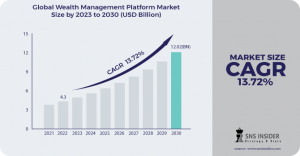

Wealth Management Platform Market size was valued at USD 4.3 billion in 2022 and is expected to grow to USD 12.02 billion by 2030 and grow at a CAGR of 13.72 %

The SNS Insider report indicates that the Wealth Management Platform Market, valued at USD 4.3 billion in 2022, is projected to achieve a market size of USD 12.02 billion by 2030”

AUSTIN, TEXAS, UNITED STATES, January 9, 2024 /EINPresswire.com/ -- The SNS Insider report indicates that the Wealth Management Platform Market, valued at USD 4.3 billion in 2022, is projected to achieve a market size of USD 12.02 billion by 2030. This growth is driven by a compound annual growth rate (CAGR) of 13.72% expected over the forecast period from 2023 to 2030.— SNS Insider

Wealth management platforms, supporting digital channels like smartphones and tablets, enable seamless cross-channel experiences, reducing friction between financial institutions, customers, and advisors. As trading and investment fees trend towards zero, the industry is compelled to digitize processes, seeking efficiencies to combat decreasing margins. In a transformative era driven by the constant rise in the number of High Net Worth Individuals (HNWIs), digitalization, and stringent industry regulations, the Wealth Management Platform Market is poised to exceed USD 12.02 billion by 2030. The market growth is fueled by the imperative need to automate wealth management procedures, catering to the evolving preferences of HNWIs for digital investment management solutions.

𝐆𝐞𝐭 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: @ https://www.snsinsider.com/sample-request/2805

𝐓𝐡𝐞 𝐩𝐫𝐨𝐦𝐢𝐧𝐞𝐧𝐭 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭:

• Comarch SA

• Profile Software,

• Fiserv Inc.

• Fidelity National Information Services

• Temenos Headquarters SA

• Dorsum Ltd.

• Finantix

• Objectway S.p.A.

• Avaloq Group AG

• SEI Investments Company

• SS&C Technologies Holdings Inc.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The growth of the wealth management platform market is underpinned by the automation of wealth management procedures and the increasing preference of HNWIs for digital investment solutions. Leveraging advanced technologies such as machine learning, chatbots, big data analytics, and artificial intelligence, the market presents attractive potential. Rising demand for alternative investment options and innovations in fintech, including blockchain and AI technologies, further stimulate market adoption. However, challenges such as lack of awareness and inadequate technical expertise are countered by innovations in fintech and the increased adoption of blockchain and AI technologies.

Segment Analysis:

In terms of enterprise size, large enterprises dominate due to their extensive data storage needs. SMEs are anticipated to grow at the highest CAGR, driven by innovative and technology-focused businesses.

By end-users, banks and financial institutions hold the maximum share, with retail projected as the fastest-growing sector. The robust demand for wealth management software is driven by the need for managing unmanageable data generated by millions of customer interactions.

𝐁𝐲 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲 𝐌𝐨𝐝𝐞:

• Human Advisory

• Robo Advisory

• Hybrid

𝐁𝐲 𝐨𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐒𝐢𝐳𝐞:

• Large Enterprises

• Small & Medium Enterprises

𝐁𝐲 𝐨𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐒𝐢𝐳𝐞:

• Financial Advice & Management

• Portfolio, Accounting, & Trading Management

• Performance Management

• Risk & Compliance Management

• Reporting

• Others

𝐁𝐲 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭:

• Cloud

• On-premise

𝐁𝐲 𝐄𝐧𝐝-𝐮𝐬𝐞:

• Banks

• Investment Management Firms

• Trading & Exchange Firms

• Brokerage Firms

𝐊𝐞𝐲 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭:

North America, with early adoption of emerging technologies, is expected to dominate the market. APAC is projected to grow at the highest CAGR due to the region's increasing data and a surge in mergers and acquisitions.

𝐁𝐮𝐲 𝐓𝐡𝐢𝐬 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: @ https://www.snsinsider.com/checkout/2805

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬:

• The Wealth Management Platform Market is on a trajectory to surpass USD 12.02 billion by 2030, driven by the digitalization wave, regulatory compliance, and the increasing number of HNWIs.

• Large enterprises currently dominate, but SMEs are set to grow rapidly, leveraging advanced technologies.

• North America remains at the forefront, while APAC is the region with the highest growth potential.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬:

• Wealth management firms are strategically investing to gain traction and recognition, diversifying market operations.

• In June 2021, BMO Harris Bank expanded its relationship with FIS to transform its core banking systems, aligning with the bank's growth vision in the U.S.

𝐓𝐚𝐛𝐥𝐞 𝐨𝐟 𝐂𝐨𝐧𝐭𝐞𝐧𝐭𝐬

1.Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2.Research Methodology

3.Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4.Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Russia-Ukraine War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6.Porter’s 5 forces model

7. PEST Analysis

8. Wealth Management Platform Market Segmentation, By Advisory Mode

8.1 Human Advisory

8.2 Robo Advisory

8.3 Hybrid

𝗖𝗼𝗻𝘁𝗶𝗻𝘂𝗲….

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company 's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety.

Akash Anand

SNS Insider

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram