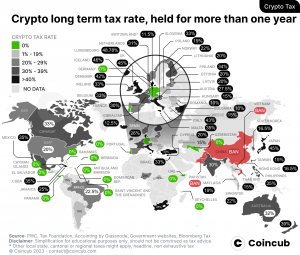

Crypto Tax Map 2023

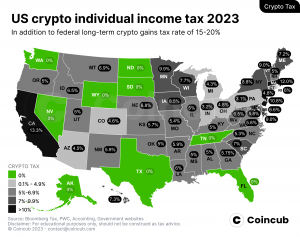

US Map Crypto Tax Rates 2023

Top 20 Countries for crypto tax

Crypto Tax Report 2023: The world’s top 20 lowest crypto tax countries, 11 European countries enter the ranking through advanced taxation rules and concessions

DUBLIN, IRELAND, June 27, 2023/EINPresswire.com/ -- Heading up the low crypto tax index from one to five are the classic havens of UAE, Bahamas, Bermuda, Cayman Islands and Seychelles. The UAE is now a top destination for crypto businesses and individuals seeking zero taxation on crypto gains. Crypto and blockchain companies are attracted to the UAE because it offers zero taxes on crypto earnings and its positive regulatory outlook.

In Europe, Monaco has no direct taxation - but you’d have to gain residency which puts it out of the reach of all but the wealthiest investors. Slightly easier to access is Panama, at number seven on the index, offering zero capital gains tax on crypto.

Locating to the Caribbean for zero taxation is a matter for specialist accounting and taxation guidance, but there are plenty of countries that, whilst not being zero tax locations, still offer considerable tax advantages as part of their taxation environment. In this respect comes El Salvador (the world’s first adopter of Bitcoin as legal tender) which has taken all things Bitcoin to the heart of its economy.

Indonesia at nine presents a somewhat greyer area - with a 0.1% tax on transaction costs of buying crypto. The country also offers a zero percent tax on foreign domiciled investors that have obtained a ‘double taxation avoidance agreement’ - but this is by no means for the casual investor.

Next in line are famous European crypto hubs, with Malta (‘Crypto-Island’), Gibraltar, and Liechtenstein, all countries with oft-stated aims of becoming leading centres for digital assets investment. Taxes on crypto can be waived for entities based permanently in Liechtenstein, and again generous low tax concessions apply to entities based in Malta and Gibraltar.

Reassuringly come a slew of traditional tax-based economies, starting with Germany at number 13. Germany surprised the world with its decision to promote zero tax to pay on crypto gains if held for at least twelve months before disposal (nb - this also followed an equally progressive decision to allow German savers to let Bitcoin form part of their institutional savings).

Switzerland has no direct tax on crypto gains, per se, but can exact a proportional wealth tax on the value of your crypto holdings. Switzerland is also home to a large number of leading blockchain and crypto-related companies.

Low-tax countries in the top twenty include Romania and Bulgaria with just a 10% tax on crypto income followed by Hungary and Greece at 15% on income gained through crypto investment.

Crypto taxation variable across the United States

The Crypto Tax Ranking 2023 gives also an overview of the US state's position on crypto tax. There have been some profound changes in the US's crypto economy this year, and the overall sentiment varies greatly from state to state. On taxes, you could be paying short-term income tax on your crypto gains as high as 37%, and long-term gains over a year at a still hefty 20%. But this is highly variable - we look at key states with the most tax-friendly approach to the crypto market. States like California, Colorado, Florida, Puerto Rico, Texas, and Wyoming want to attract the crypto industry by following specific approaches such as crypto payments adoption, friendly regulations, and much more.

Sergiu Hamza

Coincub Limited

+353 87 175 6897

email us here

Visit us on social media:

Twitter

LinkedIn

Instagram

![]()