O'Connor has seen a remarkable rise in Batavia Township property values, which increased by 10% in 2024.

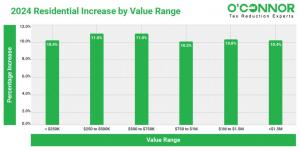

CHICAGO, IL, UNITED STATES, November 5, 2024 /EINPresswire.com/ -- Market Values up for Batavia HomesBatavia Township, Kane County homes witnessed a moderate in 2024 as each value range grew. The residential property market in Batavia Township increased by 10.9%, from $4 billion in 2023 to $4.4 billion in 2024. Properties priced between $250k and $500k, as well as $500k and $750k, had the greatest 11% gain in value. Property prices ranging from $1 million to $1.5 million climbed significantly by 10.8%.

Batavia Commercial Property Increases

The value of commercial property in Batavia Township saw a modest increase in percentage of 10.5% by 2024. Commercial properties in the timeframe of 2023 to 2024 experienced a range of value increases, from 7% to 11%. A modest 8.2% increase was observed in properties priced below $250k. The growth rate for commercial property owners with properties valued between $1 million and $1.5 million was 9.8%. There was an 8.6% increase in the value of properties priced between $750k and $1 million.

What Can Property Owners Do?

According to the graphs, the value of the assessment for Batavia Township, which is located in Kane County, Illinois, has significantly grown. In order to increase chances of receiving a decrease in property taxes, residents in Kane County should first look into exemptions before appealing their assessment value. O’Connor will work to simplify the process and make it more efficient. To guarantee tax reduction and unequal appraisal claims backed by the most persuasive evidence, O’Connor collaborates with top property tax professionals. To reduce the amount of property taxes that their clients are required to pay, O’Connor and his property tax attorneys investigate every possible avenue.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.