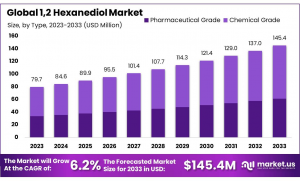

1,2 Hexanediol Market size is expected to be worth around USD 145.4 Mn by 2033, from USD 79.7 Mn in 2023, growing at a CAGR of 6.2% from 2024 to 2033.

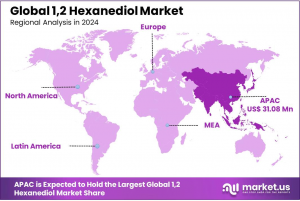

Asia Pacific (APAC) region dominated the 1,2-Hexanediol market, capturing a significant share of approximately 38.3%, valued at USD 31.08 million. ”

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global 1,2-Hexanediol market has witnessed consistent growth in recent years, primarily driven by its extensive application across various industries including cosmetics, pharmaceuticals, and industrial solvents. 1,2-Hexanediol, a multifunctional compound characterized by its moisture-retaining properties and microbial resistance, serves as a critical ingredient in the formulation of skincare and haircare products.— Tajammul Pangarkar

The 1,2-Hexanediol is robust, benefiting from a surge in consumer demand for personal care products that are safe, effective, and environmentally sustainable. The chemical's compatibility with various cosmetic formulations without compromising product stability or safety enhances its attractiveness to manufacturers. Furthermore, the pharmaceutical sector's use of 1,2-Hexanediol as an excipient to improve the efficacy of various drugs adds another layer of demand that supports market growth.

Driving factors for the 1,2-Hexanediol market include the increasing awareness of advanced skincare routines among consumers worldwide, especially in emerging markets. The rise in disposable income in regions such as Asia-Pacific has led to an uptick in consumer spending on personal care products, thereby propelling the demand for high-quality ingredients like 1,2-Hexanediol. Additionally, the shift towards sustainable and bio-based chemicals is prompting manufacturers to invest in bio-based 1,2-Hexanediol, which is expected to open new avenues for growth in the sector.

Regulatory support for safer cosmetic ingredients also plays a significant role in the market dynamics. In regions like Europe and North America, stringent regulations governing the safety of ingredients used in cosmetic and personal care products encourage the adoption of non-irritating and non-toxic ingredients such as 1,2-Hexanediol. This regulatory landscape, combined with the growing trend of clean beauty, drives the demand for 1,2-Hexanediol as it aligns with the market's move towards formulations that are free from harmful chemicals.

Looking ahead, the future growth opportunities for the global 1,2-Hexanediol market are promising. The ongoing innovation in skincare and cosmetics, along with technological advancements in the production of bio-based chemicals, is expected to enhance the efficiency and sustainability of 1,2-Hexanediol production.

👉 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/12-hexanediol-market/free-sample/

Key Takeaways

— 1,2 Hexanediol Market size is expected to be worth around USD 145.4 Mn by 2033, from USD 79.7 Mn in 2023, growing at a CAGR of 6.2%.

— Chemical Grade held a dominant market position, capturing more than a 58.5% share of the global 1,2-hexanediol market.

— Cosmetics held a dominant market position, capturing more than a 41.2% share.

— Chemical Grade held a dominant market position, capturing more than a 48.5% share.

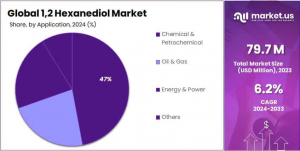

— Chemical & Petrochemical held a dominant market position, capturing more than a 47.4% share.

1,2 Hexanediol Statistics

By Type

In 2023, Chemical Grade held a dominant market position, capturing more than a 58.5% share of the global 1,2-hexanediol market. This segment is primarily driven by its widespread use in industrial applications such as coatings, adhesives, plastics, and personal care products. Chemical grade 1,2-hexanediol is favored for its versatility, cost-effectiveness, and ability to meet the requirements of large-scale manufacturing processes.

By Application

In 2023, Cosmetics held a dominant market position, capturing more than a 41.2% share of the global 1,2-hexanediol market. This segment’s strong performance is primarily due to the growing demand for personal care products that require safe, effective, and sustainable ingredients. 1,2-Hexanediol is widely used in cosmetics as a humectant, solvent, and preservative.

By Industrial grade

In 2023, Chemical Grade held a dominant market position, capturing more than a 48.5% share of the global 1,2-hexanediol market. This segment is driven by its widespread use across various industrial applications, including coatings, adhesives, plastics, and personal care products. Chemical grade 1,2-hexanediol is preferred for its cost-effectiveness and versatility, making it an essential ingredient in many manufacturing processes.

By End-use

In 2023, Chemical & Petrochemical held a dominant market position, capturing more than a 47.4% share of the global 1,2-hexanediol market. This segment is the largest due to the extensive use of 1,2-hexanediol as a solvent, stabilizer, and intermediate in the production of various chemicals. It plays a critical role in manufacturing plastics, coatings, adhesives, and personal care products.

Key Market Segments

By Type

— Pharmaceutical Grade

— Chemical Grade

By Application

— Ink

— Cosmetics

— Medicine

— Others

By Industrial grade

— Chemical grade

— Pharmaceutical grade

— Others

By End-use

— Chemical & Petrochemical

— Oil & Gas

— Energy & Power

— Others

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=135618

Emerging Trends

1. Increased Demand in Cosmetic Formulations: There is a growing trend towards using 1,2-Hexanediol as a key ingredient in cosmetic and personal care products. Its excellent microbial properties and ability to function as a humectant and solvent make it increasingly popular in formulations aimed at improving product stability and user safety.

2. Shift towards Sustainable and Green Chemistry: Sustainability initiatives are driving innovation in the chemical manufacturing sector. 1,2-Hexanediol producers are increasingly investing in green chemistry practices to reduce environmental impact. This includes methods to improve yield and reduce waste in the production process, appealing to eco-conscious consumers and regulatory bodies focusing on environmental sustainability.

3. Technological Advancements in Production: Advances in chemical synthesis and processing technology have enabled manufacturers to produce 1,2-Hexanediol more efficiently and at a higher purity. These improvements help meet the stringent quality standards required in pharmaceutical applications and sensitive cosmetic formulations.

4. Expansion in Asian Markets: The Asia-Pacific region is experiencing rapid growth in both production and consumption of 1,2-Hexanediol. Driven by booming cosmetic industries in countries like South Korea and China, this trend is supported by increasing local manufacturing capacities and growing middle-class consumer bases seeking premium personal care products.

5. Regulatory Impact on Market Dynamics: Increasingly stringent regulations concerning safety and environmental impact are influencing the market dynamics of 1,2-Hexanediol. Producers are compelled to adhere to these regulations, leading to changes in manufacturing processes and supply chain adjustments to comply with global standards.

Regulations on 1,2 Hexanediol Market

U.S. Environmental Protection Agency (EPA): Under the Toxic Substances Control Act (TSCA), 1,2-hexanediol is subject to specific reporting requirements for manufacturing and importation. The EPA assesses chemicals for risks related to health and environmental exposure and can impose restrictions if deemed necessary.

European Chemicals Agency (ECHA): In the European Union (EU), 1,2-hexanediol is regulated under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation. Manufacturers and importers must register the chemical and submit data on its potential risks to human health and the environment.

In the EU, REACH regulations have led to a 30% increase in the cost of compliance for producers of 1,2-hexanediol, as companies must meet strict safety and environmental standards. However, this is offset by the increased market demand for safer, regulated chemicals in consumer goods.

The U.S. EPA’s evolving regulations under TSCA have resulted in a 5-8% increase in the operational costs for companies in the U.S. market, as manufacturers must report more detailed safety data and comply with new environmental guidelines.

Regional Analysis

In 2023, the Asia Pacific (APAC) region led the 1,2-Hexanediol market with a 38.3% share, valued at USD 31.08 million. This dominance stems from rapid industrialization, growing demand for personal care products, and the expansion of automotive and chemical industries. Key countries like China, India, and Japan drive consumption and production, fueled by rising demand for bio-based chemicals and government incentives for sustainable materials. Additionally, established supply chains and the presence of leading chemical manufacturers strengthen APAC's market position.

Key Players Analysis

Leading companies in the 1,2-Hexanediol market are adopting strategies such as innovation, partnerships, and geographic expansion to maintain their dominance. Key players include:

— KOWA

— Eastman

— TNJ

— Chungdo

— CM

— Sabinsa

— KIGA

— Celanese

— Novagaurd

— Solvay

— Penta

— KIGA

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.