Artificial Intelligence (AI) in Insurance Market Research Report By Offerings, Deployment Model, Technology, Enterprise Size, End Users, Application, and Region

Growing trend of personalized insurance services”

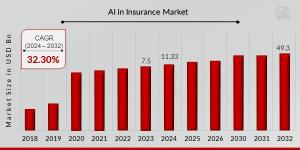

CA, UNITED STATES, January 10, 2025 /EINPresswire.com/ -- The global Artificial Intelligence (AI) in insurance market has seen impressive growth and is set for significant expansion in the coming years. In 2023, the market was valued at USD 7.5 billion and is projected to grow from USD 11.33 billion in 2024 to an estimated USD 49.3 billion by 2032, reflecting an extraordinary compound annual growth rate (CAGR) of 32.30% during the forecast period (2024–2032). This growth is driven by the increasing adoption of AI technology in the insurance sector to enhance operational efficiency, customer experience, and data-driven decision-making.— Market Research Future

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐀𝐈 𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

• Applied Systems

• Cape Analytics

• OpenText Corporation

• IBM Corporation

• Oracle Corporation

• Pegasystems Inc

• Quantemplate

• Microsoft Corporation

• Salesforce, Inc

• SAP SE

• SAS Institute Inc

• Shift Technology

• SimpleFinance

• Slice Insurance Technologies

• Vertafore, Inc

• Zego

• Zurich Insurance Group Ltd

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 - https://www.marketresearchfuture.com/sample_request/8465

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

➤ Automation and Efficiency Improvements

Insurance companies are increasingly turning to AI to automate various tasks such as claims processing, underwriting, and fraud detection. By leveraging AI-powered systems, insurers can reduce human intervention, increase processing speed, and improve accuracy, leading to cost savings and enhanced operational efficiency.

➤ Data Analytics and Predictive Modeling

AI's ability to analyze vast amounts of data quickly allows insurance companies to assess risks more accurately and predict future trends. AI-powered predictive analytics help insurers make informed decisions about pricing, underwriting, and claims management, offering a competitive edge in the market.

➤ Fraud Detection and Prevention

AI plays a key role in detecting fraudulent activities in the insurance industry. Machine learning algorithms are used to identify unusual patterns and behaviors that may indicate fraud, reducing losses and ensuring the integrity of claims processes.

➤ Improved Customer Experience

AI technologies, such as chatbots and virtual assistants, are revolutionizing the way insurers interact with their customers. By providing 24/7 assistance, personalized recommendations, and quick responses, AI enhances customer satisfaction, leading to greater retention and customer loyalty.

➤ Cost Reduction and Risk Management

AI helps insurers identify and manage risks more effectively, minimizing losses due to claims and helping to optimize pricing strategies. With AI, insurers can streamline operations and reduce costs, improving their bottom line while maintaining competitive pricing for policyholders.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.marketresearchfuture.com/reports/ai-in-insurance-market-8465

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

To provide a detailed understanding, the AI in insurance market is segmented based on technology, application, region, and other key factors.

1. By Technology:

o Machine Learning (ML): ML algorithms are used to automate decision-making, improve underwriting processes, and optimize claims handling.

o Natural Language Processing (NLP): NLP is employed for chatbots, virtual assistants, and claims processing automation, helping insurers to understand and respond to customer queries efficiently.

o Robotic Process Automation (RPA): RPA is used to automate repetitive tasks, increasing speed and reducing errors in insurance operations.

o Computer Vision: This technology is used for claims processing, particularly in areas like vehicle damage assessment, medical claims, and property damage evaluation.

2. By Application:

o Claims Processing: AI is used to automate claims processing, reducing the time taken to evaluate and approve claims, and ensuring faster resolution for policyholders.

o Underwriting: AI helps insurance companies assess risk more accurately by analyzing historical data and identifying potential risks, leading to more precise underwriting decisions.

o Fraud Detection: Machine learning algorithms analyze patterns in claims data to identify anomalies and potential fraud, protecting both insurers and policyholders from financial losses.

o Customer Service and Support: AI-powered chatbots and virtual assistants improve customer engagement by providing real-time support, answering queries, and offering personalized recommendations.

3. By End-User Industry:

o Life Insurance: AI is transforming the life insurance sector by improving risk assessment, streamlining policy issuance, and enhancing customer service.

o Health Insurance: AI technologies help in claims processing, fraud detection, and personalized recommendations for policyholders, improving efficiency and service delivery.

o Automobile Insurance: AI is used for claims assessment, damage detection, and pricing optimization in the automobile insurance industry.

o Property and Casualty Insurance: AI helps assess risks, handle claims, and provide tailored policies for property and casualty insurance.

4. By Region:

o North America: North America leads the market due to the high adoption of AI technologies by insurance companies in the region. The U.S. and Canada are at the forefront of AI-driven innovations in the insurance industry.

o Europe: The European market is also growing rapidly, driven by increased regulatory pressure and the adoption of AI for better risk management and customer engagement.

o Asia-Pacific: The Asia-Pacific region is expected to witness the highest growth during the forecast period, fueled by digital transformation in countries like China, India, and Japan.

o Rest of the World (RoW): AI adoption in the Middle East, Latin America, and Africa is on the rise, with an increasing focus on improving operational efficiency and customer satisfaction.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8465

The AI in insurance market is experiencing rapid growth, driven by increasing automation, data analytics, and technological advancements. With AI revolutionizing the way insurance companies handle underwriting, claims processing, fraud detection, and customer service, the sector is poised for tremendous transformation. As insurers seek to enhance operational efficiency, reduce costs, and offer personalized services to customers. As the demand for innovative, AI-powered solutions continues to rise, the AI in insurance market is set to play a crucial role in shaping the future of the global insurance industry.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

Business Insurance Market

Peer Analysis Market

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.