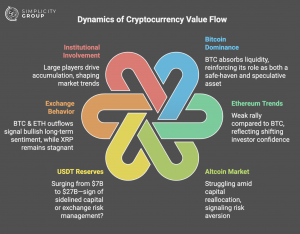

A new report provides an in-depth analysis of crypto market liquidity, highlighting Bitcoin’s dominance, institutional inflows, and shifting capital trends.

LONDON, UNITED KINGDOM, February 11, 2025 /EINPresswire.com/ -- The research examines exchange reserves, large wallet movements, and retail participation, painting a clear picture of the evolving market landscape.Bitcoin Exchange Reserves Hit Record Lows

Bitcoin reserves on exchanges have been steadily declining throughout this bull cycle. The sustained drop in available BTC suggests a bullish market structure, reducing the likelihood of major sell-offs. With fewer coins on exchanges, the supply shock strengthens Bitcoin’s position as the primary asset attracting liquidity.

Institutional Investors Are Leading the Market

The latest data on Bitcoin inflows indicates that institutional players are taking the lead in accumulation. Wallets holding between $100K and $10M in BTC are responsible for most of the recent buying activity, while smaller retail wallets between $100 and $10K have seen declining influence. At the same time, USDT reserves on exchanges have surged from $7 billion to $27 billion, signaling that liquidity is re-entering the market—but primarily into Bitcoin rather than alternative assets.

Altcoins Struggle as Market Share Declines

Ethereum and the broader altcoin market are facing liquidity challenges as capital shifts away from riskier assets. Despite a surge in overall market liquidity, capital is flowing toward Bitcoin rather than into altcoins. Stablecoin dominance, particularly USDT, has also declined, reinforcing the trend that money is coming back into crypto but avoiding speculative altcoin investments. The widening gap between Bitcoin and the altcoin market cap suggests that investor sentiment is shifting toward capital preservation rather than high-risk speculation.

Solana’s DEX Market Defies the Trend

While most altcoins are struggling to attract liquidity, Solana’s decentralized exchange (DEX) market has emerged as an exception. In late 2024, over 62.3% of all Solana DEX transactions were driven by Pumpdotfun, a significant catalyst in the network's activity. Between December 2024 and January 2025, high-value trades exceeding $50K accounted for over $1.3 trillion in Solana DEX volume, making it the leading blockchain for high-frequency trading. Unlike other parts of the market, Solana's trading activity has been fueled by both institutional and retail participants, with even trades under $100 making up 20.5% of total Solana DEX volume.

Key Takeaways from the Report

The research presents a clear picture of the current crypto market landscape. Bitcoin is absorbing the majority of new inflows, with exchange reserves at record lows and institutional investors driving accumulation. Retail participation remains weak, as smaller wallets see declining transaction volumes. Altcoins, with the exception of Solana, are losing liquidity and struggling to capture investor attention in a Bitcoin-led cycle. Meanwhile, USDT reserves have surged, but the majority of re-entering liquidity is flowing into Bitcoin, not altcoins.

Read the full report here: https://www.simplicitygroup.xyz/blog/flow-of-value-in-crypto

Nadzeya Sankovich

Blockchain Centre Vilnius

+370 693 05293

info@blockchaincentre.io

Visit us on social media:

X

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.