Vance W. Boyd, former pro bull rider, running for Congress in Texas

ANSON, TEXAS, UNITED STATES, January 18, 2024 /EINPresswire.com/ -- A rancher and former pro bull rider who is running for Congress to represent rural West Texas has released a new video containing a surprise for many Americans: the double taxation of Social Security benefits.

"So, you work your whole life, and Social Security tax is withheld from your paycheck with the promise that you're gonna get it all back when you finally retire," Vance W. Boyd says, gazing directly into the camera in the new video.

"But, in the 1980s, Congress made those Social Security payments taxable income. Which means we get to pay a second tax on the same money--all over again." He adds: "That's just wrong at any level." He vows to change this.

Vance Boyd is running for the Republican seat in the 19th congressional district of Texas, a mostly rural district with two small cities, Lubbock and Abilene, and more cows than people (pop. ~725,000). The primary election is slated for March 5, 2024.

A comfortable communicator on camera, Boyd has appeared in the TV western series "1883," a "Yellowstone" spinoff. He is using homespun selfie videos, posted to his website at vancewboyd.com, to communicate more directly with voters.

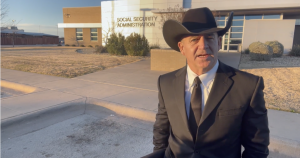

In his latest message, Boyd wears a black Stetson, a crisp white dress shirt with a buttoned-down collar, and a dark tie and dark suit as he stands outside the local Social Security office in Abilene, Texas. He tells viewers:

"You heard that right. That's a double tax, plain and simple. Congress never talks about this. Because they're addicted to the money that those Social Security taxes generate."

Then he vows: "Silence is acceptance. I do not and I will not ever accept this. As your Congressman, I will do everything within my power to right this wrong."

Some 66 million Americans get Social Security benefits. Monthly payments began in 1940, and for more than 40 years they were tax-free. This made sense, Boyd argues: why have government pay out benefits with one hand and then take back a portion of it with the other?

Then Congress acted in 1983 to begin taxing Social Security payments like regular income. To limit the impact and aim at higher earners, the new tax was applied only to 50% of all benefit payments, and to people earning over $20,000 a year or $25,000 for a married couple.

Only 10% of people getting Social Security checks were going to have to pay the new tax, and the government would collect $30 billion over seven years, $4.2 billion a year.

"But no tax ever goes away, it only grows," Boyd says. "Today, 40% of Social Security recipients are hit by this tax. And government now collects $50 billion every year."

The $25,000 family income figure was set in 1983 when median family income was at $25,000 a year, and the poverty line was at $10,000. The $25,000 trigger has remained in place ever since--even though $25k now is the poverty line for a family of four.

Plus, for most people on Social Security today, 80% of their benefits are subject to the tax rather than just 50%, because of a second increase passed by Congress in the early 1990s.

In his video, Boyd tells viewers: "People last, government first. That's how it is right now. As your congressman, we will work together, and we're going to change that."

Boyd's latest video can be see here: https://vancewboyd.com/social-security-tax/

His website can be seen here: https://vancewboyd.com

# # #

-------------

Website for reference.

https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

L. Cauley

Boyd Campaign

email us here

Visit us on social media:

Facebook

Twitter

Instagram