TALLINN, ESTONIA, January 23, 2024 /EINPresswire.com/ -- Cryptocurrencies are often viewed as both an investment asset and a payment tool. Using cryptocurrencies as a payment method has its advantages, including simpler cross-border transfers, an overall easier and more cost-effective procedure for large transfers, and increased payment confidentiality. Many companies already use them as a means of payment. There are several methods for setting up payments using digital assets, and cryptocurrency processors often act as payment solution providers for such businesses. Simply put, processors handle electronic payments between individuals and legal entities in fiat and crypto.

The year 2024 opens up serious prospects for the development of the processing direction, promising the formation of new economic markets, greater transparency in regulations, a focus on integrating fiat and crypto businesses, and the development of the Web3 ecosystem.

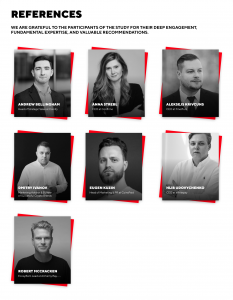

BDC Consulting provides comprehensive support to companies, aimed at optimizing various stages of the sales funnel, enhancing brand visibility, and efficiently working on customer retention. Within strategic partnerships, we conduct extensive market and audience research, paying special attention to the payment market as one of the key focus areas. We’ve conducted a series of interviews with leading experts in the cryptocurrency payment provider market and are ready to share insights and opinions regarding the 2024 trends.

THE KEY TASK OF PROCESSORS IS TO MAKE CRYPTOCURRENCIES AS ACCESSIBLE, CONVENIENT, AND SIMPLE AS FIAT

To achieve this, processors work in several directions:

the creation of technical capabilities for integrating necessary functions for businesses;

establishing partnerships with local financial institutions (banks, aggregators, etc.);

forming a strong compliance team that actively monitors changes in cryptocurrency regulations in various geographies.

MiCA: THE MOST ANTICIPATED REGULATORY FRAMEWORK

The introduction of MiCA in 2024 in Europe will contribute to a significant simplification of processing operations in the region.

Along with this, players expect a sharp increase in competition.

PARTNERSHIPS ARE A MANDATORY REQUIREMENT FOR THE SUSTAINABLE DEVELOPMENT OF CRYPTOCURRENCY PROCESSING BUSINESS

Building a high-quality network and online/offline networking are two of the most important tasks in developing the processing business.

The main challenge is establishing partnerships with large, well-known organizations that need to be convinced of the advantages of using cryptocurrency.

A winning strategy is to partner with payment aggregators to be the first to offer merchants and end-users cryptocurrency payments.

Another direction is working with banks and other financial organizations. Partnerships with local banks and regional payment systems are becoming increasingly popular.

LOCAL MARKET PENETRATION AS A STRATEGY FOR 2024

There is a trend towards transitioning from a global development strategy (working with various countries worldwide) to targeted operations within specific macro-regions (prioritizing the onboarding of merchants from selected regions).

According to experts, the most promising regions are Asia, Africa, Latin America, and the EU, with Turkey being a notable separate mention.

Read more details here.

The year 2024 opens up serious prospects for the development of the processing direction, promising the formation of new economic markets, greater transparency in regulations, a focus on integrating fiat and crypto businesses, and the development of the Web3 ecosystem.

BDC Consulting provides comprehensive support to companies, aimed at optimizing various stages of the sales funnel, enhancing brand visibility, and efficiently working on customer retention. Within strategic partnerships, we conduct extensive market and audience research, paying special attention to the payment market as one of the key focus areas. We’ve conducted a series of interviews with leading experts in the cryptocurrency payment provider market and are ready to share insights and opinions regarding the 2024 trends.

THE KEY TASK OF PROCESSORS IS TO MAKE CRYPTOCURRENCIES AS ACCESSIBLE, CONVENIENT, AND SIMPLE AS FIAT

To achieve this, processors work in several directions:

the creation of technical capabilities for integrating necessary functions for businesses;

establishing partnerships with local financial institutions (banks, aggregators, etc.);

forming a strong compliance team that actively monitors changes in cryptocurrency regulations in various geographies.

MiCA: THE MOST ANTICIPATED REGULATORY FRAMEWORK

The introduction of MiCA in 2024 in Europe will contribute to a significant simplification of processing operations in the region.

Along with this, players expect a sharp increase in competition.

PARTNERSHIPS ARE A MANDATORY REQUIREMENT FOR THE SUSTAINABLE DEVELOPMENT OF CRYPTOCURRENCY PROCESSING BUSINESS

Building a high-quality network and online/offline networking are two of the most important tasks in developing the processing business.

The main challenge is establishing partnerships with large, well-known organizations that need to be convinced of the advantages of using cryptocurrency.

A winning strategy is to partner with payment aggregators to be the first to offer merchants and end-users cryptocurrency payments.

Another direction is working with banks and other financial organizations. Partnerships with local banks and regional payment systems are becoming increasingly popular.

LOCAL MARKET PENETRATION AS A STRATEGY FOR 2024

There is a trend towards transitioning from a global development strategy (working with various countries worldwide) to targeted operations within specific macro-regions (prioritizing the onboarding of merchants from selected regions).

According to experts, the most promising regions are Asia, Africa, Latin America, and the EU, with Turkey being a notable separate mention.

Read more details here.

ALES KAVALEVICH

BDC-HQ OÜ

+48 733 627 014

email us here