Beforepay (ASX:B4P) has been named 2023 Ethical Lender of the Year by Pan Finance.

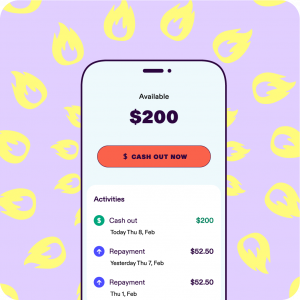

Beforepay provides eligible customers with access to advances of up to $2000 for a 5% fixed transaction fee, with no interest or late fees.

Beforepay Group Limited (ASX:B4P)

It’s fantastic to have delivered positive EBITDA this early in our journey. It shows the power of steady, focused execution of our strategy, and sets us up for sustained profitability going forward.”

— Jamie Twiss, CEO of Beforepay

SYDNEY, NSW, AUSTRALIA, July 28, 2023/EINPresswire.com/ -- Beforepay Group Limited (Beforepay) (ASX: B4P) today released its results, which showed that the ethical lending fintech delivered a positive EBITDA of $0.57m in the fourth quarter of FY23 (Q4 FY23). This is the first positive EBITDA for the company in its six quarters as a public company and demonstrates the significant progress it has been making towards profitability.

“It’s fantastic to have delivered positive EBITDA this early in our journey,” said CEO Jamie Twiss. “It shows the power of steady, focused execution of our strategy, and sets us up for sustained profitability going forward.”

The company attributed this outcome to its ability to both tightly control operating expenses even while growing strongly, and to its strong data-driven approach to risk management. The results released today show that quarterly operating revenue had increased 49% year-on-year even while operating expenses have fallen 27% over the same period. While no guarantee of future profitability, given natural fluctuations in credit outcomes as well as other factors, these results demonstrate the sustainability of the company’s business model.

“We’ve driven the cost agenda hard throughout the business, keeping our overheads flat while becoming significantly more efficient at performance marketing,” said Twiss. “In Q4 FY23, this enabled us to write an average of more than 35,000 pay advances every week with a full-time staff of 30 people in Australia plus some offshore contractors.” Twiss noted that over the last two years, employee headcount has reduced 3% while revenue has grown more than 500%, showing the operational leverage of the business.

Tight risk management has also been instrumental in delivering these financial outcomes. The company announced that its database in 2023 now held 1.3 billion transactions in a single, modern, cloud-based environment. This data asset, refreshed each day for more than 400,000 linked accounts, enables a team of data scientists to continue to upgrade and retrain the company’s machine-learning models to assess potential customers for risk and to set advance limits.

Jamie Twiss added, “While we’re very pleased to have delivered such a strong financial outcome, we’re also always focused on fulfilling our mission of supporting working Australians. Our average revenue per advance during the quarter was $17, with no late fees, compounding interest, penalty fees, or anything to pay aside from the fully transparent up-front fee. Because customers can only take one advance at a time, they’re able to bridge temporary cashflow gaps without the risk of paying more than they expect to or getting into a debt spiral. For the average customer, we believe that this makes our product safer and more affordable than a credit card or a payday loan.”

-END-

About Beforepay

Beforepay was founded in 2019 to support working Australians who have not been well-served by the traditional financial-services industry. The product is an ethical, customer-friendly way to help people manage temporary cash-flow challenges. We provide our customers with early access to a portion of their pay, on-demand, in exchange for a single fixed fee, which helps them to get through short-term challenges whilst not living beyond their means. For more information visit www.beforepay.com.au.

Important notice

All figures are unaudited. All dollar values are in Australian dollars ($ or A$) unless stated otherwise. Change percentages are calculated using unrounded figures and may differ slightly from a number calculated using rounded figures.

This announcement contains selected summary information only and is provided for general information purposes only. It should be read in conjunction with Beforepay Group’s continuous disclosure announcements available at www.beforepay.com.au/investor-hub/asx-announcements. Nothing in this announcement constitutes financial product, investment, legal, tax, accounting or other advice and it is not to be relied upon in substitution for the recipient’s own exercise of independent judgment regarding the operations, financial condition and prospects of the Beforepay Group. To the maximum extent permitted by law, no member of the Beforepay Group makes a representation or warranty, express or implied, as to the accuracy, completeness, timeliness or reliability of the contents of this announcement, nor accepts any liability (including, without limitation, any liability arising from fault or negligence) for any loss whatsoever arising from the use of this announcement or its contents or otherwise arising in connection with it.

This announcement includes information regarding past performance of Beforepay Group and investors should be aware that past performance is not and should not be relied upon as being indicative of future performance. Investors should note that certain financial data included in this announcement is not recognised under the Australian Accounting Standards and is classified as ‘non-IFRS financial information’ under ASIC Regulatory Guide 230 ‘Disclosing non-IFRS financial information’ (‘RG 230’). Beforepay Group considers that non-IFRS information provides useful information to users in measuring the financial performance and position of the Beforepay Group. The non-IFRS financial measures do not have standardized meanings under Australian Accounting Standards and therefore may not be comparable to similarly titled measures determined in accordance with Australian Accounting Standards. Readers are cautioned therefore not to place undue reliance on any non-IFRS financial information and ratios in this announcement.

kasey kaplan

Beforepay

mediaenquiries@beforepay.com.au

Visit us on social media:

Facebook

LinkedIn

Instagram

![]()