BitcoinZ Value jumped 70% in less than 20 days while most crypto assets see a never ending slump during the last 3 months

BitcoinZ Coin info

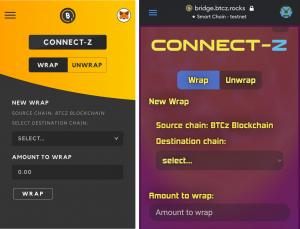

Skins for Connect-Z Testnet by the BitcoinZ Community

BTCZ is turning to a hedge against the hyper inflated "DeFi" platforms and their tokens. The BITCOINZ Community repeatedly warned for the upcoming disaster

BITCOINZ will be soon available in popular blockchains like Binance Smart Chain, with the launch of the Connect-Z bridging platform which is already open for Community testing”

— BITCOINZ Community

LONDON, LONDON, UK, July 7, 2022 /EINPresswire.com/ -- During the recent weeks the vast majority of cryptocurrencies and tokens have seen huge losses that in many scenarios are between -60% down to -99% and this doesn't seem to be just an accidental event.

Most specifically during the last 3 months popular assets like Bitcoin and Litecoin had a loss of more than -50% for their value.

But the bigger losers of the last month are the so called "DeFi" projects that like Ethereum, Algorand , Polkadot and Solana, with loses that are even over -60% to -75% (The provided table contains information taken from the popular CoinmarketCap platform).

However there was a specific cryptocurrency that skyrocketed during the last month gaining more than +70% . This is BITCOINZ.

Trying to understand these moves : Why the "DeFi" platforms and their tokens had so huge losses ?

The "Defi" platforms became trendy on 2019 and were introduced by Ethereum. Most of the recent DeFi projects have been battling with each other trying to be "the next Ethereum". The "DeFi" model is concentrated in the creation of tokens with smart contracts that interact with the mother chain and other tokens. Tokens are assets that don't have their own independent networks. By contrast, they depend on their mother network which offers a ready and easy to use infrastructure with wallets and exchanges to every potential "project creator/ token founder".

The quotes are used because in the most cases fraudulent developers launch scam digital assets with token form, abusing this easiness.

A token asset is a totally pre-mined one, completely away from the logic of classic cryptocurrency assets that Bitcoin had introduced with its Proof of Work (PoW) model. In a Bitcoin-like PoW blockchain , people are antagonizing with their hardware to solve algorithmic problems, participating in a decentralized network of transactions. So they get rewards for each new block, each new solution that they find. This way new coins are created slowly and are distributed to thousands or even millions of people around the world according to the rules of each PoW cryptocurrency network , like a fixed maximum supply, a defined curve for the emissions rate etc.

On the contrary, a token asset is totally pre-mined which means that a founder created all of its supply and allocated it to an address... to his address.

The token's founder using heavy marketing and the right connections (aka bribing influencers and owners of popular exchanges by giving them a percentage of this supply), creates an extreme demand for his new asset and literally sells thin air to all the buyers. He then jumps to his next creation, usually abandoning the previous one and the history is repeated again and again.

In the end the investors and buyers are left with useless tokens that in most cases even hundreds of them have much lower value than the cost of the required gas fees in order to just move them in the mother network (mother networks are blockchains like Ethereum, Solana or Avalanche for example).

This is what we call a "rug pull" and this is how the cryptocurrency landscape ended having countless useless "assets" and many new ones created every day. Obviously this would not end well.

Which is the role of the mother networks? Do they follow the original cryptocurrency idea?

The mother networks are usually company driven projects that are again either heavily premined (like Ethereum) or completely premined (most ETH wannabe chains). This means that when these networks had been launched, their founders allocated a huge part or all the coins' supply in their wallets. This gave them huge economical power to demonstrate and advertise their own "token-factory/DeFi" platform, targeting to be the next Ethereum:

A project that would centralize almost every digital asset in its own network. This way a mother network makes its coins more precious because of the demand for "Gas fees" hence every proxy token, that depends on it, has to pay fees in iits mother network's coins. Exactly like many thousand ETH tokens do with Ethereum Fees, leading to the legendary ETH GAS fee spikes that had a cost of even over $170 in ETH. In simple words, a user that wished to transfer $100 in Shiba Inu, Safemoon or other tokens that were originally based on Ethereum, had to pay a cost that was almost double of the transferred sum (!). Many times with additional issues like network congestion and failures because of the high traffic.

Of course again all the above have no relation with the original cryptocurrency idea, that Bitcoin introduced, for some obvious reasons :

1) A classic cryptocurrency was supposed to offer Decentralization in the levels of coin Distribution, Governance and Network.

The "Defi" model seems more like... Centralized Finance as the founders of these mother-chain platforms always receive a huge or the whole of their project's coin supply during the launch in their wallets.

2) A Bitcoin-like cryptocurrency has the target to offer Freedom from Central Authorities and the lowest possible fees for borderless transactions.

In the "DeFi" model the mother chain and his founder acts as a central authority in every level:

-They allocated the supply to their wallets.

-The network is not fully decentralized because specific servers support it and not potentially everyone like in PoW Projects

(for example Cosmos and Luna networks had shut down for hours, Solana's network had repeatedly shut downin the past etc)

- The fees can touch the sky with so many assets gathered on a single project as these mother chains act like a magnet for fraudulent token founders. "Assets" that are created without any use case, like meme and hype tokens made in order to make their founders rich.

3) A cryptocurrency was supposed to act as a hedge against inflation, with fixed maximum supply and immutable rules. This was the concept and one of the main arguments of the crypto supporters versus the Central Banks and their printed money.

In the "DeFi" model there is extreme inflation that is extremely worse than the inflation of most Central Banks.

People are "Staking assets" in order to receive other "assets" which are going to give other "assets" and so on.

In just two years the Ethereum Blockchain alone was full with useless and meme tokens that could not even act as a simple medium of transfer due to its extreme gas fees.

The original cryptocurrency idea was without doubt one of the most genius discoveries ever but obviously the so called "DeFi" projects and their countless tokens are not. Actually they are an inflating bubble and a disgrace for the real cryptocurrency concept.

This is why now this family of assets are the bigger losers with every market drop and it will get only worse since this kind of assets extremely outnumber the classic cryptocurrency networks.

But why BITCOINZ made it to attract the interest of the buyers, against the general downtrend ?

There are two main reasons behind this move.

First Reason

A team of developers have already launched the testing phase of Connect-Z.

Connect-Z is a bridging platform that will enable the users of the BitcoinZ Blockchain to swap native BTCZ coins into wrapped / tokenized versions (wBTCZ) in other blockchains like Binance Smart Chain, Ethereum and more in the future.

This way the BitcoinZ ecosystem will be dramatically expand , widening its audience with more mainstream users coming in contact with BITCOINZ, discovering its unique features and joining its highly active Community.

Second Reason

Most importantly, BITCOINZ is a pure cryptocurrency network that follows all the fundamentals that the classic Bitcoin introduced for years, with many extra advantages and this begins to be more and more obvious as the noise coming from unnumbered meaningless meme tokens and scam assets is fading during this bear crypto market. Some people inevitably discover what was the original cryptocurrency idea was about. What definitions like Decentralization, Freedom, Privacy, Democracy and Mining Algorithms mean.

How BITCOINZ differs from the classic Bitcoin without breaking the classic fundamentals ?

BITCOINZ (BTCZ) was launched on 2017 and is a pure cryptocurrency that offers solutions to all the five “flaws” of the legendary Bitcoin :

1) Its scalability offered higher transaction speed and more transactions per second

2) BITCOINZ’s high maximum supply is the ideal for easier prices without long non integer numbers.

3) The 21B coin supply in combination with the much more transactions per second, guarantees super low, next to zero fees even if it had the BTC cap and network load. BitcoinZ is ideal for transferring even very small sums of under $10 with ~0% cost.

4) BITCOINZ’s ASIC resistant Zhash algorithm protects the PC miners from the ASIC elites. This way it achieves a Decentralized Network with truly fair distribution of coins to the world Community. Not to the rich people owning an ASIC device.

5) BITCOINZ features private transactions offering true privacy for everyone.

6) (extra) BITCOINZ is a green Proof of Work Network since a) it utilizes a much more energy efficient algo than BTC b) the users can use their PCs for other activities while mining BTCZ because only the GPU is (mildly) used for the process and c) it supports more transactions per second with plenty of space for future upgrades.

At the same time BITCOINZ fulfills all the fundamentals of a pure cryptocurrency :

1) It was founded by anonymous founders and it is a 100% Community Driven project, with no central authority issuing coins.

2) 100% of its coin supply is distributed to its network’s supporters (miners) with the Proof of Work model. Everyone if free to join it through the mining procedure, using just a PC.

3) It had the fairest launch ever with absolutely no premine , no initial coin offerings and no instamine period (something that is questionable even for Bitcoin).

4) It is an asset that acts as a hedge against inflation because it has a fixed maximum supply and reduced coin emission over time with fair and slow mining halving plan, every 4 years.

Why BITCOINZ uses the "BITCOIN" name and why it is really different from the so many projects that used it.

BITCOINZ used the "BITCOIN" name adding a Z because it honored and followed all the aforementioned fundamentals that the classic BITCOIN introduced (fair rules, 100% Community Driven, 100% Decentralized, 100% Proof of Work) and at the same time it offed Zero fees, only PC-mining with its Zhash algorithm and optional privacy based on the Zk-snarks cryptography. So there was no better name to describe all these than "BITCOIN+Z".

It is worth mentioning that BITCOINZ is the oldest (launched on 2017) and maybe the only "BITCOIN" named project that can still be mined with a normal PC and it is not a Bitcoin blockchain fork since it had its own genesis block.

Other crypto projects that have used the "Bitcoin" name, did it afterwards, in a misleading way or they are just copies of the BITCOIN's blockchain (blockchain-forks) that have given free coins (forkdrops) to the Bitcoin holders. In such a way, these "BITCOIN" named projects try to enjoy a high free exposure by distributing coins to the BITCOIN owners. Sometimes bad actors from the BITCOIN chain-fork projects even steal the private keys from the BTC owners that try to claim their free coins in the BTC-forks.

In contrast, BITCOINZ had its own unique blockchain exactly like Bitcoin did and never made any forkdrops. Offering equal opportunities to everyone by distributing the 100% of its supply to the whole world Community and not to a closed team. Exactly like a real cryptocurrency should be destined to do, being the gift of Freedom and Equality.

A Conclusion for the cryptocurrency moves of the last months

As a conclusion, the moves of the last months are a trend and not a random event.

The biggest victims of this new downtrend are the very overvalued cryptocurrencies and the DeFi projects, especially tokens that have hyper-inflated supply or represent useless meme/scam projects .

BITCOINZ, being among the most decentralized, classic, pure mineable projects with many advantages over Bitcoin, fixed supply and the most fair rules ever, makes it to surprise everyone acting as a hedge against inflation, centralized assets and scam tokens.

A positive trend that is going to be accelerated further, especially with the upcoming Connect-Z platform that is going to offer the BTCZ asset in very popular platforms like in Binance Smart Chain and Ethereum Blockchain.

Discover 33 reasons why BITCOINZ should not go unnoticed

Get your BITCOINZ Discord channel Invitation here

Exchanges where you can trade BITCOINZ

PS. Please be always extra careful for bad actors giving fake contract addresses in BSC and claiming that they are BTCZ contracts (like they do with other assets). When Connect-Z is completed, you will find legitimate Contract Address provided by the BitcoinZ Community in the official sites and in the BITCOINZ associated CoinmarketCap / CoinGecko pages.

Rok Mikuz

BitcoinZ

listings@btcz.rocks

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

![]()