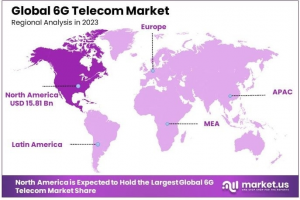

North America holds the dominant regional market share with 37.2%, attributed to early technology adoption and major industry players...

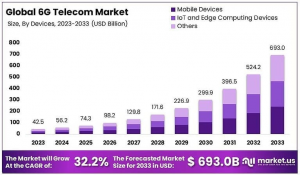

Mobile devices dominate the device segment with 34.3%, due to the increasing adoption of smartphones and tablets...”

NEW YORK, NY, UNITED STATES, February 24, 2025 /EINPresswire.com/ -- The 6G Telecom Market is projected to reach a substantial valuation of USD 693 billion by 2033, expanding from USD 42.5 billion in 2023. This growth, at a robust CAGR of 32.2%, underscores the transformative potential of 6G technology, set to eclipse the current capabilities of 5G. — Tajammul Pangarkar

6G aims to achieve unparalleled peak data rates of 1000 Gbps, enabling groundbreaking applications in areas such as autonomous driving, smart cities, and telemedicine, thus offering expansive connectivity solutions and fostering digital inclusivity by bridging gaps in underserved regions.

Key takeaways highlight mobile devices as the dominant device category, driven by the widespread use of smartphones and tablets, constituting 34.3% of the market. Wireless infrastructure leads with a 56.2% share, crucial for flexible and scalable network growth.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=125318

Terahertz Communication, a significant technological domain, commands 44.6% market dominance, benefiting from advancements in high-frequency data transmission.

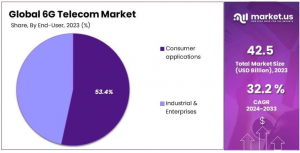

Furthermore, consumer applications represent the largest end-user segment, claiming 53.4% due to soaring demands for enhanced broadband services. North America captures the largest regional market share at 37.2%, propelled by early tech adoption and the presence of leading industry players. These factors collectively position the 6G market for expansive growth and innovative technological developments.

Experts Review

Government incentives and technological innovations are pivotal in accelerating 6G telecom market growth. Initiatives like the Next G Alliance in North America foster public-private partnerships, boosting research and positioning the region as a 6G leader. In China, significant government strategies, such as the 14th Five-Year Plan, underscore the importance of 6G in national security and economic competitiveness. Technologically, advancements in terahertz and vortex millimeter waves set new benchmarks for data transmission speeds, essential for 6G evolution.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/6g-telecom-market/free-sample/

Investment opportunities abound, driven by the demand for infrastructure and innovation. However, risks include high R&D costs and regulatory complexities. Extensive infrastructure requirements challenge rural expansions, potentially hampering growth.

Consumer awareness is increasing, with a growing understanding of 6G's potential in enhancing connectivity and digital services, though education on technical complexities remains necessary to drive widespread adoption.

The regulatory environment presents both challenges and opportunities. While stringent regulations ensure network security, they can also impede the rapid deployment of new technologies. Countries prioritizing regulatory frameworks favorable to innovation will likely lead the global 6G race, fostering a more favorable environment for growth.

These dynamics indicate a promising yet challenging landscape for the 6G telecom market, requiring strategic navigation of opportunities, risks, and regulatory considerations.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/6g-telecom-market/free-sample/

Report Segmentation

The 6G Telecom Market is categorized by devices, communication infrastructure, technologies, and end-users, each segment addressing specific market demands and innovations. Within devices, mobile solutions dominate with a 34.3% share, driven by the pervasive use of smartphones. IoT and Edge Computing Devices play a critical role, facilitating complex tasks like real-time analytics, vital for autonomous vehicles and smart city innovations. Emerging categories like smart wearables also hold significant growth potential as 6G technology matures.

Communication infrastructure is primarily led by wireless, holding a 56.2% share, due to its flexibility and capacity to support high-speed internet access across varied environments. Fixed infrastructure, while secondary, remains essential for stable and secure data transmission, forming an integral part of the 6G ecosystem by providing the backbone for core network functions.

Technology-wise, Terahertz Communication leads with 44.6%, offering vast improvements in data speed and capacity. Quantum and Holographic Communications enhance security and interaction capabilities, pivotal for sectors demanding secure data transfer and immersive experiences.

End-user segmentation shows consumer applications at 53.4%, reflecting the mass market's adoption of advanced telecom services. Industrial and Enterprise users also harness 6G's capabilities to enhance manufacturing efficiency and enable automation, contributing to broader market expansion and technological evolution.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/6g-telecom-market/free-sample/

Drivers, Restraints, Challenges, and Opportunities

Drivers of the 6G telecom market include technological advancements in communication, particularly terahertz frequencies and vortex millimeter waves, which push the boundaries of data transmission speeds. Additionally, government initiatives and global collaborations, such as the Next G Alliance, are crucial in propelling research and standardization efforts, positioning regions like North America as 6G leaders.

Restraints involve high R&D costs and infrastructure challenges, particularly in rural areas where deployment complexities hinder rapid expansion. Extensive new infrastructure needs, including advanced cell towers, pose financial and logistical barriers that could slow market progress.

Challenges also arise from technological and regulatory hurdles. Developing 6G networks involves overcoming significant engineering challenges due to high propagation loss and molecular absorption in the terahertz frequency band. Regulatory complexities further complicate swift market deployment, necessitating precise compliance to safeguard network security.

Opportunities focus on expanding connectivity to underserved areas and fostering innovative applications across industries. As the global demand for enhanced connectivity grows, 6G's ability to offer ultra-high-speed communications opens new revenue streams and economic benefits, particularly for industries requiring rapid data exchange and low latency, such as telemedicine and smart manufacturing, ensuring inclusive growth and digital transformation.

Key Player Analysis

The 6G telecom market is driven by leading players such as Huawei, Samsung, and Qualcomm, who spearhead technological advancements and strategic developments. Huawei's strong presence in 6G research, evident in its substantial patent holdings, underscores its pivotal role in shaping the market. Samsung focuses on developing low-latency networks and high-speed connections, aiming for speeds significantly surpassing current standards, thereby maintaining its competitive edge.

Qualcomm's partnerships with major telecom operators highlight its commitment to enhancing 6G capabilities, while Intel and Cisco contribute through network infrastructure and semiconductor solutions, essential for 6G's future. Strategic alliances, like those formed by Nokia and Ericsson, leverage extensive telecommunications experience and facilitate collaborations with global operators, fostering broader deployment and adoption of 6G.

Apple's integration of 6G within its ecosystem ensures seamless user experiences, driving consumer demand. Together, these companies drive the 6G market through innovation, collaboration, and market leadership, pivotal in transitioning towards widespread 6G adoption.

Recent Developments

Recent developments in the 6G market demonstrate substantial momentum. In August 2024, Huawei showcased its extensive involvement in 6G by integrating 5G and AI technologies at Hungary's East-West Gate railway terminal, marking Europe's first such implementation in the railway sector. Huawei's revenue growth by 10% in 2023 underscores its strong market position and technological advancements.

In July 2024, Samsung led research into developing 6G standards aimed at achieving speeds up to 500 times faster than 5G, a strategic move to solidify its market leadership. This initiative underscores Samsung's focus on advancing low-latency networks and high-speed connectivity.

Qualcomm's June 2024 announcement highlighted strategic partnerships to enhance 6G capabilities, collaborating with Betacom and US Cellular on private networks. Moreover, Qualcomm secured a deal with Apple to supply future 5G and 6G chips, reinforcing its semiconductor dominance.

These developments highlight the competitive landscape and ongoing innovation driving the 6G telecom market's rapid evolution and expansion.

Conclusion

The 6G telecom market is on the brink of transformative growth, driven by technological innovation and strategic collaborations. Despite challenges such as high development costs and regulatory complexities, opportunities to advance global connectivity and facilitate new technological applications are vast. Leading companies play a crucial role in driving innovation and establishing standards, paving the way for widespread adoption. As 6G technology matures, it promises to revolutionize telecom services, augment digital transformation across industries, and foster economic growth. The future of 6G is set to redefine connectivity and communication on a global scale.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Humanoid Robot Market - https://market.us/report/humanoid-robot-market/

AI in Publishing Market - https://market.us/report/ai-in-publishing-market/

Second-Hand Trading Platform Market - https://market.us/report/second-hand-trading-platform-market/

AI in Project Management Market - https://market.us/report/ai-in-project-management-market/

AI In Software Market - https://market.us/report/ai-in-software-market/

AI in Accounting Market - https://market.us/report/ai-in-accounting-market/

AI in Urban Planning Market - https://market.us/report/ai-in-urban-planning-market/

AI in Digital Marketing Market - https://market.us/report/ai-in-digital-marketing-market/

Cybersecurity in Gaming Market - https://market.us/report/cybersecurity-in-gaming-market/

B2B Laptop & PC Market - https://market.us/report/b2b-laptop-pc-market/

AI in Personal Finance Market - https://market.us/report/ai-in-personal-finance-market/

AI in Career Development Market - https://market.us/report/ai-in-career-development-market/

Satellite Bus Market - https://market.us/report/satellite-bus-market/

AI in Fraud Management Market - https://market.us/report/ai-in-fraud-management-market/

AI in Corporate Banking Market - https://market.us/report/ai-in-corporate-banking-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.