Bancorp 34, Inc. (OTCQB:BCTF)

The strength of the loan growth we have experienced over the last six months has provided core revenue that has helped replace the one-time PPP loan income realized in 2021.”

SCOTTSDALE, ARIZONA, UNITED STATES, July 18, 2022 /EINPresswire.com/ -- Bancorp 34, Inc. (OTCQB: BCTF), the parent company for Bank 34, reports second quarter performance and announces quarterly dividend. — Jim Crotty, President and Chief Executive Officer of Bancorp, 34

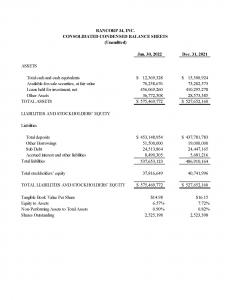

Bancorp 34, Inc. reported net income and diluted EPS for the quarter ended June 30, 2022, of $1.2 million and $0.51, respectively, compared with $1.1 million and $0.35 for the same period in 2021. The Company reported consolidated total assets of $575.5 million, up from $527.7 million as of December 31, 2021.

Balance sheet growth continues to be centered in the loan portfolio as net total loans grew $45.8 million during the first half of the year. Provisions provided to the Allowance for Loan and Lease Losses totaling $655,000 were to support the loan portfolio’s growth as the credit quality of the portfolio remains strong. Total stockholders' equity declined slightly in the second quarter due to mark-to-market adjustments on the Company’s investment portfolio resulting from increases in interest rates. As a result, tangible book value per share was $14.98 as of June 30, 2022.

Commenting on the quarter Jim Crotty, President and Chief Executive Officer of Bancorp 34, stated “The strength of the loan growth we have experienced over the last six months has provided core revenue that has helped replace the one-time PPP loan income realized in 2021. We remain focused on enhancing shareholder value as we navigate a rapidly changing economy and rate environment.”

The Company’s Board of Directors approved a quarterly cash dividend of $0.07 per share of common stock, payable on August 26, 2022, to shareholders of record as of the close of business on August 12, 2022.

ABOUT BANCORP 34, INC. - Bank 34 has four full-service community bank branches, one each in Otero and Dona Ana Counties in the cities of Alamogordo and Las Cruces in southern New Mexico and two in Maricopa County, Arizona in the cities of Scottsdale and Peoria.

FORWARD-LOOKING STATEMENTS - Certain statements herein constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by words such as “believes,” “will,” “expects,” “project,” “may,” “could,” “developments,” “strategic,” “launching,” “opportunities,” “anticipates,” “estimates,” “intends,” “plans,” “targets” and similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to, general economic conditions, changes in interest rates, the effects of any health pandemic, regulatory considerations, competition and the other risks. Further, given the ongoing and dynamic nature of the COVID-19 outbreak, it is difficult to predict the impact on our business which will depend on highly uncertain future developments including when the coronavirus can be controlled and abated and when and how the economy may be reopened or remain open. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update any of these statements in light of new information, future events or otherwise unless required under federal securities laws.

Kevin Vaughn

Bancorp 34, Inc.

+1 6233346202

BCTF@Bank34.com

Visit us on social media:

Facebook

LinkedIn