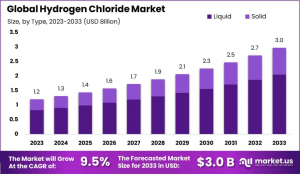

Hydrogen Chloride Market is expected to be worth around USD 3.0 Billion by 2033, up from USD 1.2 Billion in 2023, and grow at a CAGR of 9.5% from 2024 to 2033.

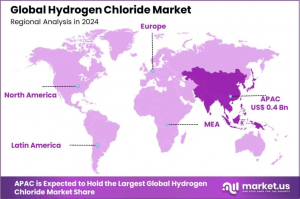

In 2023, the Asia-Pacific Hydrogen Chloride Market held a 35.6% share, valued at USD 0.4 billion.”

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global hydrogen chloride (HCl) market is a critical segment within the chemical industry, valued for its extensive use in applications ranging from hydrochlorination to the production of chlorides and as a catalyst and solvent in various industrial processes. Hydrogen chloride, a colorless and pungent gas, is both produced as a byproduct in many chemical reactions and manufactured for specific industrial uses.— Tajammul Pangarkar

Hydrogen chloride is shaped by its utility in major industries such as pharmaceuticals, steel manufacturing, and food processing. In the pharmaceutical industry, HCl is indispensable for producing a wide range of therapeutic drugs. It is also employed in the purification of silicon in the electronics industry, where high-purity silicon is essential for making semiconductors and other electronic components. Moreover, the metal processing industry uses hydrogen chloride in applications such as pickling and cleaning of metal surfaces, where its corrosiveness is utilized to treat metal substrates.

The demand for hydrogen chloride is primarily driven by its widespread use in the pharmaceutical industry, where it is used as a reagent in the synthesis of various active pharmaceutical ingredients (APIs). With the global pharmaceutical sector expanding in response to increasing healthcare demands, the need for HCl is expected to rise correspondingly. Additionally, growth in sectors such as electronics, where HCl is used in the etching of semiconductor devices, further compounds this demand.

Recent technological advancements in technology have led to improved production techniques that are more environmentally friendly and economically viable. For instance, the development of membrane electrolysis technology offers a more efficient method of producing hydrogen chloride while reducing environmental impact. This technology also allows for the recovery of hydrogen chloride from waste streams, providing both an economic and environmental benefit.

Looking ahead, the global hydrogen chloride market is poised to capitalize on several growth opportunities. The increasing emphasis on sustainability and waste reduction presents opportunities for the development of recycling and recovery systems for hydrogen chloride from industrial processes. Such systems not only reduce environmental impact but also improve economic efficiency by turning waste into valuable resources.

Don't miss out on business opportunities | Get sample pages at: https://market.us/report/hydrogen-chloride-market/free-sample/

Key Takeaways

◘ The Global Hydrogen Chloride Market is expected to be worth around USD 3.0 Billion by 2033, up from USD 1.2 Billion in 2023, and grow at a CAGR of 9.5% from 2024 to 2033.

◘ In the Hydrogen Chloride Market, 68.3% of products are offered in liquid form for diverse applications.

◘ Technical Grade hydrogen chloride dominates the market, accounting for 73.2% of all available grades.

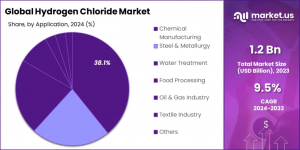

◘ The chemical manufacturing sector utilizes 38.1% of the hydrogen chloride supplied in the market.

◘ In Asia-Pacific, the Hydrogen Chloride Market is valued at USD 0.4 billion, 35.6% share.

Hydrogen Chloride Top Trends

1. Growth in the Semiconductor Industry: The semiconductor sector is increasingly using high-purity hydrogen chloride gas for etching and cleaning silicon wafers. This trend is driven by the rising demand for electronic devices, leading to a higher consumption of HCl in semiconductor manufacturing processes.

2. Expansion in the Pharmaceutical Sector: Hydrogen chloride is essential in synthesizing active pharmaceutical ingredients (APIs). The pharmaceutical industry's growth, fueled by increased healthcare needs, is boosting the demand for HCl, particularly in emerging markets.

3. Advancements in Chemical Manufacturing: The chemical industry utilizes hydrogen chloride in producing various compounds, including vinyl chloride for PVC production. Technological advancements and the push for sustainable practices are enhancing HCl's role in chemical synthesis.

4. Rising Demand in Steel Pickling: In the steel industry, HCl is used for pickling to remove impurities from metal surfaces. The expansion of steel production, especially in developing regions, is increasing the consumption of hydrogen chloride for this application.

5. Environmental and Safety Regulations: Stringent environmental policies are influencing the hydrogen chloride market. Companies are adopting cleaner production methods and improving safety measures in response to regulatory standards, impacting HCl production and usage practices.

To Get Moment Access, Buy Report Here: Enjoy Discounts of Up to 30%! https://market.us/purchase-report/?report_id=137632

Key Market Segments

Analysis by Type

In 2023, the liquid form of hydrogen chloride dominated the market, securing a 68.3% share. Favored for its ease of handling and broad application across industries such as pharmaceuticals and smart agriculture, liquid hydrogen chloride is the preferred choice for many due to its versatility and efficiency in use. Solid hydrogen chloride held 31.7% of the market share. Its use is particularly advantageous in environments that necessitate solid state storage and transport, such as in specific chemical synthesis operations where controlled reactivity is crucial. The targeted applications of solid hydrogen chloride support its consistent demand across the market.

Analysis by Grade

Technical-grade hydrogen chloride was the most prevalent in 2023, capturing 73.2% of the market. Predominantly used in industrial processes like metal refining and organic synthesis, technical-grade hydrogen chloride is integral to numerous manufacturing activities. Electronic grade made up 26.8% of the market. This high-purity level is essential for the electronics sector, especially for the cleaning and etching processes in semiconductor manufacturing, representing a vital but smaller portion of the market compared to the technical grade.

Analysis by Application

Chemical manufacturing was the leading application for hydrogen chloride, accounting for 38.1% of the market. This sector primarily utilizes hydrogen chloride in the production of chlorides and organic compounds, highlighting its critical role. The steel and metallurgy industry followed with a 22.4% share, using hydrogen chloride in metal treatment processes like pickling and cleaning to enhance end-product quality.

Water treatment processes accounted for 14.6% of the market, employing hydrogen chloride for pH adjustment and impurity precipitation, crucial for ensuring water purity. Food processing comprises 11.2% of the market, where hydrogen chloride is used in the production of food additives and as a processing aid, contributing to the safety and quality of food items. The oil and gas industry utilized 8.5% of the market, primarily for acidizing oil wells to enhance production efficiency. Lastly, the textile industry held a 5.2% share, using hydrogen chloride in textile processing and finishing to achieve the desired qualities in fabrics.

Key Market Segments List

By Type

-- Liquid

-- Solid

By Grade

-- Technical Grade

-- Electronic Grade

By Application

-- Chemical Manufacturing

-- Steel and Metallurgy

-- Water Treatment

-- Food Processing

-- Oil and Gas Industry

-- Textile Industry

-- Others

Regulations On the Hydrogen Chloride Market

⦿ United States (EPA - Environmental Protection Agency)

Clean Air Act (CAA) – Hazardous Air Pollutants (HAPs): Hydrogen chloride is classified as a hazardous air pollutant (HAP) under the CAA Section 112, requiring industries to install air pollution control systems to limit HCl emissions.

National Emission Standards for Hazardous Air Pollutants (NESHAP): Industries such as chemical processing and metal refining must adhere to strict HCl emission limits to prevent air contamination.

Resource Conservation and Recovery Act (RCRA): Governs the handling, storage, and disposal of hydrogen chloride to prevent groundwater contamination and soil degradation.

⦿ European Union (EU) Regulations

EU Industrial Emissions Directive (IED) (2010/75/EU): Establishes strict limits on HCl emissions from industrial processes, particularly in steel, cement, and chemical production.

REACH Regulation (EC 1907/2006): Requires manufacturers and importers to register hydrogen chloride, assess its risks, and ensure safe handling and labeling.

Seveso III Directive (2012/18/EU): Hydrogen chloride is categorized as a highly hazardous substance, requiring risk management measures for storage and transport.

⦿ China’s Environmental Protection Regulations

Ministry of Ecology and Environment (MEE) Regulations: China enforces strict HCl emission limits on industries under its Air Pollution Prevention and Control Action Plan.

Hazardous Chemical Safety Control Measures: Requires industries to implement strict workplace safety standards and emission reduction technologies.

⦿ Occupational Safety and Health Administration (OSHA, USA)

OSHA has set the Permissible Exposure Limit (PEL) for HCl at 5 ppm (parts per million) over an 8-hour work shift to protect workers from prolonged exposure.

The Hazard Communication Standard (HCS) mandates that Material Safety Data Sheets (MSDS) be provided for HCl-containing products.

⦿ European Agency for Safety and Health at Work (EU-OSHA)

The EU Workplace Exposure Limits (WELs) specify a short-term exposure limit (STEL) of 10 ppm to prevent health risks.

Employers must provide protective equipment (PPE), ventilation systems, and training for workers handling hydrogen chloride.

Regional Analysis

Asia-Pacific: Dominating the global landscape, the Asia-Pacific region held a 35.6% share of the Hydrogen Chloride Market, valued at approximately USD 0.4 billion. This dominance is largely fueled by strong manufacturing outputs from major economies such as China and India.

North America: North America maintained a significant market presence, supported by its advanced chemical manufacturing capabilities and strict environmental regulations. These factors have spurred the demand for high-purity hydrogen chloride across various sectors.

Europe: Europe's market strength is underpinned by a solid industrial foundation, coupled with growing investments in the pharmaceuticals and food processing sectors. These industries rely heavily on hydrogen chloride, enhancing its demand within the region.

Middle East & Africa: While smaller in market size compared to other regions, the Middle East & Africa displayed growth potential, driven by the oil and gas sector, which utilizes hydrogen chloride for applications like oil well acidizing.

Latin America: The Latin American market showed moderate growth, closely linked to the development of industrial and water treatment facilities. This growth reflects the expanding economic landscape and the increasing industrial needs of the region.

Key Players Analysis

-- AGC Chemicals

-- Air Liquide

-- B Vynova Group

-- BASF

-- BASF SE

-- Chinalco

-- Coogee Chemicals

-- Covestro AG

-- Detrex Corporation

-- Dongyue Group

-- ERCO Worldwide

-- Ercros SA

-- Inovyn

-- Juhua Group

-- Linde Industrial Gas

-- Merck KGaA

-- Nouryon Industrial Chemicals

-- Occidental Petroleum Corporation

-- Olin Corporation

-- PCC Group

-- Praxair

-- Shandong Xinlong Group

-- Shin-Etsu Chemical Co. Ltd

-- Solvay

-- Tessenderlo Group

-- Toagosei Co. Ltd

-- Versum Materials

-- Wandali Special Gas

-- Westlake Chemical Corporation

Conclusion

The Hydrogen Chloride Market is experiencing diverse regional dynamics, reflecting its broad range of applications across various industries. Asia-Pacific leads the market, driven by its expansive manufacturing sector, particularly in China and India. North America and Europe also show strong market presences, supported by advanced chemical production capabilities and increasing sector-specific demands.

Meanwhile, emerging regions like the Middle East, Africa, and Latin America are showing growth potential, driven by industrial developments and expanding needs in sectors such as oil and gas and water treatment. Overall, the global hydrogen chloride market is poised for continued growth, underpinned by its essential role in numerous industrial processes and compliance with stringent safety and environmental standards.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.