Optoelectronics Market Driven by Increasing demand for optoelectronic devices in telecommunications, consumer electronics, and automotive industries.

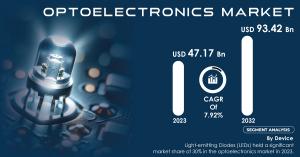

AUSTIN, TX, UNITED STATES, November 6, 2024 /EINPresswire.com/ -- Market Size & Industry InsightsAs Per the S&S Insider,“The Optoelectronics market size was valued at USD 47.17 Billion in 2023 and is expected to reach a market size of USD 93.42 billion by the end of 2032 at CAGR about 7.92% during the forecast period of 2024-2032.”

The Rising Influence of Optoelectronics in Consumer Electronics: Innovations and Future Trends

The optoelectronics market is flourishing, significantly influenced by the consumer electronics sector. Optoelectronic components are vital for advanced smartphone features and high-quality TV displays. For instance, Light-Emitting Diodes (LEDs) enhance the brightness and energy efficiency of devices, with major companies like Samsung incorporating them into their QLED TVs. Additionally, OLED technology, championed by LG, utilizes OLED materials for superior display performance, including deep black levels and wide viewing angles. Optoelectronic sensors enhance device functionalities, enabling features like automatic screen brightness adjustment and face recognition. Industry leaders like Broadcom produce a variety of optoelectronic sensors tailored for consumer electronics. The growing consumer demand for high-resolution screens and energy-efficient devices is propelling the need for these components. Furthermore, research into ultrafast optics and 2D materials is pushing the boundaries of optoelectronic applications, promising breakthroughs that could revolutionize telecommunications, data processing, and display technologies in the future.

Get a Sample Report with Full TOC & Graphs @ https://www.snsinsider.com/sample-request/4382

SWOT Analysis of Key Players as follows:

-Renesas Electronics Corporation

-ams-OSRAM AG

-Hamamatsu Photonics K.K.

-ROHM Co. Ltd.

-Samsung Electronics Co. Ltd.

-Jenoptik AG

-Semiconductor Components Industries LLC

-Sharp Corporation

-Sony Semiconductor Solutions Corporation

-TT Electronics

-Vishay Intertechnology Inc.

-Toshiba Electronic Devices & Storage Corporation

Driving Forces of the Optoelectronics Market: LEDs and Gallium Arsenide

The optoelectronics market is significantly shaped by the dominance of Light-emitting Diodes (LEDs) and Gallium Arsenide (GaAs) in 2023. LEDs captured a noteworthy 30% market share, driven by their energy efficiency and versatility, which make them suitable for various applications—from commercial lighting to electronic indicators. Their longevity further reduces maintenance costs, bolstered by innovative offerings from leaders like Samsung. On the other hand, GaAs, also commanding a 30% share, stands out for its efficient electron movement and direct bandgap, essential for high-quality light production in LEDs, solar cells, and fiber optic sensors. Its rapid signal transmission capabilities are crucial for advancing mobile networks and data centers, reinforcing GaAs's critical role in the ever-evolving landscape of optoelectronics. Together, these components represent the industry's innovative spirit and its commitment to sustainability and performance.Light-emitting Diodes (LEDs) captured a substantial 30% market share in the optoelectronics sector in 2023, to their energy efficiency, which reduces electricity costs and environmental impact. Unlike traditional incandescent bulbs, LEDs come in various sizes and colors, making them suitable for diverse applications, from commercial lighting to small indicators in electronic devices. Their longevity minimizes maintenance costs, as they require less frequent replacements. Samsung, a leader in the LED market, continues to innovate with a wide range of LED options, reinforcing its position in the industry.

Gallium Arsenide (GaAs) is expected to lead the optoelectronics market in 2023, commanding a 30% share due to its unique properties. Its ability to facilitate efficient electron movement results in brighter, more effective LEDs. GaAs features a "direct bandgap," making it ideal for producing high-quality light, essential in solar cells and fiber optic sensors. Additionally, its high-speed signal transmission is crucial for mobile networks and data centers, cementing GaAs’s importance in the evolving optoelectronics landscape.

Connect with Our Expert for any Queries @ https://www.snsinsider.com/request-analyst/4382

KEY MARKET SEGMENTS:

By Device

-Light-emitting Diodes (LEDs)

-Laser Diodes

-Solar Cells

-Photodiodes

-Image Sensors

-Others (Optoisolators, Phototransistors, etc.)

By Material

-Gallium Arsenide (GaAs)

-Indium Phosphide (InP)

-Gallium Nitride (GaN)

-Gallium Antimonide (GaSb)

-Silicon Carbide

By End User

-Automotive

-Aerospace & Defense

-Consumer Electronics

-IT & Telecommunication

-Healthcare

-Energy & Power

-Others (Research & Academia, Industrial, etc.)

Regional Dominance in the Optoelectronics Market: North America and Asia Pacific in 2023

-In 2023, North America leads the optoelectronics market with a 35% share, driven by a robust automotive industry. The rising demand for premium vehicles featuring advanced technologies, like autonomous driving and sophisticated lighting systems, fuels the need for innovative optoelectronic components. North American manufacturers invest significantly in research and development, fostering technological advancements. Additionally, the region prioritizes smart infrastructure and automation, evident in the growing number of specialized facilities for advanced optoelectronic device production, solidifying its market dominance.

-In 2023, the Asia Pacific region leads the optoelectronics market with a 31% share and is experiencing rapid growth. Strong economies in countries like China and India drive demand for optoelectronic components in displays and LEDs. Supportive government policies and investments in research and development bolster domestic industries, while South Korea's automotive sector fuels further growth through automation reliant on these components.

Recent Development

-In February 2024, TSMC, Sony Semiconductor Solutions Corporation, DENSO Corporation, and Toyota Motor Corporation announced additional investments in Japan Advanced Semiconductor Manufacturing, Inc. ("JASM"), TSMC's majority-owned subsidiary located in Kumamoto Prefecture, Japan. This funding aims to establish a new fabrication facility, expected to be operational by late 2027. With strong support from the Japanese government, the total investment in JASM will exceed $20 billion when its initial fab begins operations in 2024.

-In January 2024, Osram Licht AG launched a new line of side-looking, low-power LEDs designed for easier implementation and a consistent appearance in long light bars and rear lighting applications for vehicles. By replacing toplooker LEDs with SYNIOS P1515 sidelookers, automotive manufacturers can achieve a uniform look across the vehicle's width. The new design allows for a thinner and simpler optical assembly for RCL or turn indicators, using the same number of LEDs as a traditional toplooker setup.

Make an Inquiry Before Buying @ https://www.snsinsider.com/enquiry/4382

Key Takeaways

-The optoelectronics market is poised for significant growth, fueled by technological advancements and rising demand across multiple sectors.

-Continuous development of innovative products and applications positions optoelectronics as a vital element in future technologies.

-The market is attracting considerable interest from industry leaders and investors.

-An in-depth analysis of market segments and regional insights provides valuable information for stakeholders aiming to seize emerging opportunities in this dynamic landscape.

Table of Content - Major Points Analysis

Chapter 1. Introduction

Chapter 2. Executive Summary

Chapter 3. Research Methodology

Chapter 4. Market Dynamics Impact Analysis

Chapter 5. Statistical Insights and Trends Reporting

Chapter 6. Competitive Landscape

Chapter 7. Optoelectronics Market Segmentation, by Device

Chapter 8. Optoelectronics Market Segmentation, by Material

Chapter 9. Optoelectronics Market Segmentation, by End User

Chapter 10. Regional Analysis

Chapter 11. Company Profiles

11.1 Renesas Electronics Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 ams-OSRAM AG

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Hamamatsu Photonics K.K.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 ROHM Co., Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Samsung Electronics Co., Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

…..

Chapter 12. Use Cases and Best Practices

Chapter 13. Conclusion

Continued…

Purchase Single User PDF of Optoelectronics Market Forecast Report @ https://www.snsinsider.com/checkout/4382

Akash Anand

SNS Insider Pvt. Ltd

+1 415-230-0044

info@snsinsider.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.