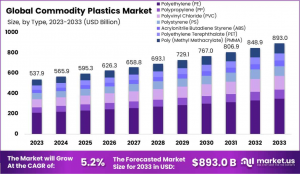

The commodity Plastics Market is expected to be worth around USD 893.0 Billion by 2033, up from USD 537.9 Billion in 2023, at a CAGR of 5.2% from 2024 to 2033.

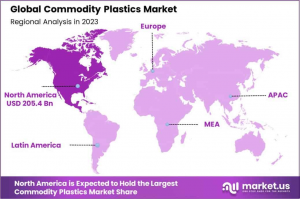

In Asia-Pacific, the commodity plastics market holds a 38.2% share, valued at USD 205.4 billion.”

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global commodity plastics market plays a pivotal role in the modern economy, offering a range of polymers that are extensively used across diverse industries due to their cost-effectiveness, versatility, and performance. Commodity plastics, including polyethylene, polypropylene, polyvinyl chloride (PVC), polystyrene, and others, are primarily employed in packaging, construction, electronics, automotive, and consumer goods due to their durability and ease of manufacturing.— Tajammul Pangarkar

Several driving factors are propelling the growth of the commodity plastics market. Key among them is the rising demand from the packaging industry, driven by the increasing consumption of packaged foods and consumer goods, particularly in rapidly urbanizing regions. The automotive sector also significantly contributes to demand, as there is a growing shift towards lighter vehicles for better fuel efficiency, where plastics are used to replace heavier materials like metal and glass.

Economic development in emerging markets is another crucial driver, as rising incomes lead to increased consumption of products made with commodity plastics. Additionally, advancements in healthcare and pharmaceutical sectors create a steady demand for plastics used in medical devices and packaging.

The demand for commodity plastics is also influenced by environmental concerns and regulatory policies aimed at reducing plastic waste. This has led to a push for more sustainable and recyclable plastics, which in turn is steering innovations within the industry. Despite these environmental pressures, the demand for commodity plastics continues to grow, albeit with a stronger emphasis on sustainability and circular economy principles, where the focus is on recycling and reusing plastic materials.

Technological advancements have significantly impacted the commodity plastics market, particularly in the development of enhanced polymer properties and production processes. Innovations in catalyst technologies and process engineering have led to more efficient polymerization techniques, which improve yield and reduce energy consumption. There is also a notable trend towards the production of high-performance commodity plastics with improved functionalities like enhanced strength, clarity, and barrier properties, which expand their applicability in various industries.

The future growth of the global commodity plastics market looks promising with several opportunities on the horizon. The continuous expansion of the packaging industry, particularly in Asia-Pacific regions like China and India, is expected to be a major growth driver. Additionally, the push for lightweight and energy-efficient materials in the automotive and aerospace industries presents significant opportunities for the increased use of commodity plastics.

The rising trend of sustainability and the circular economy offers a pathway for growth through innovations in recycling technologies and the development of bio-based plastics. These advancements are not only environmentally beneficial but also align with global regulatory trends pushing for sustainable manufacturing practices and waste reduction.

For a deeper understanding, click on the sample report link: https://market.us/report/commodity-plastics-market/free-sample/

Key Takeaways

◘ The Global Commodity Plastics Market is expected to be worth around USD 893.0 Billion by 2033, up from USD 537.9 Billion in 2023, and grow at a CAGR of 5.2% from 2024 to 2033.

◘ In the Commodity Plastics Market, Polyethylene (PE) holds a substantial 39.3% share by type.

◘ Films, as an application in the Commodity Plastics Market, represent 29.1% of the market.

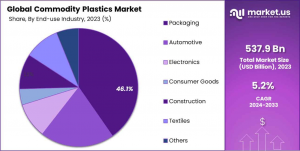

◘ Packaging dominates the end-use industry segment in the Commodity Plastics Market with 46.1%.

◘ The Asia-Pacific commodity plastics market holds 38.2% with a value of USD 205.4 billion.

Commodity Plastics Top Trends

1. Increased Demand for Sustainable Plastics: As environmental concerns rise, there's a growing shift towards eco-friendly alternatives such as biodegradable polymers, bio-based plastics, and increased recycling. This shift is motivated by consumer preferences and stricter environmental regulations.

2. Innovative Packaging Solutions: The surge in e-commerce has accelerated demand for both traditional and advanced packaging solutions. Innovative packaging that extends shelf life, enhances user experience and incorporates tamper-evident features is gaining traction.

3. Technological Advancements in Production: Continuous improvements in material science and manufacturing techniques are expected to lead to the development of new varieties of commodity plastics. These advancements aim to enhance efficiency and cost-effectiveness in the production process.

4. Expansion in Medical Applications: Commodity plastics are increasingly used in the healthcare sector, particularly in disposable medical supplies and equipment. This is driven by the need for hygienic, durable, and cost-effective materials that comply with health regulations.

5. Growth in the Automotive Sector: The automotive industry continues to utilize commodity plastics for manufacturing lightweight vehicle components. This trend is supported by the ongoing push towards fuel-efficient vehicles.

Key Market Segments

By Type Analysis

In 2023, the Commodity Plastics Market was led by Polyethylene (PE), which claimed a substantial 39.3% market share in the "By Type" segment. Known for its versatility, PE is extensively utilized due to its durability, flexibility, and moisture resistance, making it indispensable in packaging, containers, and household items. Following PE, Polypropylene (PP) held a significant position with its valued properties of stiffness and chemical resistance, finding applications in automotive parts, textiles, and consumer packaging. This demonstrates its wide-ranging utility across diverse sectors.

Polyvinyl Chloride (PVC), with its notable strength and rigidity, plus resistance to moisture and corrosion, secured a considerable segment of the market. It is primarily used in construction for products such as pipes, doors, and windows, as well as in healthcare for tubing and containers. Polystyrene (PS) is prized for its moldability and excellent insulation properties, commonly employed in food service packaging and building insulation for its lightweight and cost-effectiveness.

Acrylonitrile Butadiene Styrene (ABS) is favored for its combination of toughness and rigidity, commonly used in high-impact tools, automotive components, and consumer electronics, ensuring sustained demand due to its performance capabilities. Polyethylene Terephthalate (PET) dominates the packaging industry, especially for producing beverage bottles and containers, appreciated for its strength, thermal stability, and recyclability. Poly (Methyl Methacrylate) (PMMA) stands out for its clarity and resistance to UV light and weather conditions, serving as an ideal glass substitute in automotive, construction, and lighting applications for its aesthetic flexibility and durability.

By Application Analysis

Films dominated the "By Application" segment of the Commodity Plastics Market in 2023, holding a 29.1% share. Their widespread application across packaging, agriculture, and construction sectors is attributed to their excellent protective and barrier properties. Bottles, primarily crafted from PET and PE, are integral to the beverage, pharmaceutical, and personal care industries, driven by the materials’ strength, light weight, and recyclability.

Containers made from PP and PE are vital in food service and storage, valued for their durability, chemical resistance, and safety in food contact applications. Insulation Materials, mainly consisting of PS and PU, play a critical role in the building and construction industry for their thermal and acoustic insulation properties, driven by the demand for energy-efficient building solutions. Pipes, predominantly manufactured from PVC and PE, are essential in infrastructure projects for water supply and sewage systems due to their longevity, corrosion resistance, and cost-effectiveness.

By End-Use Industry Analysis

The Packaging sector led the Commodity Plastics Market in 2023 with a 46.1% share, underpinned by the extensive use of plastics in food and beverage packaging, favored for its cost-effectiveness and product protection capabilities. The Automotive sector followed, capturing a 17.8% share, with plastics playing a crucial role in reducing vehicle weight and enhancing fuel efficiency, particularly in components like bumpers, dashboards, and door panels.

Electronics held an 11.6% market share, with plastics essential in the production of lightweight, durable consumer electronics such as smartphones and computers. Consumer Goods accounted for 9.4% of the market, with plastics utilized in a diverse range of products from household items to sports equipment, benefiting from their adaptability and ease of molding.

The Construction sector comprises 7.5% of the market, where plastics are indispensable in applications like piping, insulation, and vinyl siding due to their durability and environmental resistance. Textiles represented 4.5% of the market, with synthetic fibers such as polyester and nylon being critical for their versatility and performance in textile applications. Medical and Pharmaceuticals made up 3.1% of the market, where plastics are crucial for producing sterile packaging, disposable syringes, and various medical devices, offering advantages in safety, reliability, and sanitation.

To Get Moment Access, Buy Report Here: Enjoy Discounts of Up to 30%! https://market.us/purchase-report/?report_id=137614

Key Market Segments List

By Type

-- Polyethylene (PE)

-- Polypropylene (PP)

-- Polyvinyl Chloride (PVC)

-- Polystyrene (PS)

-- Acrylonitrile Butadiene Styrene (ABS)

-- Polyethylene Terephthalate (PET)

-- Poly (Methyl Methacrylate) (PMMA)

By Application

-- Films

-- Bottles

-- Containers

-- Insulation Materials

-- Pipes

-- Others

By End-use Industry

-- Packaging

-- Automotive

-- Electronics

-- Consumer Goods

-- Construction

-- Textiles

-- Medical and Pharmaceutical

-- Others

Regulations On the Commodity Plastics Market

1. Single-Use Plastic Bans: Several states introduced bans on single-use plastics, including Massachusetts which prohibited the sale of single-use plastic bottles under 21 ounces. Canada also implemented a ban affecting the manufacture and sale of certain single-use plastics.

2. Advanced Recycling Legislation: States like Indiana, Utah, and Kansas passed laws facilitating the recycling of difficult-to-recycle plastics, such as films and wrappers. This aims to boost recycling technology and create economic opportunities.

3. Extended Producer Responsibility (EPR): New EPR laws have been proposed and enacted, particularly in New York, which require producers to manage the waste lifecycle of their products, including achieving recycled content goals. Washington state also saw proposals for new EPR measures.

4. Federal Recycling and Composting Acts: The U.S. saw proposals for the Recycling Infrastructure and Accessibility Act and the Recycling and Composting Accessibility Act, focusing on increasing recycling rates nationwide through federal support and grants.

5. Recycled Content Requirements: Several states now mandate that certain percentages of recycled content must be included in plastic packaging, supporting the demand for post-consumer recycled materials and aiming to stabilize the recycling market.

Regional Analysis

Asia-Pacific: Leading the global commodity plastics market with a 38.2% share, valued at USD 205.4 billion, Asia-Pacific benefits from rapid industrialization, population growth, and increased consumer spending. China and India are key contributors, heavily influencing the demand across packaging, consumer goods, and electronics sectors due to their expansive markets.

North America: Driven by innovation in product design and a strong manufacturing base, North America excels particularly in the automotive and packaging industries. The region's focus on sustainable and high-performance materials supports consistent market growth.

Europe: Europe prioritizes sustainability and recycling, with stringent environmental regulations boosting the demand for eco-friendly commodity plastics. The focus on innovative plastic solutions in the automotive and packaging sectors marks Europe as a leader in the field.

Middle East & Africa and Latin America: Although smaller, the markets in these regions are expanding, spurred by urbanization and economic progress. Investments in infrastructure and consumer goods are key drivers, offering new opportunities for market expansion in these less saturated regions compared to their Western counterparts.

Key Players Analysis

- Lg Chem

- Sumitomo Chemical

- Sabic

- Exxon Mobil Corporation

- Chevron Phillips Chemical Company, LLC

- BASF SE

- Dow

- DuPont

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Braskem

- Eni S.p.A

- Formosa Plastics Corporation

- Sumitomo Chemical Co., Ltd.

- Hanwha Group

- INEOS

Conclusion

In conclusion, the global commodity plastics market is poised for continued growth, driven by robust demand from traditional sectors and new opportunities arising from technological advancements and shifting consumer preferences. With a focus on sustainability and innovation, the market is well-positioned to meet the evolving needs of industries and consumers alike, ensuring its relevance and expansion in the years to come.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.