Discover how accounting outsourcing firms New York help businesses stay compliant, reduce risks, and drive financial growth.

Outsourcing accounting is not just about cost savings—it’s a strategic move to ensure compliance, minimize risks, and drive growth while optimizing operations for long-term success.”

MIAMI, FL, UNITED STATES, March 15, 2025 /EINPresswire.com/ -- Businesses are increasingly turning to accounting outsourcing firms New York to navigate complex regulations and maintain compliance. As state and federal requirements evolve, small and mid-sized enterprises (SMEs) face growing challenges in meeting financial reporting standards. Outsourcing provides specialized expertise, streamline processes, and reduces risks, allowing businesses to focus on growth. This strategic approach supports financial transparency and long-term stability in a competitive market. — Ajay Mehta , CEO of IBN Technologies

Optimize your finance partner with top New York accounting experts! Click here

As regulatory demands intensify, the growing complexity of tax laws, financial reporting requirements, and compliance mandates has led to a surge in demand for outsourced accounting services. In New York’s highly competitive business environment, enforcement has become stricter, increasing pressure on companies to maintain financial transparency. Businesses that fail to comply face significant penalties, legal challenges, and reputational risks.

"Accounting outsourcing firms New York are empowering businesses with expert financial management," said Ajay Mehta, CEO of IBN Technologies. "Outsourcing accounting is not just about cost savings—it’s a strategic move to ensure compliance, minimize risks, and drive growth while optimizing operations for long-term success."

To navigate these challenges, many companies are turning to accounting outsourcing firms in New York for expert financial management. These firms provide comprehensive services, including bookkeeping, payroll, tax preparation, financial reporting, accounts receivable and payable management, CFO advisory, financial planning, and compliance auditing. By outsourcing, businesses gain access to specialized professionals who ensure accuracy, efficiency, and adherence to evolving regulations.

Significantly, the rise in technological advancements has further accelerated the demand for outsourced accounting services. Cloud-based accounting platforms and automated reporting tools now provide real-time financial insights, minimize manual errors, and enhance decision-making. These innovations not only improve efficiency but also ensure financial transparency and regulatory alignment.

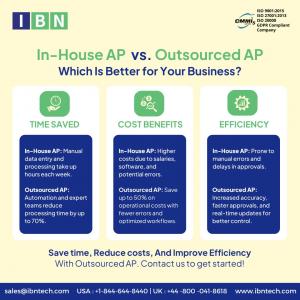

Industry experts emphasize that outsourcing is no longer solely about compliance. Businesses are increasingly engaging external accounting firms to access high-level financial expertise without the cost of maintaining in-house teams. For SMEs, this shift is particularly strategic, offering the financial management capabilities of larger corporations without the expense of full-time staff.

Get a free 30-minute bookkeeping consultation—streamline your finances now!

https://www.ibntech.com/free-consultation/?pr=EIN

"Accounting outsourcing firms in New York are helping businesses streamline financial operations," said Ajay Mehta, CEO of IBN Technologies. "Outsourcing empowers SMEs with top-tier financial expertise, ensuring compliance and growth without the cost of in-house teams."

Recognizing the strategic benefits, businesses in New York are increasingly turning to outsourced accounting services to enhance financial management. Beyond compliance and cost savings, outsourcing offers scalability, enabling companies to adjust financial support as they expand. This flexibility is particularly valuable in an unpredictable economic climate, where businesses must navigate shifting financial conditions while maintaining efficiency.

Industry analysts highlight that outsourcing allows companies to reallocate internal resources toward innovation and growth. With financial experts handling compliance and reporting, business leaders can focus on strategic planning, customer engagement, and overall expansion. This shift not only optimizes operations but also strengthens long-term business resilience.

Amid rising regulatory scrutiny, accounting outsourcing firms New York are expected to play an increasingly vital role in ensuring compliance and financial stability. As businesses seek cost-effective, technology-driven financial solutions, the trend toward outsourcing is poised to accelerate, reshaping the financial management landscape.

Get a custom quote—find the best outsourced accounting solutions!

https://www.ibntech.com/pricing/?pr=EIN

Businesses that embrace outsourced accounting services gain a competitive edge by reducing financial risks, improving efficiency, and ensuring compliance with evolving regulations. As demand for specialized financial expertise grows, IBN Technologies has emerged as a key player in strengthening the role of accounting outsourcing firms in New York. By offering customized financial management solutions, the company helps businesses navigate complex regulatory landscapes while optimizing their accounting operations.

IBN Technologies is redefining financial management for businesses across New York by equipping accounting outsourcing firms in New York with the expertise and technology needed to ensure accuracy, compliance, and efficiency. By streamlining bookkeeping, payroll, and financial reporting, the company helps businesses navigate regulatory changes while optimizing operations. With scalable solutions and a team of skilled professionals, IBN Technologies enables companies to mitigate risks, enhance productivity, and drive long-term growth in a competitive market.

Related Services:

1) Catch-up Bookkeeping/ Year End Bookkeeping Services

https://www.ibntech.com/ebook/catch-up-bookkeeping-guide-for-financial-and-tax-success/?pr=EIN

2) AP/AR Management

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EIN

3) Tax Preparation and Support

https://www.ibntech.com/us-uk-tax-preparation-services/?pr=EIN

4) Payroll Processing

https://www.ibntech.com/payroll-processing/?pr=EIN

5) USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.