The industry's focus on sustainability, uniqueness, and affordability contributes to the increasing demand for lab-grown diamond jewelry.

Revolutionizing the market with ethical, sustainable and affordable alternatives to natural diamonds. Sparkling brilliance redefined.”

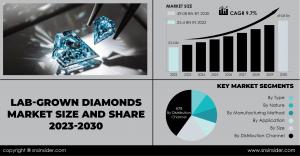

AUSTIN, TX, UNITED STATES, January 31, 2024 /EINPresswire.com/ -- The SNS Insider report indicates that the 𝐋𝐚𝐛-𝐆𝐫𝐨𝐰𝐧 𝐃𝐢𝐚𝐦𝐨𝐧𝐝𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 valued at USD 23.4 billion in 2022, is projected to reach USD 49.08 billion by 2030, growing at a CAGR of 9.7% from 2023 to 2030.— SNS Insider Research

The lab-grown diamonds market has been steadily gaining traction in recent years, revolutionizing the traditional diamond industry. These diamonds, also known as synthetic or cultured diamonds, are created in a controlled laboratory environment using advanced technology that replicates the natural diamond-growing process.

One of the key factors driving the growth of the lab-grown diamonds market is their ethical and sustainable nature. Unlike mined diamonds, which often come with environmental concerns and potential human rights issues, lab-grown diamonds are produced without any negative impact on the environment or communities. This aspect has resonated with a growing number of consumers who prioritize sustainability and ethical sourcing.

Get a Report Sample of Lab-Grown Diamonds Market

@ https://www.snsinsider.com/sample-request/3985

Market Report Scope:

Lab-grown diamonds, embraced for their sustainability, are witnessing a surge in demand, particularly in the fashion and jewelry sector, and are finding applications in various industrial verticals. These diamonds, identical to their natural counterparts, present an affordable option, steering away from the environmental and social impacts associated with traditional diamond mining. Lab-grown diamonds, with the same physical and chemical properties as natural diamonds, provide an environmentally friendly and cost-effective alternative to mined diamonds. The increasing consumer preference for sustainable and ethically sourced products has led to a substantial rise in the popularity of lab-grown diamonds. These diamonds, produced without the environmental and social impact associated with traditional diamond mining, offer a more affordable and accessible option for consumers. The fashion and jewelry industry's greater adoption of lab-grown diamonds is a key driver propelling market growth.

Market Segmentation :

By Size

• Below 2 carats

• 2-4 carat

• Above 4 carats

By Type

• Polished

• Rough

By Nature

• Colored

• Colorless

By Manufacturing Method

• Chemical Vapor Deposition (CVD)

• High-Pressure High Temperature (HPHT)

By Application

• Fashion

• Industrial

By Distribution Channel

• Online

• Special Store

• Supermarket

• Others

Market Analysis:

Lab-grown diamonds' increasing adoption in the fashion and jewelry sector, along with their growing applications in the industrial sector, has fueled demand across various industry verticals. These diamonds can be customized, and personalized, and offer advantages beyond being economical, sustainable, and environmentally friendly. However, consumer confusion and misinformation pose challenges, as the term 'synthetic' creates a negative image, hindering market growth.

Lab-Grown Diamonds Market Challenges

• One of the major challenges faced by the lab-grown diamonds market is the perception and acceptance of these diamonds among consumers. Traditional diamonds have long been associated with luxury, rarity, and emotional significance. Lab-grown diamonds, on the other hand, are created in a controlled environment and lack the natural formation process that gives traditional diamonds their unique characteristics.

• To overcome this challenge, lab-grown diamond manufacturers need to educate consumers about the benefits and value of their products. They must emphasize that lab-grown diamonds are chemically and physically identical to natural diamonds, offering the same brilliance, hardness, and durability. Additionally, highlighting theethical aspects of lab-grown diamonds such as their minimal environmental impact and conflict-free origin can help change consumer perceptions.

Segment Analysis:

Based on the manufacturing method, the CVD segment dominated with a 56.5% market share in 2022, driven by continuous innovation in diamond manufacturing technology. In terms of nature, the colorless segment held the major share, particularly popular for making engagement and wedding rings. The below 2-carat segment dominated the size category, while the fashion segment led the application with over 70% revenue share in 2022, driven by custom sizes and carats appealing to the fashion industry.

Lab-Grown Diamonds Market Opportunities:

• Lab-grown diamonds have emerged as a disruptive force in the diamond industry, presenting numerous market opportunities. As consumers become more conscious about sustainability and ethical sourcing, lab-grown diamonds offer an attractive alternative to mined diamonds. This growing demand for sustainable luxury goods opens up a vast market for lab-grown diamonds.

• One of the significant opportunities lies in the bridal jewelry segment. Lab-grown diamonds provide an affordable option for couples looking to purchase engagement rings and wedding bands without compromising on quality or aesthetics. With their identical physical and chemical properties to natural diamonds, lab-grown diamonds offer a compelling choice for budget-conscious consumers who still desire the beauty and symbolism of a diamond.

Key Regional Development:

Asia Pacific led the Lab-Grown Diamonds Market, with a revenue share exceeding 40%, driven by China's prominence in production and export. India is emerging as a major hub, with improvements in living standards and rising disposable incomes contributing to the region's significant growth. North America is expected to grow with the highest CAGR of about 10.1% during the forecast period.

Key Takeaways:

• Lab-grown diamonds' popularity is propelled by sustainability, affordability, and ethical sourcing.

• Consumer confusion and misinformation hinder market growth, emphasizing the need for education and clarity.

• Asia-Pacific dominates the market, driven by China's production prowess and rising consumer demand.

Recent Developments:

• In June 2023, WD Lab Grown Diamonds actively seeks new investments, leveraging the CVD method.

• In Jan 2023, Diamond Foundry entered the luxury jewelry market.

• In March 2022, Clean Origin secured a substantial $20 million equity investment.

• In Oct 2022, Swarovski launched its Created Diamonds collection, following a successful pilot program.

Lab-Grown Diamonds Market Drivers:

Lab-grown diamonds market drivers can be attributed to several factors that have contributed to the growth and popularity of these diamonds in recent years.

• Ethical and Sustainable Sourcing: One of the primary drivers for lab-grown diamonds is the increasing demand for ethical and sustainable alternatives to natural diamonds. Lab-grown diamonds are created in controlled laboratory environments, eliminating the need for environmentally damaging mining practices associated with natural diamond extraction. Consumers who are conscious about the environmental impact of their purchases are opting for lab-grown diamonds as a more responsible choice

• Cost-Effectiveness: Another significant driver is the cost-effectiveness of lab-grown diamonds compared to their natural counterparts. Lab-grown diamonds are typically priced at a lower point than natural diamonds, making them more accessible to a wider range of consumers. This affordability factor has attracted budget-conscious buyers who desire the beauty and elegance of a diamond without breaking the bank.

Buy the Latest Version of this Report

@ https://www.snsinsider.com/checkout/3985

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Lab-Grown Diamonds Market Segmentation, By Size

9. Lab-Grown Diamonds Market Segmentation, By Type

10. Lab-Grown Diamonds Market Segmentation, By Nature

11. Lab-Grown Diamonds Market Segmentation, By Manufacturing Method

12. Lab-Grown Diamonds Market Segmentation, By Application

13. Lab-Grown Diamonds Market Segmentation, By Distribution Channel

14. Regional Analysis

14.1 Introduction

14.2 North America

15 Company Profile

15.1 WD Lab Grown Diamonds

15.1.1 Company Overview

15.1.2 Financials

15.1.3 Product/ Services Offered

15.1.4 SWOT Analysis

15.1.5 The SNS View

15.2 New Diamond Technology LLC.

15.2.1 Company Overview

15.2.2 Financials

15.2.3 Product/ Services Offered

15.2.4 SWOT Analysis

15.2.5 The SNS View

15.3 ABD Diamonds Pvt. Ltd.

15.3.1 Company Overview

15.3.2 Financials

15.3.3 Product/ Services Offered

15.3.4 SWOT Analysis

15.3.5 The SNS View

15.4 Clean Origin LLC.

15.4.1 Company Overview

15.4.2 Financials

15.4.3 Product/ Services Offered

15.4.4 SWOT Analysis

15.4.5 The SNS View

15.5 Swarovski AG

15.5.1 Company Overview

15.5.2 Financials

15.5.3 Product/ Services Offered

15.5.4 SWOT Analysis

15.5.5 The SNS View

15.6 Mittal Diamonds

15.6.1 Company Overview

15.6.2 Financials

15.6.3 Product/ Services Offered

15.6.4 SWOT Analysis

15.6.5 The SNS View

15.7 De Beers Group

15.7.1 Company Overview

15.7.2 Financials

15.7.3 Product/ Services Offered

15.7.4 SWOT Analysis

15.7.5 The SNS View

15.8 Henan Huanghe Whirlwind CO. Ltd.

15.8.1 Company Overview

15.8.2 Financials

15.8.3 Product/ Services Offered

15.8.4 SWOT Analysis

15.8.5 The SNS View

15.9 Diam Concept

15.9.1 Company Overview

15.9.2 Financials

15.9.3 Product/ Services Offered

15.9.4 SWOT Analysis

15.9.5 The SNS View

15.10 Diamond Foundry Inc.

15.10.1 Company Overview

15.10.2 Financials

15.10.3 Product/ Services Offered

15.10.4 SWOT Analysis

15.10.5 The SNS View

16. Competitive Landscape

16.1 Competitive Benchmarking

16.2 Market Share Analysis

16.3 Recent Developments

16.3.1 Industry News

16.3.2 Company News

16.3.3 Mergers & Acquisitions

17. USE Cases and Best Practices

18. Conclusion

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube