costs and reduce productivity. Optimized storage solutions and vertical space utilization are essential for efficiency.

2. Inventory Inaccuracy

Inventory discrepancies lead to stockouts or surpluses, causing customer dissatisfaction and operational inefficiencies.

3. Slow Technological Transition

Despite advancements, 35% of warehouses still rely on outdated systems, slowing the adoption of automation and affecting productivity.

The report provides a comprehensive analysis of the India Warehousing and Cold Chain Market (2018-2030), examining market segmentation by structure (traditional, automated, temperature-controlled), services (storage, transportation, inventory management), and ownership models (logistics companies, manufacturers, 3PL providers). It highlights warehouse sizes, key industry verticals (e-commerce, retail, pharmaceuticals), and geographical distribution across major cities. The study emphasizes technology integration like WMS and automation, along with government initiatives, emerging trends, and competitive dynamics. Detailed forecasts reveal growth opportunities driven by e-commerce expansion, advanced technologies, and rising demand for temperature-sensitive storage, offering actionable insights for investors, policymakers, and industry leaders.

How we have helped: Case Studies - Makreo Research: Driving Growth in APAC and Middle East Logistics and Warehousing Sector

Qatar Pharmaceutical Warehousing Market:

Makreo Research played a crucial role in assisting a leading logistics player in the MENA region. By conducting an in-depth study of the Qatar Pharmaceutical Warehousing Market, we provided actionable solutions to overcome key challenges.

• Past and future performance of Qatar’s pharmaceutical industry.

• Current state and challenges of the logistics and warehousing sectors.

• Demand dynamics for logistics and warehousing services.

• Current trends in cold chain logistics and major challenges.

• The dimensions of pallets and the cost associated with each pallet.

• The financial stability, market performance, and notable accomplishments of key players operating in this sector.

Indonesia Logistics and Pharmaceutical Cold Storage Market:

Makreo Research delivered an extensive Pharmaceutical Cold Storage Market Report to a prominent client in Indonesia, focusing on growth drivers and market opportunities. Key deliverables included:

• Market performance of the pharmaceutical cold storage in Indonesia

• Trade scenarios (imports/exports) for pharmaceutical products.

• Regulatory policies affecting pharmaceutical warehousing.

• Key companies involved in Indonesia's pharmaceutical supply chain.

• Cold storage providers offering warehousing and distribution services.

• Emerging cold storage startups and their impact on the market.

• Investment and strategic opportunities.

• Technological aspects of the cold storage having facility for pharmaceutical products.

• Cold transport cost, packaging material, and technologies used to transport products from manufacturing facilities to cold storage.

With a proven track record in market research, Makreo Research empowers businesses to navigate complexities, foster innovation, and drive sustainable growth. From smart warehousing in India to cold chain logistics in Asia-Pacific, Makreo is reshaping the global logistics and warehousing industry.

Saurabh Adsule

Makreo Research and Consulting

+91 96196 99069

email us here

Visit us on social media:

X

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.