Rising demand for rubber additives in sustainable industries and advanced automotive solutions accelerates with material innovations and efficiency focus.

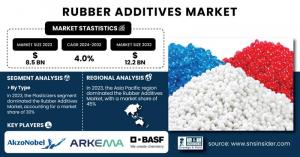

AUSTIN, TX, UNITED STATES, January 7, 2025 /EINPresswire.com/ -- The Rubber Additives Market Size was valued at USD 8.5 billion in 2023 and is expected to reach USD 12.2 billion by 2032 and grow at a CAGR of 4.0% over the forecast period 2024-2032.The rubber additives market has been experiencing significant growth due to increasing applications in various industrial and automotive sectors. Rubber additives, essential for enhancing the properties of rubber, are widely used in manufacturing tires, conveyor belts, and specialty tapes. According to the International Rubber Study Group (IRSG), global rubber consumption rose by 5.5% in 2022, driven by demand in the tire and non-tire sectors. Moreover, the automotive industry's push for high-performance and durable tires has spurred innovation in additive formulations. For instance, BASF announced in 2023 the development of eco-friendly additives designed to enhance rubber durability while reducing environmental impact. Additionally, governments worldwide are promoting sustainable rubber practices, as seen with initiatives like the "Sustainable Natural Rubber Initiative" (SNR-i) by the International Rubber Association, further fueling market expansion.

Get a Sample Report of Rubber Additives Market @ https://www.snsinsider.com/sample-request/1730

Prominent Key Players Included are:

• Akzonobel N.V. (Durethan, Hybrane)

• Arkema SA (Kraton, Eliokem)

• BASF SE (Elastoflex, Irganox)

• Behn Meyer Group (Vulcanizing Agents, Anti-oxidants)

• China Petroleum and Chemical Corporation (Sinopec Rubber Processing Additives, Rubber Antioxidants)

• Eastman Chemical Company (Eastman Tetrashield, Eastman Versaflex)

• Emery Oleochemicals LLC (Emery Lox, Bio-Additives)

• Lanxess AG (Vulcanization accelerators, Rhein Chemie Additives)

• T. Vanderbilt Company Inc (Vanderbilt Carbon Black, Vanderbilt Anti-Oxidants)

• Solvay SA (Solef, Hydralene)

• Addivant USA LLC (Epolene, Addivant 1440)

• Cabot Corporation (Cabot Carbon Blacks, Cabot Specialty Compounds)

• DuPont de Nemours, Inc. (DuPont Keltan, DuPont Tychem)

• Evonik Industries AG (Aerosil, VESTANAT)

• Hexpol AB (Hexpol TPE, Hexpol Compounding)

• Kumho Petrochemical Co., Ltd. (Kumho Styrene-Butadiene Rubber, Kumho EPDM)

• Momentive Performance Materials Inc. (Momentive Silicones, Momentive MQ Silicones)

• Michelin Group (Michelin Compounding Agents, Michelin Tread Compounds)

• Rhein Chemie Rheinau GmbH (Rhenofit, Rhenogran)

• The Dow Chemical Company (Dow Silicones, Dow Epoxy Resins)

What are the Growth Factors of the Rubber Additives Market?

• With the surge in automotive manufacturing, particularly in emerging economies, demand for high-performance tires containing advanced rubber additives is on the rise.

• Growing interest in eco-friendly and durable materials has led to the adoption of rubber additives in green tire production and industrial goods.

• Increasing use of rubber additives in the medical sector for gloves and other biomedical products due to their enhanced properties like elasticity and resistance.

Regional Rubber Consumption Trends 2023: Asia-Pacific Leads with Robust Growth

In 2023, the Asia-Pacific region led global rubber consumption with 12.8 million tons, growing at a robust 7.5% CAGR, driven by thriving automotive and industrial sectors in China, India, and Japan. North America consumed 5.1 million tons, supported by demand for advanced tires in the electric vehicle market. Europe followed with 4.7 million tons, with steady growth (4.8% CAGR) attributed to the region's focus on sustainable materials and green tire production. Other regions collectively accounted for 2.3 million tons, with a moderate growth rate (3.6%), driven by increasing industrialization in emerging economies. This regional distribution highlights Asia-Pacific’s dominance, reflecting its role as a global manufacturing hub.

Market Segmentation and Sub-Segmentation included are:

By Type

• Accelerators

• Activators

• Peptizers

• Plasticizers

• Tackifiers

• Others

By Application

• Tires

• Conveyor Belts

• Electric Cables

• Specialty Tapes

• Others

By End Use Industry

• Automotive

• Electronics and Semiconductors

• Construction

• Industrial

• Healthcare

• Others

Which segment dominated the Rubber Additives Market?

Tires dominated the Rubber Additives Market in 2023, holding a market share of 40%. This dominance is attributed to the increasing demand for high-performance tires in the automotive sector, which relies heavily on rubber additives to enhance durability, heat resistance, and elasticity. For example, the shift toward electric vehicles (EVs) has led to the development of specialized tires with improved rolling resistance, further boosting the demand for additives in this segment.

Buy Full Research Report on Rubber Additives Market 2024-2032 @ https://www.snsinsider.com/checkout/1730

What are the opportunities in the Rubber Additives market?

• With environmental concerns on the rise, the development of bio-based rubber additives presents a significant growth opportunity.

• The increasing use of conveyor belts, specialty tapes, and electric cables due to advancements in product formulation is opening new avenues for market expansion.

Which region dominated the Rubber Additives market?

Asia-Pacific dominated the Rubber Additives Market in 2023, accounting for a market share of 45%. This dominance is driven by robust growth in the automotive and industrial sectors in countries like China, India, and Japan. For instance, China's tire production output reached record levels in 2023, fueling the demand for rubber additives. Moreover, government initiatives promoting sustainable manufacturing in the region further support market growth.

Recent Developments:

• February 2023: Yokohama Rubber Co., Ltd. (YRC) announced plans to expand its passenger car tire production in India, aiming for a 60% increase in output, reaching an annual capacity of 4.5 million units, following the completion of its Yokohama Transformation 2023 strategy.

The Rubber Additives Market is poised for robust growth, driven by advancements in automotive technology, sustainable material development, and increased industrial applications. The shift toward eco-friendly practices and the rising demand for specialty rubber products highlight the market's transformative potential.

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/1730

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.