Letter of Credit Confirmation Market Research Report By, Confirmation Type, Application, Size of Letter, Tenor, Confirmation Fee Structure, Regional

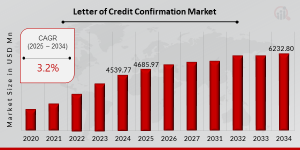

WV, UNITED STATES, January 20, 2025 /EINPresswire.com/ -- The global Letter of Credit (LC) Confirmation Market has been experiencing steady growth and is projected to continue expanding in the coming years. In 2024, the market size was valued at USD 4,539.77 million and is expected to grow from USD 4,685.97 million in 2025 to USD 6,232.80 million by 2034, exhibiting a compound annual growth rate (CAGR) of 3.2% during the forecast period (2025–2034). This growth is driven by the increasing global trade, the need for secure international transactions, and the rising demand for trade finance solutions.Key Drivers of Market Growth -

➤ Growing International Trade With the ongoing globalization of markets, the volume of international trade continues to rise, driving the demand for secure and reliable payment mechanisms. Letters of Credit (LCs) are widely used to facilitate cross-border transactions, ensuring that both exporters and importers are protected. The need for LC confirmation services has grown as businesses require additional security and risk mitigation.

➤ Rising Demand for Secure Payment Solutions In international trade, both buyers and sellers face risks related to payment and delivery of goods. The confirmation of LCs by financial institutions provides an added layer of security, ensuring that payment will be made to the exporter once terms are met. As global trade transactions become more complex, businesses increasingly rely on LC confirmations to manage financial risks.

➤ Adoption of Trade Finance Solutions Trade finance is rapidly evolving, with companies increasingly adopting financial products that facilitate smoother and safer cross-border transactions. The confirmation of LCs plays a critical role in trade finance by providing greater assurance to exporters that payments will be honored. This is particularly important in high-risk regions or emerging markets where the banking infrastructure may not be as robust.

➤ Technological Advancements in Trade Finance With digital transformation taking place across industries, the Letter of Credit Confirmation Market is also benefiting from innovations such as blockchain, automated trade finance platforms, and digitized document handling. These advancements streamline the LC process, reduce fraud risks, and enhance efficiency, further driving market growth.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23174

Key Companies in the Letter of Credit Confirmation Market Include

• Standard Chartered Bank

• Bank of America Corporation

• Mizuho Bank, Ltd.

• Industrial and Commercial Bank of China

• ICBC

• Eastern Bank Limited

• First Abu Dhabi Bank PJSC

• Sumitomo Mitsui Banking Corporation

• HSBC Holdings

• JPMorgan Chase Co

• Citigroup

• MUFG Bank, Ltd

• Deutsche Bank AG

• BNP Paribas

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.marketresearchfuture.com/reports/letter-of-credit-confirmation-market-23174

Market Segmentation

By Type of Letter of Credit

• Sight Letter of Credit (LC): Payment is made as soon as the documents are presented to the issuing bank, offering immediate payment to the exporter.

• Usance Letter of Credit (LC): Payment is made after a certain period, usually 30 to 180 days after the shipment is made, providing time for the importer to pay the seller.

• Revolving Letter of Credit (LC): This LC is automatically renewed at the end of each cycle, useful for businesses that have frequent and ongoing trade transactions.

• Standby Letter of Credit (LC): Used as a backup for payment if the buyer defaults, typically serving as a guarantee rather than a payment method.

• Confirmed Letter of Credit (LC): A Letter of Credit where a second bank (confirming bank) guarantees payment in addition to the issuing bank’s guarantee.

By End-User

• Importers: Businesses involved in international purchasing rely on LCs and their confirmation to ensure that goods are delivered as per the agreed-upon terms before payment is made.

• Exporters: Companies involved in international sales require the confirmation of LCs to ensure that they will receive payment once the shipment is completed and the conditions are met.

• Banks and Financial Institutions: Financial institutions act as intermediaries in the LC confirmation process, offering guarantees and securing payment for trade transactions.

• Trade Finance Providers: These firms specialize in providing various financial products, including Letter of Credit confirmation services, to help streamline international trade processes.

By Industry

• Manufacturing: Manufacturers involved in producing goods for export rely heavily on Letters of Credit to secure payment and reduce financial risk.

• Retail: Retailers involved in global sourcing of products often use LC confirmation to ensure the timely delivery of goods and secure payments to international suppliers.

• Energy & Commodities: The energy sector, including oil, gas, and commodities trading, frequently uses LC confirmation to manage large transactions and mitigate payment risk.

• Construction: Large-scale construction projects, particularly those involving cross-border procurement of materials, utilize LCs to secure financing and ensure delivery of goods.

By Region

• North America: A dominant market for Letter of Credit confirmations, driven by strong trade activity, particularly between the U.S., Canada, and other global markets.

• Europe: A major hub for international trade and trade finance, with many multinational banks offering comprehensive LC services to businesses across various industries.

• Asia-Pacific: The fastest-growing region, fueled by the increasing volume of trade between countries such as China, India, Japan, and Southeast Asia. The growing middle class and expanding businesses are driving the need for secure payment mechanisms.

• Rest of the World (RoW): Steady growth is expected in regions such as Latin America, the Middle East, and Africa, as businesses in these regions increasingly turn to trade finance solutions to facilitate international transactions.

Procure Complete Research Report Now - https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23174

The Letter of Credit Confirmation Market is poised for steady growth, supported by the increasing volume of global trade, the need for secure transactions, and the adoption of advanced financial technologies. As businesses continue to expand their international operations, the demand for secure and efficient trade finance solutions, including LC confirmation services, is expected to rise. The market will continue to evolve, offering innovative solutions to streamline the confirmation process and address the growing needs of exporters, importers, and financial institutions.

Related Report –

Banking Market

https://www.marketresearchfuture.com/reports/banking-market-23852

Compulsory Third Party Insurance Market

https://www.marketresearchfuture.com/reports/compulsory-third-party-insurance-market-23867

Credit Intermediation Market

https://www.marketresearchfuture.com/reports/credit-intermediation-market-23877

Financial Consulting Software Market

https://www.marketresearchfuture.com/reports/financial-consulting-software-market-23902

Hedge Funds Market

https://www.marketresearchfuture.com/reports/hedge-funds-market-23921

About Market Research Future (MRFR)

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.