CHINA, January 9, 2024 /EINPresswire.com/ -- A team of researchers from Korea, Canada, and the UK have proposed a new quantum model that explains the power law distribution and herding behavior in stock returns. The model uses quantum mechanics to capture the dynamics of stock returns and the role of economic uncertainty as a bridge between business cycles and investors’ mimetic behavior. The study provides a theoretical and empirical link between macroeconomic factors and stock market anomalies.

A new study published in Financial Innovation has developed a novel quantum model for stock market fluctuations that incorporates economic uncertainty and herding behavior. The study aims to provide a deeper understanding of the origins and implications of stock market anomalies such as fat tails, volatility clustering, and contrarian effects.

In this study, quantum mechanics, a branch of physics explaining subatomic particle behavior, serves as the foundation for modeling stock return dynamics. “Stock return drift results from an external potential representing market forces, pulling short-term fluctuations back to long-term equilibrium”, explains Dr. Kwangwon Ahn, the first author of the study and an Associate Professor of Industrial Engineering at Yonsei University. Introducing a diffusion coefficient capturing stock return volatility, they solve the Schrödinger equation, a fundamental quantum mechanics equation, yielding a power law distribution in the tail—a common feature in stock returns.

The power law distribution implies that extreme events, such as stock market crashes, are more likely to occur than expected under a normal distribution. The researchers also show that the power law exponent, which measures the degree of fatness of the tail, is inversely related to the diffusion coefficient and the external potential. This means that higher volatility and slower reversion to equilibrium lead to stronger herding behavior in stock returns, as investors tend to mimic others in times of uncertainty and information asymmetry.

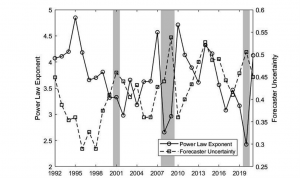

The researchers then test their model using empirical data from the US stock market. They use the growth rate of gross domestic product (GDP) and the forecaster uncertainty as proxies for business cycles and economic uncertainty, respectively. They find that the power law exponent is positively associated with the GDP growth rate and negatively associated with the forecaster uncertainty, confirming their theoretical predictions. They also find that economic uncertainty is the intermediary that links business cycles and herding behavior in stock returns.

“Our study shows that quantum mechanics can be a useful tool to understand the stock market, which is a complex system with many interacting agents. We hope that our study can inspire more interdisciplinary research that combines physics and finance to explore the hidden patterns and mechanisms of the stock market,” clarifies Dr. Daniel Sungyeon Kim, the corresponding author and Associate Professor of Finance at the Chung-Ang University, “We show that economic uncertainty is the origin of counter-cyclical herding behavior in stock returns, which can have significant implications for investors and policymakers.”

DOI

10.1186/s40854-023-00540-z

Original Source URL

https://doi.org/10.1186/s40854-023-00540-z

Funding information

This work was supported by the National Research Foundation of Korea grant funded by the Korean government (No. 2022R1A2C100425811, Kwangwon Ahn).

Lucy Wang

BioDesign Research

email us here