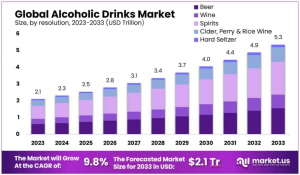

Alcoholic Drinks Market is expected to reach a value of USD 5.3 Trillion by 2033, up from USD 2.1 Trillion in 2023.

In 2023, the Asia Pacific region is dominate the market with a 38.2% share, with a value of USD 798 Billion.

”

NEW YORK, NY, UNITED STATES, February 3, 2025 /EINPresswire.com/ -- Alcoholic Drinks Market Overview— Tajammul Pangarkar

The global alcoholic drinks market is set to expand significantly, with an anticipated growth from USD 2.1 trillion in 2023 to USD 5.3 trillion by 2033, at a CAGR of 9.8%. This market encompasses a variety of alcoholic beverages such as beer, wine, spirits, cider, perry, rice wine, and hard seltzer. The rise in consumption, particularly of premium and craft varieties, is driven by evolving consumer preferences, increased disposable income, and a growing trend toward socializing and entertainment activities like dining out.

The industry's growth is further fueled by innovative flavors and healthier drink options, alongside a shift from traditional distribution methods towards online and direct-to-consumer sales platforms. Regional expansion, especially in the Asia-Pacific area, is evident, reflecting cultural shifts and rising consumer purchasing power. Key distribution channels include pubs, bars, restaurants, liquor stores, supermarkets, and online platforms, each responding to changing consumer behaviors. Spirits dominate the market share, bolstered by the increasing appeal of premium products.

👉 Request a free sample PDF report for valuable insights: https://market.us/report/alcoholic-drinks-market/request-sample/

Key Takeaways

• The Global Alcoholic Drinks Market is expected to reach a value of USD 5.3 Trillion by 2033, up from USD 2.1 Trillion in 2023.

• The market is projected to grow at a CAGR of 9.8% during the forecast period from 2023 to 2033.

• These beverages are categorized into three main types: beers, wines, and spirits, typically having alcohol content ranging from 3% to 50%.

• Spirits hold the dominant market share, accounting for over 36.5% of the market.

• Liquor stores dominate distribution channels, capturing over 27.5% of the market.

• In 2023, the Asia Pacific region is dominate the market with a 38.2% share, with a value of USD 798 Billion.

Experts Review

Government incentives and technological innovations are pivotal drivers in the alcoholic drinks market. Regulatory frameworks globally are evolving to accommodate new consumption trends and technological advancements. Countries are offering incentives to support brewing and distillation industries, promoting local manufacturing and employment. Technological innovations are reshaping production processes, enabling enhanced flavor profiles and sustainable practices.

Investment opportunities are significant, with a focus on artisanal spirits and premium products, though risks include rising health awareness and regulatory challenges. Consumer awareness is growing alongside societal shifts towards healthier lifestyles, posing potential risks. Technological impact is notable in distribution, with online sales platforms gaining traction. The regulatory environment remains complex, with variations across regions impacting business strategies and compliance costs.

Report Segmentation

The alcoholic drinks market is segmented by type and distribution channel. By type, it includes beer, wine, spirits, cider, perry, rice wine, and hard seltzer. Each segment showcases distinct consumer tendencies, with spirits leading the charge due to a preference for premium and innovative flavors. Beers see continual innovation with craft varieties, while wines benefit from their health perceptions. Cider and perry offer alternatives with unique flavors, and hard seltzer is rising rapidly, especially in Western markets.

Distribution channels comprise pubs, bars, and restaurants; liquor stores; supermarkets; online platforms; and others. This segmentation reflects varied consumer purchasing behaviors, with each channel adapting to trends such as convenience and digital integration. Traditional liquor stores maintain a stronghold due to variety and accessibility, while pubs and bars drive social consumption.

Key Market Segments

By Type

• Beer

• Wine

• Spirits

• Cider, Perry & Rice Wine

• Hard Seltzer

By Distribution Channel

• Pub, Bars & Restaurants

• Liquor Stores

• Supermarkets

• Online

• Others

👉 Buy Now to access the full report: https://market.us/purchase-report/?report_id=32203

Drivers, Restraints, Challenges, and Opportunities

The market is driven by increased consumption among young adults and the growth of wineries and breweries, offering diverse choices. Restraints include the rising popularity of non-alcoholic beverages as health consciousness rises. Challenges involve navigating health concerns and regulatory hurdles, which require substantial compliance efforts and capital investment. Opportunities lie in the increasing demand for artisanal spirits and the growth of online sales, providing new avenues for consumer engagement.

Innovations in flavor and packaging also present opportunities to capture niche markets and respond to evolving consumer preferences. However, the industry must address challenges related to health impact perceptions and ensure adherence to regulatory standards that vary widely by region.

Key Player Analysis

Major players in the alcoholic drinks market include Diageo Plc, Anheuser-Busch InBev, Heineken N.V., and Bacardi Limited, among others. These companies hold significant market shares through strategic partnerships, mergers, and acquisitions. Diageo's craft whisky initiatives and Anheuser-Busch's expansion in premium segments exemplify efforts to capture emerging market dynamics. Innovation and sustainability are key focuses, with many players investing in eco-friendly practices and community engagement. The competitive landscape is marked by a push for differentiation through unique flavor profiles and enhanced consumer experiences, often facilitated by digital platforms.

Key Market Players

• Bacardi Limited

• Carlsberg A/S

• Anheuser-Busch InBev SA/NV

• Beam Suntory Inc.

• Diageo Plc

• Constellation Brands Inc.

• United Spirits Ltd.

• Molson Coors Brewing Co.

• Heineken N.V.

• Pernod Ricard SA

• Brown-Forman Corporation

• Kirin Holdings Company, Limited

• Asahi Group Holdings, Ltd.

• Thai Beverage Public Company Limited

• Boston Beer Company

• Moutai

• LVMH Moët Hennessy Louis Vuitton SE

• Other Key Players

Recent Developments

Recent industry developments include Diageo's acquisition of Seedlip, emphasizing non-alcoholic spirits, and Constellation Brands' full acquisition of Bruichladdich Distillery, expanding its high-end offerings. The rise of canned cocktails and direct-to-consumer sales channels highlights shifting consumer preferences for convenience and personalized experiences. Functional beverages incorporating ingredients like CBD are gaining traction among health-conscious consumers. Additionally, companies are committing to sustainable practices, such as Heineken's pledge to utilize 100% renewable energy by 2030 and Bacardi's development of biodegradable packaging. The trend toward premiumization continues as consumers increasingly value high-quality and artisanal products.

Conclusion

The global alcoholic drinks market is on a robust growth trajectory, driven by innovation, consumer trends towards premiumization, and expansion in emerging markets. While opportunities abound, the industry faces significant challenges from health concerns and regulatory complexities. Adaptation to consumer demands, enhanced distribution channels, and sustainable practices are crucial for stakeholders aiming to capture market share and ensure long-term growth. Strategic collaborations, technological advancements, and a focus on diverse product portfolios will remain key to sustaining competitive advantage in this dynamic industry landscape.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.