The US plays a key role in the Private and Public Cloud in Financial Services Market, driving innovation, security, and digital transformation.

Private and public cloud adoption in the US financial services market is driving digital transformation, enhancing data security, enabling scalable, efficient solutions improved customer experiences.”

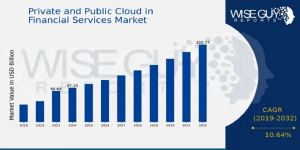

NEW YORK, NY, UNITED STATES, January 13, 2025 /EINPresswire.com/ -- According to a new report published by WiseGuy Reports, the Private and Public Cloud in Financial Services Market was valued at USD 67.15 Billion in 2024, and is estimated to reach USD 150.7 Billion by 2032, growing at a CAGR of 10.64% from 2024 to 2032.— WiseGuy Reports

The global Private and Public Cloud in Financial Services market is expanding rapidly, driven by the increasing need for scalable, secure, and cost-effective IT solutions. The financial services industry is embracing cloud computing to streamline operations, enhance data security, and reduce costs. Both private and public clouds offer unique benefits tailored to the financial sector’s demands for data storage, analytics, and regulatory compliance. The private cloud provides a more controlled environment, while the public cloud allows for greater scalability and flexibility, making them vital tools for the digital transformation of financial institutions.

Download Sample Report (Get Full Insights in PDF - 200 Pages) at -

https://www.wiseguyreports.com/sample-request?id=654885

Market Key Players:

The market is highly competitive with several global and regional players offering cloud-based solutions tailored to the financial services sector. Key players include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud, and Alibaba Cloud. These companies provide a range of cloud services such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) to meet the diverse needs of financial institutions. Their advanced cloud offerings help organizations optimize costs, improve scalability, and increase security compliance.

Market Segmentation:

The Private and Public Cloud in Financial Services market can be segmented based on service models, deployment types, and region. Service models include IaaS, PaaS, and SaaS, each catering to different operational requirements within the financial sector. Deployment types are categorized into private cloud, public cloud, and hybrid cloud models, with financial institutions opting for one or a mix based on their specific needs for flexibility and control. Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with varying growth trends across regions.

Scope of the Report:

This report provides a comprehensive analysis of the Private and Public Cloud in Financial Services market, covering market size, trends, growth drivers, and challenges. It analyzes the adoption of cloud technologies in the financial services sector and their impact on operational efficiency, cost management, and compliance. The report also examines the competitive landscape, key market players, and technological advancements. It highlights the opportunities for growth in the private and public cloud sectors and outlines the regulatory environment that influences cloud adoption in financial services.

Buy Now Premium Research Report -

https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=654885

Market Drivers:

The rapid adoption of digital technologies in the financial services sector is a key driver of the Private and Public Cloud market. The need for flexible, scalable, and cost-effective solutions to store and process large amounts of data is pushing financial institutions to migrate to the cloud. Furthermore, increasing demand for improved customer experiences, automation, and advanced data analytics is fueling the shift towards cloud computing. The cloud enables financial institutions to quickly scale operations, respond to market changes, and optimize resource utilization, further driving market growth.

Market Opportunities:

The growing emphasis on data security and regulatory compliance presents significant opportunities for cloud providers in the financial services industry. With stringent regulatory requirements, financial institutions are increasingly adopting private cloud models to ensure data security and compliance. Additionally, the rise of hybrid cloud deployments, combining the benefits of both private and public clouds, offers financial organizations the flexibility to balance control and scalability. The advent of artificial intelligence (AI) and machine learning (ML) in cloud platforms also creates opportunities for advanced analytics in the financial services market.

Restraints and Challenges:

Despite the rapid adoption of cloud technologies in financial services, several challenges hinder the growth of the market. Data privacy concerns, particularly regarding sensitive financial information, pose a significant challenge to cloud adoption. Regulatory compliance, such as GDPR in Europe and other regional regulations, further complicates the implementation of cloud solutions. Additionally, the high costs associated with cloud migration and the need for skilled personnel to manage complex cloud environments may restrict market growth. Moreover, concerns about data breaches and system vulnerabilities in the public cloud are potential deterrents.

Browse In-depth Wise Guy Reports (200 Pages, Charts, Tables, Figures) Private and Public Cloud in Financial Services Market –

https://www.wiseguyreports.com/reports/private-and-public-cloud-in-financial-service-market

Regional Analysis:

The North American region dominates the Private and Public Cloud in Financial Services market, driven by the presence of key cloud service providers and a well-established financial services industry. The U.S. remains a major adopter of cloud technologies due to its robust regulatory framework and significant investment in digital infrastructure. In Europe, the market is experiencing steady growth due to increasing demand for secure cloud solutions and regulatory compliance requirements. The Asia-Pacific region is anticipated to witness substantial growth, driven by the growing financial services sector in countries like China, India, and Japan.

Industry Updates:

Recent developments in the Private and Public Cloud in Financial Services market indicate significant investments in cloud infrastructure and advanced technologies. Companies like Microsoft, Amazon, and Google are increasing their focus on enhancing the security and scalability of their cloud platforms, particularly for the financial services industry. Regulatory bodies are also stepping up to provide clearer guidelines on data privacy and cloud adoption in the financial sector. Additionally, financial institutions are increasingly leveraging AI and ML-powered cloud solutions to drive efficiency, enhance customer experience, and improve risk management in their operations.

Top Trending Reports:

Private and Public Cloud in Financial Services Market Size

Gym Management Software Market -

https://www.wiseguyreports.com/reports/gym-management-software-market

Hadoop Market -

https://www.wiseguyreports.com/reports/hadoop-market

Visualization And 3D Rendering Software Market -

https://www.wiseguyreports.com/reports/visualization-and-3d-rendering-software-market

Data Center Server Market -

https://www.wiseguyreports.com/reports/data-center-server-market

Advanced Process Control Software Market -

https://www.wiseguyreports.com/reports/advanced-process-control-software-market

Outbound Telemarketing Market -

https://www.wiseguyreports.com/reports/outbound-telemarketing-market

Contact Center Outsourcing Market -

https://www.wiseguyreports.com/reports/contact-center-outsourcing-market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Maharashtra, India 411028

Sales +91 20 6912 2998

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.