Mezzanine Finance Market Research Report By Debt Structure, Industry Application, Capital Type, Investment Strategy, Loan Size, Regional

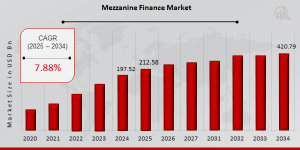

IL, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global Mezzanine Finance Market has shown significant growth and is projected to expand further in the coming decade. In 2024, the market size was valued at USD 197.52 billion and is expected to grow from USD 212.58 billion in 2025 to an impressive USD 420.79 billion by 2034, reflecting a compound annual growth rate (CAGR) of 7.88% during the forecast period (2025–2034). The growth is primarily driven by increasing demand for flexible financing options, rising private equity investments, and the growing need for strategic capital solutions in diverse industries.Key Drivers Of Market Growth

Rising Demand for Flexible Financing Solutions: Mezzanine financing offers a hybrid funding solution that blends debt and equity characteristics, providing businesses with access to capital while minimizing equity dilution. Its flexibility has made it a preferred choice for companies looking to finance growth or acquisitions.

Growing Private Equity Investments: With private equity firms seeking higher returns, mezzanine financing has become an essential component in funding leveraged buyouts, recapitalizations, and growth strategies. This trend is driving significant growth in the market.

Increased Adoption by Small and Mid-Sized Enterprises (SMEs): SMEs often rely on mezzanine financing as a strategic tool to secure growth capital while maintaining control of their operations. The rising number of SMEs globally has contributed to the growing demand for mezzanine finance.

Global Infrastructure Development: Infrastructure and real estate projects are increasingly leveraging mezzanine financing to fill funding gaps. Governments and private developers are utilizing this financial instrument to execute large-scale projects.

Download Sample Pages: https://www.marketresearchfuture.com/sample_request/24034

Key Companies In The Mezzanine Finance Market

• Bain Capital Credit

• Madison Capital Funding

• Oaktree Capital Management

• Apollo Global Management

• Ares Management Corporation

• Ares Management Corporation

• Blackstone Group

• TPG

• The Carlyle Group

• KKR

• Goldman Sachs Asset Management

• Bridgepoint Development Capital

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/mezzanine-finance-market-24034

Market Segmentation

To provide a detailed understanding, the Mezzanine Finance Market is segmented based on application, end-user, source, and region.

1. By Application

• Acquisitions & Buyouts: Commonly used in leveraged buyouts to enhance capital structure.

• Growth Capital: Financing expansion strategies for companies in various sectors.

• Real Estate & Infrastructure: Funding large-scale projects with long-term capital needs.

2. By End-User

• SMEs: Utilizing mezzanine financing for scaling operations and expansion.

• Large Enterprises: Funding acquisitions, mergers, and strategic growth initiatives.

• Real Estate Developers: Bridging financing gaps in development projects.

3. By Source

• Private Equity: Mezzanine investments through private equity firms.

• Institutional Investors: Pension funds, insurance companies, and asset managers participating in mezzanine financing.

• Banks & Financial Institutions: Offering mezzanine loans as part of structured financing.

4. By Region

• North America: Dominating the market due to the mature private equity ecosystem and widespread adoption of mezzanine financing.

• Europe: Growth driven by increasing demand for infrastructure financing and SME funding.

• Asia-Pacific: Fastest-growing region, with rising economic activities and private equity investments in emerging markets such as India and China.

• Rest of the World (RoW): Moderate growth anticipated, with opportunities in Latin America, the Middle East, and Africa.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24034

The global Mezzanine Finance Market is on a growth trajectory, driven by the increasing demand for innovative financing solutions across various sectors. As businesses and investors continue to prioritize strategic capital deployment, the mezzanine finance industry is poised to play a critical role in shaping the future of financial markets and global infrastructure development.

Related Report:

Musical Instrument Insurance Market

https://www.marketresearchfuture.com/reports/musical-instrument-insurance-market-33663

Real Estate Loan Market

https://www.marketresearchfuture.com/reports/real-estate-loan-market-34157

Performance Bank Guarantee Market

https://www.marketresearchfuture.com/reports/performance-bank-guarantee-market-34160

Robotic Process Automation in Financial Services Market

https://www.marketresearchfuture.com/reports/robotic-process-automation-in-financial-services-market-34152

Social Media Analytics-Based Insurance Market

https://www.marketresearchfuture.com/reports/social-media-analytics-based-insurance-market-34159

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.