baby powder market is expected to grow from USD 1.4 billion in 2023 to USD 2.5 billion by 2033, with a CAGR of 6.1% from 2024 to 2033

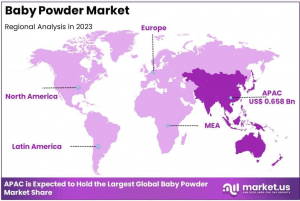

Asia-Pacific dominates the global baby powder market with a 47% share, valued at USD 0.658 billion in 2023. Get up to 30% off – Buy Now!”

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- **Report Overview**— Tajammul Pangarkar

The Global Baby Powder Market is projected to reach USD 2.5 billion by 2033, up from USD 1.4 billion in 2023, growing at a CAGR of 6.1% from 2024 to 2033.

Baby powder is a fine, typically talc-based or cornstarch-based powder, widely used for personal hygiene, primarily in infants. It is applied to the skin to prevent irritation, diaper rash, and to absorb excess moisture. The product's key ingredients, talc and cornstarch, provide soothing properties and have been staples in baby care for decades. Baby powder is also commonly used in cosmetic and adult personal care products due to its moisture-absorbing and softening qualities. Over the years, alternative formulations have emerged to address safety concerns, especially regarding talc’s potential association with health risks.

The baby powder market refers to the global industry encompassing the production, distribution, and sales of baby powder products. It includes both traditional powder-based products as well as newer alternatives. The market has expanded as consumer awareness of personal care and safety issues has led to shifts in product demand. Regulatory changes and the growing preference for natural, organic ingredients are reshaping the competitive landscape.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/baby-powder-market/request-sample/

Key growth factors include increasing parental awareness of infant care, the rise of disposable diapers, and the growing preference for personal hygiene products that are safe and dermatologically tested. The demand for baby powder is also influenced by factors such as rising disposable incomes and urbanization, which drive higher consumption in emerging markets.

Opportunities in the market lie in the growing trend of organic and natural products, as well as in expanding product lines for adults, particularly in skincare and body care. Companies that innovate around safety, sustainability, and skin-friendly ingredients are well-positioned to capture an evolving consumer base.

**Key Takeaways**

~~ The global baby powder market is projected to grow from USD 1.4 billion in 2023 to USD 2.5 billion by 2033, with a CAGR of 6.1% during the forecast period (2024-2033).

~~ Talc-free baby powder dominates the market, accounting for over 65% of the share in 2023, driven by a shift towards health-conscious consumer preferences.

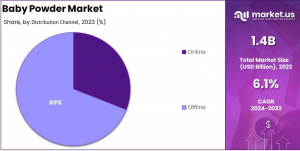

~~ Offline distribution channels lead the market with a 69% share, favored for their accessibility and immediate product availability.

~~ The Asia-Pacific region holds the largest market share at 47%, fueled by high birth rates and rising disposable incomes in populous countries.

**Market Segmentation**

In 2023, talc-free baby powder dominated the market with over 65% share, driven by increasing consumer awareness of health risks linked to talc-based products and a growing demand for natural, hypoallergenic alternatives. Formulated with ingredients like cornstarch, talc-free powders are seen as safer for infant skin, aligning with the shift towards cleaner, sustainable personal care. Meanwhile, talc-based baby powder saw a decline, dropping to under 35% of the market due to concerns over health risks like respiratory issues and cancer. However, it remains relevant in markets where price and availability are key, with manufacturers innovating to improve safety and appeal

In 2023, the offline distribution channel dominated the baby powder market, holding over 69% of the total share. Traditional retail outlets like supermarkets, hypermarkets, and pharmacies offer benefits such as instant product availability, tactile evaluation, and personalized shopping experiences, making them popular among parents. The widespread presence of these stores in both urban and rural areas, along with in-store promotions, further strengthens their dominance. The online distribution channel, while representing under 31% of the market share in 2023, is growing rapidly due to increased internet access and the convenience of home delivery. E-commerce platforms offer competitive pricing, a wide range of options, and product reviews, attracting tech-savvy and time-constrained consumers.

**Key Market Segments**

Key Market Segments

By Product

~~ Talc-based

~~ Talc-free

By Distribution Channel

~~ Online

~~ Offline

**Driving factors**

Rising Awareness of Infant Health and Hygiene

The global baby powder market is being driven by increasing awareness about infant health and hygiene. Parents today are more conscious of the products they use on their babies, particularly regarding skin health. Baby powder, known for its ability to keep babies dry and prevent rashes, is a preferred product in many households. Enhanced by a growing focus on infant well-being, the demand for powders that are safe, natural, and free from harmful chemicals is propelling the market forward.

The rise of health-conscious consumerism, coupled with growing awareness of skin sensitivity, is contributing to an uptick in product sales. As more parents turn to trusted, dermatologically-tested powders, the market is expanding, with projections showing significant growth in the coming years. The ongoing shift towards organic and hypoallergenic baby care products is further driving the demand, with many consumers opting for talc-free formulations that offer greater peace of mind regarding their child’s safety.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=26813

**Restraining Factors**

Safety Concerns Over Talc-Based Products

A significant restraint on the baby powder market is the ongoing safety concerns surrounding talc-based products. Talc, historically used in many baby powders, has been associated with potential health risks, including links to respiratory issues and, in extreme cases, cancer. As a result, these concerns have led to a decline in consumer confidence and sales, with many parents opting for alternatives that are perceived as safer. Regulatory scrutiny over talc-based products, along with growing litigation cases, has caused many manufacturers to shift towards non-talc formulas, further limiting the use of traditional baby powders. The stigma surrounding talc is expected to persist, limiting market growth in regions where these concerns are more pronounced.

**Growth Opportunity**

Growing Demand for Organic and Natural Products

The growing demand for organic and natural products presents a significant opportunity for expansion within the baby powder market. Parents are increasingly looking for products that are not only effective but also free from artificial chemicals and fragrances. Organic baby powders, often made from ingredients like cornstarch, rice powder, and clay, are seeing a surge in popularity due to their gentle, safe, and eco-friendly profiles. This shift towards organic alternatives offers brands a chance to differentiate themselves in a competitive market. With rising health consciousness and environmental awareness, manufacturers can capitalize on this trend by developing clean-label products that appeal to parents seeking the best for their infants while minimizing their environmental impact.

**Latest Trends**

Rise of Talc-Free and Hypoallergenic Formulations

One of the prominent trends in the baby powder market is the shift towards talc-free and hypoallergenic formulations. This trend is driven by growing safety concerns surrounding talc, coupled with heightened consumer demand for products that are gentle on sensitive baby skin. Talc-free powders, made from alternative ingredients such as cornstarch or plant-based extracts, are gaining traction as safer, more reliable options for infant care. This shift aligns with the broader movement towards hypoallergenic, dermatologically-tested, and cruelty-free products that offer peace of mind to parents. As concerns over ingredient safety continue to rise, the baby powder market is increasingly leaning towards these new formulations to meet consumer preferences and regulatory standards.

**Regional Analysis**

Asia-Pacific Baby Powder Market with Largest Market Share (47% in 2023)

The Asia-Pacific region dominates the global baby powder market, accounting for 47% of the market share in 2023, with a market value of USD 0.658 billion. This robust growth is primarily driven by the high birth rate, increasing consumer awareness about infant care products, and rising disposable income in key countries such as China, India, and Japan. Additionally, the growing preference for natural and organic baby care products in this region supports market expansion. The presence of major manufacturers and an expanding retail network further bolster the regional market's dominance.

In North America, the market is experiencing steady growth due to high product penetration and strong demand for premium baby care products. However, the region is expected to maintain a smaller market share in comparison to Asia-Pacific. Europe also exhibits a moderate growth trajectory, with increasing preference for safe and hypoallergenic baby products. The Middle East & Africa and Latin America regions are experiencing gradual market growth, driven by improving economic conditions and rising birth rates in countries like Brazil and South Africa, yet they continue to represent smaller shares of the global market.

Asia-Pacific remains the largest and most significant market for baby powder, contributing significantly to the global revenue in 2023.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, key players in the global baby powder market are actively shaping the industry through product innovation, strategic acquisitions, and a focus on safety and sustainability. Johnson & Johnson remains a dominant force, leveraging its trusted brand and extensive distribution networks. However, the company faces increasing pressure due to safety concerns over talc-based products, pushing them to introduce alternative formulations. Procter & Gamble continues to expand its market share with its high-quality baby care products, while Kimberly-Clark emphasizes sustainability with eco-friendly baby powder options.

Brands like California Baby and Himalaya Wellness have carved a niche by offering natural, organic baby powder alternatives that appeal to health-conscious parents. Emerging players such as Baby Forest and GLUKi Organics are also gaining traction, particularly in the eco-conscious market segment. Additionally, Church & Dwight and Clorox are focusing on product diversification, while Pigeon and Prestige Consumer Healthcare are enhancing their global reach to cater to evolving consumer needs.

Top Key Players in the Market

~~ Baby Forest

~~ California Baby

~~ Church & Dwight

~~ Clorox

~~ Cooney Medical

~~ GLUKi Organics

~~ Himalaya Wellness

~~ Johnson & Johnson

~~ Kimberly-Clark

~~ Pigeon

~~ Prestige Consumer Healthcare

~~ Procter & Gamble

**Recent Developments**

~~ In 2024, Johnson & Johnson announced that its subsidiary, Red River Talc LLC, filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Southern District of Texas. The filing aims to resolve all current and future ovarian cancer claims related to talc litigation in the U.S.

~~ In 2024, Unilever Ventures invested over £2 million in Luna Daily, an intimate body care brand, bringing the brand’s total raised to £4.7 million. This highlights the growth potential in the intimate care sector.

~~ In 2024, Reckitt Benckiser Group Plc outlined plans to streamline its operations and refine its brand portfolio. This initiative is designed to strengthen the company’s position in consumer health and hygiene and deliver long-term shareholder value.

~~ In 2024, FirstCry, a leading Indian baby products retailer, attracted $3.4 billion in bids for its $501 million IPO. The strong response reflects growing investor interest in India’s expanding child care market.

**Conclusion**

The global baby powder market is set to experience significant growth, reaching USD 2.5 billion by 2033, driven by increasing parental awareness of infant health, a rising preference for talc-free and organic products, and a growing demand for safe, dermatologically tested formulations. The Asia-Pacific region will continue to dominate, accounting for nearly half of the global market share. While safety concerns over talc-based products present challenges, opportunities in organic and natural alternatives are providing companies with a competitive edge. Key players like Johnson & Johnson, Procter & Gamble, and emerging brands such as California Baby are capitalizing on these trends, innovating around safety, sustainability, and consumer demand for cleaner, more eco-friendly options.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.