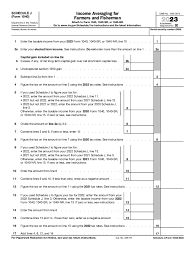

Schedule J Tax Form

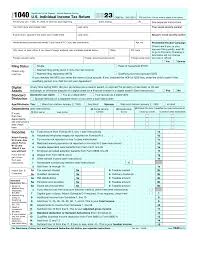

Printable IRS Tax Forms

IRS Tax Form Instructions

The Internal Revenue Service (IRS) has released the Schedule J tax form and instructions for the tax years 2023 and 2024.

TRAVERSE CITY, MI, US, January 11, 2024 /EINPresswire.com/ -- The Internal Revenue Service (IRS) has released the Schedule J tax form and instructions for the tax years 2023 and 2024.

This form is used by taxpayers who have income from farming or fishing and want to elect to average their income over a period of up to three years.

The Schedule J form allows farmers and fishermen to smooth out their income over several years, which may help in reducing the overall tax liability.

It is important to note that this form is only available to those who have income from farming or fishing and meet certain requirements outlined in the instructions.

The 2023 and 2024 Schedule J forms have been updated to reflect changes in tax laws and regulations. Taxpayers are advised to carefully review the instructions before filling out the form and submitting it to the IRS.

The IRS has also made the Schedule J form available online, making it easier for taxpayers to access and complete the form. Taxpayers can download the form from the IRS website or request a printed copy by mail.

To ensure accurate completion of the form, taxpayers are advised to seek the assistance of a tax professional or use tax preparation software that supports Schedule J.

The Schedule J form and instructions for 2023 and 2024 are available on the IRS website. Taxpayers are encouraged to review the instructions carefully and submit their forms well before the deadline to avoid penalties and interest charges.

For more information on the Schedule J form and instructions, taxpayers can visit, https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

+1 231-480-4086

email us here

Visit us on social media:

LinkedIn