In line with the early indications of the SHIFEX Freight Index by Shifl, freight rates on the main Trans-Pacific trade lanes have fallen by more than 50%

Congestion continues to play a major role in keeping spot rates higher than pre-pandemic levels as we move into the second half of the year.”

SUFFERN, NY, UNITED STATES, July 21, 2022 /EINPresswire.com/ -- Freight rates on the main Trans-Pacific trade lanes have fallen in the 3rd quarter of 2022 by more than 50% from the peak of September 2021, retreating to levels not seen since the beginning of last year. — Shabsie Levy, CEO, and Founder of Shifl

A sharp decline in demand linked to the tightening of monetary policy across the world, a shift in consumer spending from goods to services, bloated retail inventories in the US and Europe, coupled with a dramatic decline in production in China has been responsible for the sharp reversal in rates in the first six months of the year.

Rates Under Fire as Fed Battles Inflation

International shipping lines have come under increasing attack for their part in stoking inflation, with the US Congress passing a bipartisan bill in June designed to prevent future freight rate hikes and add extra capacity for exporters.

Carriers have become a popular scapegoat for US legislators who need to act to rein in inflation, and US president Joe Biden said he "promised to crack down on ocean carriers whose price hikes have hurt American families" when he signed into action the bill. The bill outlines a host of measures to fight ocean freight rate increases, but whether this will actually give the Federal Maritime Commission the teeth it needs to take on the carriers remains to be seen.

The US Federal Reserve increased the prime lending rate by 75 basis points in July 2022 to counter the rise in inflation, which hit 9.1% in July, its highest level in 40 years.

“Inflation, coupled with softening demand for goods as consumers allocate more money to eating out and holidays, has prompted US lawmakers to step up their efforts to curb runaway prices in the world’s biggest economy through various pieces of legislation such as the Ocean Shipping Reform Act 2022,” said Shabsie Levy, CEO, and Founder of Shifl.

Declining Freight rates

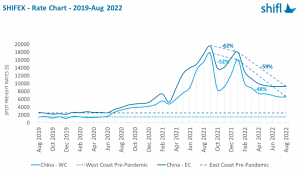

On the back of the softening demand, ocean spot freight rates for a 40’ container (FEU) from China to Los Angeles fell 62% in July 2022 compared to September 2021 and 59% compared to January 2022, reaching $6,600 in July 2022, expected to continue into August 2022.

Rates from China to New York fell 52% in July 2022 compared to September 2021 and 48% compared to January 2022, reaching $9,300 in July 2022, expected to continue to August 2022.

While these rates are still a far cry from the pre-pandemic rate levels of $1,350/FEU and $2,850 in March 2020 to the US West and East Coast, respectively, the decline is a welcomed relief for shippers.

Issues with Congestions

Landside congestion and container dwell in port continues to haunt US customers, halting the decline in spot rates.

Retail inventories continued to climb to record levels, up 2% in May to $705bn, which has raised the prospect of cargoes backing up in ports and on the landside.

“It’s estimated that congestion is responsible for taking 10% of the global container fleet out of circulation, bolstering the position of carriers in rate negotiations,” said Levy.

CNBC is reporting that a total of 19,665 rail containers have been waiting nine days or longer at Los Angeles, while the Port of Long Beach had 13,819 rail containers waiting. In total, over 60% of all containers waiting at these ports are destined for rail, accounting for over $1.54 billion in trade value.

“Rail containers continue to pile up in the ports in record numbers,” Noel Hacegaba, deputy executive director of administration and operations of the Port of Long Beach, told CNBC. “We need those boxes to move to create more capacity and to keep the economy moving.”

“Congestion continues to play a major role in keeping spot rates higher than pre-pandemic levels, and with shelves and warehouses fully stocked, we’ll probably see more containers sitting on the dock or at railway yards for longer periods as we move into the second half of the year,” said Levy.

As per data tracked by Shifl, container dwell times have been climbing steadily over the past three months. While a box was taking an average of 4 days to leave the port in May 2022, that figure increased to 5 in June and 6 in July 2022. Boxes are taking longer to leave the port in New York also with an average container dwell time of 4 days.

Climbing dwell times raises once again the prospect of the implementation of the container dwell fee - a measure introduced in the ports of Los Angeles and Long Beach in October that allows ports to charge ocean carriers $100 for each import container dwelling nine days or more at the terminal. Its implementation has been postponed every month by both ports. The Long Beach and Los Angeles Boards of Harbor Commissioners have both extended the fee program through July 28, when they will revisit if it is necessary.

Transit Times Declining

There was an overall reduction in transit times on the main trades to the East and West Coast of the USA in July, maintaining a downward trend that started in May.

Transit times from China to US west coast ports were down from 34 days in May to 32 days in July. The improvement was more noticeable on vessels sailing to the US east coast, with transit times down from 56 days to 46 days, a reduction of 18% since May.

“The off-peak season has enabled carriers to reduce some of the issues they were having with service reliability, but the transpacific trade lane and the all-water route to the US east coast are still way above their respective historical averages of 16 and 27 days,” said Levy.

Charlie Pesti

CHARLIE PESTI

+1 267-514-5497

email us here