The Application Performance Monitoring Market is expanding as businesses adopt APM solutions to ensure optimal app performance, user experience, and reliability

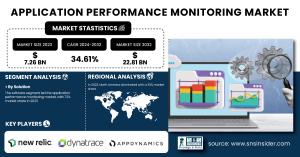

AUSTIN, TX, UNITED STATES, February 13, 2025 /EINPresswire.com/ -- The Application Performance Monitoring Market was valued at USD 7.26 billion in 2023 and is expected to reach USD 22.81 billion by 2032, growing at a CAGR of 34.61% over the forecast period of 2024-2032. The growth factors are regional adoption rates, usage metrics, regulatory and compliance considerations, and cost metrics. It is driven by increasing demand from the industries to optimize application performance, ensure regulatory compliance, and improve cost efficiency for APM solutions, thus improving user experience and business operations.Get Sample Copy of Report: https://www.snsinsider.com/sample-request/3821

Keyplayers:

IBM (IBM Instana, IBM APM)

New Relic (New Relic One, New Relic Browser)

Dynatrace (Dynatrace Full-Stack Monitoring, Dynatrace Application Security)

AppDynamics (AppDynamics APM, AppDynamics Database Monitoring)

Cisco (Cisco AppDynamics, Cisco ACI Analytics)

Splunk Inc. (Splunk Observability Cloud, Splunk IT Service Intelligence)

Micro Focus (Silk Central, LoadRunner)

Broadcom Inc. (CA APM, CA Application Delivery Analysis)

Elastic Search B.V. (Elastic APM, Elastic Stack)

Datadog (Datadog APM, Datadog Real User Monitoring)

Riverbed Technology (SteelCentral APM, SteelHead)

SolarWinds (SolarWinds APM, SolarWinds Network Performance Monitor)

Oracle (Oracle Management Cloud, Oracle Cloud Infrastructure APM)

ServiceNow (ServiceNow APM, ServiceNow Performance Analytics)

Red Hat (Red Hat OpenShift Monitoring, Red Hat Insights)

AppOptics (AppOptics APM, AppOptics Infrastructure Monitoring)

Honeycomb (Honeycomb APM, Honeycomb Distributed Tracing)

Instana (Instana APM, Instana Real User Monitoring)

Scout APM (Scout APM, Scout Error Tracking)

Sentry (Sentry APM, Sentry Error Tracking)

By Solution, Software Leads the Application Performance Monitoring Market, Services Segment to Experience Fastest Growth

In 2023, the software segment led the application performance monitoring market with a 72% share. It provided monitoring, detection, and resolution tools for performance issues. These include key players like Dynatrace, AppDynamics, and New Relic, catering to industries like e-commerce and financial services. The service segment is forecasted to witness the highest growth from 2024 to 2032 because of the sophistication of IT infrastructure. Companies like IBM Services and Accenture help businesses optimize the deployment and performance of APM, especially in finance and healthcare sectors.

By Deployment, On-Premise Leads Application Performance Monitoring Market, Cloud Segment to Experience Fastest Growth

The on-premise segment dominated the APM market in 2023 with a 58% share, widely preferred due to its robust security, control, and compliance features. On-premise solutions of finance, healthcare, and government need full data control, meet strict regulatory demands, and ensure privacy. The cloud segment is projected to be the fastest growing between 2024 and 2032, with the help of on-demand scalability, cost-effectiveness, and real-time monitoring. Cloud APM solutions are used for global monitoring, fast deployment, and are widely adopted by e-commerce, SaaS, and media streaming companies.

Enquiry Before Buy: https://www.snsinsider.com/enquiry/3821

By Enterprise Size, Large Enterprises Lead Application Performance Monitoring Market, While SMEs Set to Experience Fastest Growth

Large enterprises have dominated the application performance monitoring market because their IT infrastructures are complex, in large-scale operations, and have high application reliability demands. Companies in this segment require solid APM solutions to monitor critical business applications, optimize performance, and ensure regulatory compliance. Expectation of CAGR for SME's segment: This segment is expected to grow at the fastest CAGR from 2024 to 2032 driven by the increasing adoption of cloud-based APM solutions. Small businesses are using inexpensive, scalable APM tools to improve application performance, enhance the customer experience, and fuel digital growth.

By Access Type, Web APM Dominates Application Performance Monitoring Market, Driven by Demand for Real-Time Insights and Optimized User Experiences

Web APM dominates the application performance monitoring market due to its ability to monitor and optimize web-based applications in real time. As businesses increasingly rely on digital platforms, web APM solutions provide critical insights into user experience, application speed, and performance issues. The growing demand for seamless online experiences and e-commerce has driven the adoption of web APM, allowing organizations to improve customer satisfaction and minimize downtime, enhancing overall digital service delivery.

By End User, IT and Telecommunications Lead APM Market, Driven by Complex Systems and Demand for Continuous Performance Optimization

IT and Telecommunications dominate the application performance monitoring market due to their reliance on complex, mission-critical applications that require continuous monitoring for optimal performance. These industries face high user expectations and regulatory pressures, making reliable APM tools essential for managing large-scale systems, ensuring uptime, and delivering superior service quality. As digital transformation accelerates and customer demands grow, APM solutions help IT and telecommunications companies address performance issues swiftly, reduce downtime, and maintain seamless operations, fostering greater customer satisfaction and business efficiency.

North America Leads Application Performance Monitoring Market, APAC Set for Fastest Growth

In 2023, North America dominated the application performance monitoring market with a 33% share, as the adoption of cloud computing, DevOps practices, and digital transformation across various industries such as IT, healthcare, and finance are widespread. The key players involved in providing solutions to monitor and optimize business applications in this region include Dynatrace, New Relic, and AppDynamics.

APAC is expected to be the fastest-growing region in the APM market from 2024 to 2032. For their digital services improvement and increasing demand for enhanced customer satisfaction, APM solutions from e-commerce to manufacturing are fast being adopted within the APAC region. Firms such as Huawei, Alibaba Cloud, and Infosys deploy APM instruments to make improvement in the APAC region for performance optimization.

Access Complete Report: https://www.snsinsider.com/reports/application-performance-monitoring-market-3821

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Jagney Dave

SNS Insider Pvt. Ltd

+1 315 636 4242

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.